This is a continuation of Tyron Sharnock's article on customer loyalty and how it has long been regarded as a critical component to building a brand with traditional models focusing on loyalty metrics such as customer retention and repurchase.

If you haven’t read Part 1, click below, then continue reading.

Yesterday, today, and tomorrow

A buyer’s behaviour today does not equal their behaviour yesterday or tomorrow.

Buyers are predictably irrational and buy from a repertoire of favourite brands. Their purchase behaviour is dependent on context, mood, or needs that change over time, and at different times of the day, week, month, or year. Heavy buyers might defect and become light or even non-buyers tomorrow, new buyers enter the market at different times and light buyers fall off or become heavy buyers of a category.

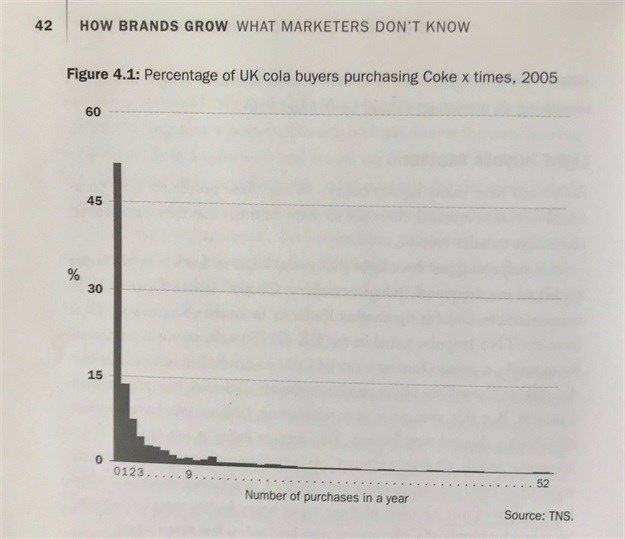

Evidence shows that heavy buyers are not only heavy buyers of a specific brand but are in fact heavy buyers of the category on the whole. Coca-Cola’s heavy buyers in the example above buy competing soft drink brands an additional 313 times in a year.

It’s also a question of timing. Many light buyers may not show in previous years’ analysis as they may have bought once in the two years analysed simply due to when their purchase took place. If She bought once in January 2017 and prior to that in December 2015 – even though it’s 13 months, just one month more than a calendar year, between her purchases the data in the marketing analysis shows her as a non-buyer for 2016 and risks that she may be shown as having defected never to be targeted again.

This is not a true indication of buying frequency but simply a function of timing due to the period analysed and this phenomenon is exacerbated when shorter periods are analysed. Heavy buyers of the grocery store example below may be seen as light buyers who only bought once if the period analysed was just a month.

Simple math

The NBD shows that most people are only occasional buyers of a brand but make-up such a large proportion of the customer base that their combined sales volume contribution cannot be ignored.

Brand growth is really a function of increasing the number of light, medium, and heavy buyers but analyses of brands who have indeed shown significant growth over time have seen a larger proportion growth in light buyers than any other.

So regardless of the growth strategy employed, acquisition or retention, most growing brands have shown growth due to increased penetration over loyalty, and growth indeed came from higher rates of customer acquisition rather than lower rates of defection. This indicates that penetration has a stronger relationship with brand growth than loyalty.

If a brand has a customer base of 10,000, and the available market is 100,000, all things considered equal, then it has a 10% market share. If its defection rate is 10% then it can expect to lose 1,000 buyers annually. Its marketing team needs to find 1,000 new buyers every year just to maintain its 10% market share before it can even consider growth.

If that brand is a local grocery store with an average basket size of R500 its entire customer base reflects a total sales revenue of R5m (10,000 x R500). Let’s say that 10% of their buyers are heavy buyers and buy from their store 12 times or more a year.

If they could get their ‘loyal’ heavy buyers to increase purchases from 12 to 13 times a year then revenue would increase by R500,000 (1,000 x 1 x R500).

If the greatest number of buyers of a brand is light buyers who significantly contribute to sales volumes and such light buyers may make up to 50% of their sales volume, then it stands to reason that getting 1,000 heavy buyers from 12 to 13 purchases annually is not as effective as taking 5,000 customers from 1 to 2 purchases in the same period, potentially showing growth of R2.5m.

But the opportunity is even greater if one considers the 90,000 non-buyers representing a total available pot of R45m in the market.

One could argue that effective mass marketing strategies that target non- or light buyers would already include heavy buyers but offers a far greater and more achievable opportunity. So, for most brands, the greatest opportunity for growth is taking buyers who buy your brand zero times to buying just once in a buying cycle.

Don’t shoot in the dark

Perhaps brand loyalty, retention and repurchase strategies are easier for marketers to get their heads around simply because they know more about their buyers through mining and analyses of customer data. It’s easier to reach them because we know who they are and where they are and it’s human nature to take such a path of least resistance.

But, mass marketing is tricky – you have to reach all potential buyers of your brand at the right time and at a suitable cost of acquisition. There is an ever-increasing amount to learn and the pace at which digital channels are growing makes keeping up even more challenging. Marketers must distinguish between mass marketing and effective mass marketing.

But digital platforms are also providing ever increased knowledge about people who do not buy your brand and can be marketed to in a way that appeals to them personally and increases the chances of convincing them to try your brand.

It’s also not an either/or scenario where marketers must choose effective mass marketing or target marketing. Marketers must consider a multi-pronged approach to effectively marketing their brand to deliver ROI and understand that due to defection rates being inevitable acquisition is simply a requirement to stay alive.

Finally, the purpose of this article is to indicate to marketers the importance and size of the opportunity that lies outside of its loyal customer base. The first step is to acknowledge the opportunity then we can talk about the how.

*This article is based on quality academic research. For a list of references please contact the author.