This is the question on everyone's lips.

Amidst a backdrop of fiercely polarised opinions, it appears to be the burgeoning throng of ardent 'Banting' disciples that, spurred on by Noakes' "Let the World Remember It Started in SA" mantra, are eclipsing the minority of sceptical naysayers who dare to question the logic behind a Low-Carb High-Fat (LCHF) 'Banting' diet.

We conducted a primary interview with perhaps the most prominent of these naysayers, Professor Salome Kruger from North West University, who explained that she "do[es] not agree with Prof Noakes", arguing the case for "a balanced diet, with meats, milk, cereals, fruits and vegetables". However such nutritional rationale, despite the academic prominence of its proponents, appears to be doing little to derail the 'Banting' bandwagon in South Africa.

But whilst 2014 consumer trends indicate a marked decline in purchases across the carb spectrum, should we, amidst the sensory inundation of Noakes-fuelled 'Banting' prophecy, make the simple assumption that such a trend is the result of a direct correlation between media hype and consumer preference?

According to Insight Survey's latest Carbohydrate Landscape Report, the answer is not so straightforward and requires a deeper, more nuanced understanding of the respective industry environments and market dynamics, both locally and globally.

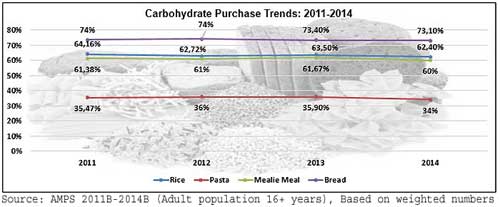

The trend is unequivocal: pasta purchasers decreased by 1.5% between 2011-2014 (down from 35.5%); bread purchasers decreased by 0.9% between 2011-2014 (down from 74%); mealie meal purchasers decreased by 2% between 2011-2014 down from 61%); rice purchasers decreased by 1.76% between 2011-2014 (down from 64%); and purchasers of frozen potato products decreased by 6% between 2011-2014 (down from 17%).

On face value, and given the recent ubiquity of 'low-carb' media dissemination, these statistics seem to provide rather compelling support for somewhat of a nexus. However if we look at bread for example, our primary data indicates that whilst the 'Banting' trend has indeed had an effect on the higher LSM's, the overall decline in sales volumes of packaged/industrial bread can largely be attributed to the current market dynamics at a production level.

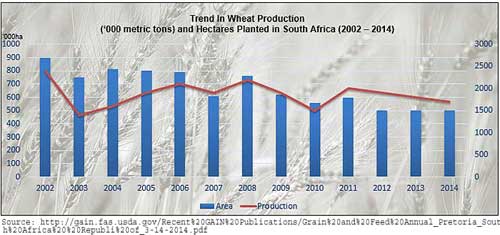

We conducted a primary interview with Petru Fourie, Agricultural Economist at Grain SA, who explained to us that costs at a primary level (i.e. at the level of wheat production) have increased continually due to increases in input costs. As she pointed out, "Profitability is the main factor driving any producer to plant a crop," and with these increases in input costs, pressure is placed on producers' profitability, resulting in them being less inclined to bring additional hectares into production.

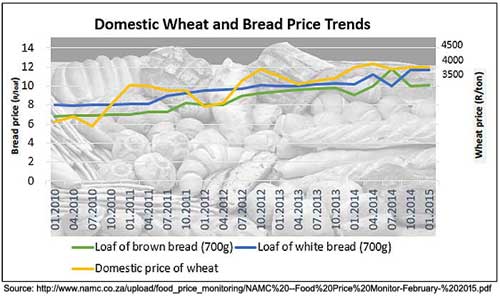

With reduced hectares, South Africa's dependency on imported wheat has increased over time and hence the domestic price for wheat, as reported by Safex, tends to be close to import parity. These imports contribute to higher bread prices than would be the case if all South African demand could be locally produced.

Thus what we are currently seeing are prices rising above the rate of inflation, which is in turn dimming consumer demand. In the last calendar year alone (Jan 2014 to Jan 2015) domestic wheat prices have risen by 36%; brown bread (700g) by 8%; and white bread (700g) by 8%. Such in-depth insight is a product of our comprehensive 'Farm to Fork' approach!

The Carbohydrate Landscape Report (124 pages) provides a dynamic synthesis of primary and secondary research, including extensive interviews with relevant stakeholders and industry experts across the value chain: from organisational bodies to manufacturers, retailers and leading academics.

Some key questions the report will help you to answer:

- What are the key factors that are restraining and driving the growth of the local and global markets?

- What are the local and global supply and production trends and predictions?

- What are the local and global demand and consumption trends and predictions?

- What were the Manufacturing and Retail sectors' overall financial performances for 2014?

- What are the consumption trends in the following carbohydrate sectors: rice; pasta; mealie meal; bread; potato chips; breakfast cereal; frozen potato products?

- What are the local and global expert opinions on the consumer 'Banting' trend?

Please note that the 124-page PowerPoint report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 830-5638.

For a full brochure please go to: http://www.insightsurvey.co.za/2015-carb-landscape-report.

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business's competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.