Kantar has combined insights from the CX+ 2020 study with an understanding of the new customer landscape across different retail sectors in Covid-19 times and into recovery from its eight-wave global Barometer study into how Covid-19 is influencing consumer behaviour, attitudes and expectations in 60+ markets.

The only sector-specific study to analyse customer-centricity holistically, CX+ pinpoints how to bridge the gap between customer experience and brand promise by revealing brand pressure points. It is informed by research in 17 countries including South Africa, across over 1,000 brands with feedback from more than 100,000 people.

TMT has always occupied a difficult customer experience space, as these brands are usually only acknowledged when there’s a product fault or service experience fail. It’s a sign that the industry isn’t yet fully tapping into its potential to create really moving experiences.

Looking specifically at network service providers, handheld devices and streaming media platforms, it’s important to empower customers and overdeliver on brand promise, as customer delight drives future affinity and brand loyalty.

Global brands Netflix and Apple top the table overall, though there’s a lack of brand loyalty to TMT brands overall. Local brands tend to better meet consumer needs as they are homegrown and rooted in that culture.

Network service providers

Telecommunications providers have come a long way from when they started, innovating in new directions with critical innovators, but they’ve become stuck when it comes to customer loyalty ratings as their innovation isn’t moving as fast as people’s needs are changing.

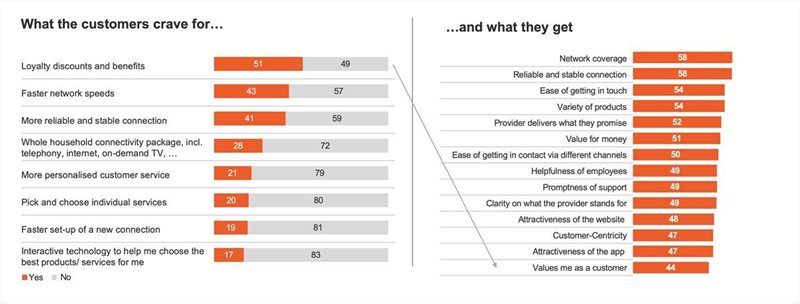

Roughly half of us have been with our service provider for five years or more but 42% have switched in the past because of poor customer experience. The Barometer study found customer experience (CX) has further decreased by 14 percentage points during the pandemic and loyalty and trust is being put to the test, as brands were not seen to act in truly customer-centric ways.

Customers certainly want loyalty discounts and to feel rewarded but being treated as a valued customer is only the second most important driver of brand preference. Topping the table for network service providers is value for money, with ease of getting in contact via different channels coming in third, followed by brands delivering what is promised. So, it really is about developing that relationship, as brand promise is the foundation of CX.

Network service providers would do well to check their blind spots for how the pandemic may be affecting CX in unexpected ways, as satisfaction has gone down in many markets.

Question whether you know your customers as well as you think you do because, over time, new industry hygiene factors have emerged as key differentiators. It’s more important than ever to create meaningfully different content for customers.

Handheld devices

It’s no surprise that lockdown living gave handheld devices an extra workout during the pandemic. Our global C19 Barometer study, into how Covid-19 is influencing the behaviour, attitudes and expectations of 150,000 connected consumers in 60+ markets globally, shows that 45% of consumers say they are using them more as the world around us changes.

The top 10 handheld device ranking has Apple leading the charge, followed by OnePlus, Samsung and Xiaomi. Given the importance of mobile phones in our daily lives, it makes sense that almost 60% of users have a strong preference for their device, a larger proportion than most categories.

For example, only 40% of consumers say they have a strong preference for fashion retail brands they’ve purchased. A brand such as Apple, therefore, has an extremely competitive profile and great performance in brand preference drivers. The look and feel of the product, functionality of the hardware and delivering the brand promise, over factors like price and value for money.

It’s that laser-sharp focus on what matters that matters in this segment, as younger customers are more open to competitor brands as the ecosystem of experience widens. So, while product-related drivers like device longevity are still tops, CX-related drivers like experience in the branded store, attractiveness of website messaging and functionality, as well as the brand delivering or even exceeding on what’s been promised, become bigger determinants of consumer satisfaction.

Mark Molenaar,

Kantar 8 Jan 2020 As the younger generation is more likely to reward brands that deliver with their own loyalty and recommendations, as well as spending more on the devices they choose and buying more additional products, the bar has been considerably raised on the relationship dynamic.

For handheld devices, optimising CX means thinking holistically to develop the branded experience ecosystem, while also thinking reciprocity in tailoring experiences to generational needs and thinking reputation, in building depth in areas of expertise to grow your support and service offerings.

Streaming media providers

Streaming media providers have proven themselves extremely important in the stay-at-home phase of the pandemic. The streaming media providers’ ranking was topped by Netflix, Tencent Video and Spotify.

They handled higher demand well in increasing numbers of subscribers but, most encouragingly, our Barometer study reveals that 32% of people said they had more positive experiences with their streaming media providers under lockdown. They felt more valued as customers, even when they didn’t always receive what they expected, so tips for future CX success in this realm tie back to making the experience more engaging.

Consumers want more content to choose from and greater variety across a broader array of categories, both of which have increased. With ‘value me as a customer’ the top preference driver, followed by quantity of programming, value for money and helpfulness of customer service.

These are important even when contact is limited, as just 22% of streaming media customers have been in touch with their streaming provider over the past year. Providers see 57% less customer churn if the brand is truly customer-centric so understand that streaming is becoming the new experience for everything and increase investment on key CX preference drivers.

Mark Molenaar,

Kantar 20 Oct 2020 Even in this exceedingly digital age, classic customer service is still central to CX, which becomes a more holistic challenge as more people live more of their daily lives online. In an ever-widening TMT ecosystem, brands need to understand how these needs are changing and what customers value today, to build their reputation for the CX success of tomorrow.

What did South African consumers think? The SA CX+ ranking

CX+ 2020, South Africa

*Gap capped at +5. Our analysis demonstrates a +5 gap is the point where the missed opportunity for the rand to attract new customers (as its marketing under-performance) exceeds the positive effect of delighting current customers by exceeding their expectations.

To find out how your brand scores on customer experience and what you can do to close the gap, contact me at moc.ratnak@raanelom.kram

Want more? Register your (free) place at our upcoming webinar in partnership with the Marketing Achievement Awards (MAA), from 11am on 11 March 2021. Barbara Cador, global head of CX+ at Kantar unpacks ‘The magnificent seven of CX’, and explains why a focus on your brand experience translates into real returns. Register your place here: https://bit.ly/3khp9F2

Find out more about our CX+ 2020 findings and follow us on LinkedIn and Twitter to keep up to date with our comms.