Related

Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 2 days

More news

Marketing & Media

AI changed how I work as a designer, faster than I expected

The most valuable South African brands in 2023 have a total combined value of $31.6bn, according to the Kantar BrandZ Top 30 Most Valuable South African Brands 2023 report published today. A combination of innovation, the ability to attract new customers, and successful pricing strategies has seen financial services, fast food and retail brands among the most resilient across all categories, despite challenging economic conditions in South Africa and across international markets.

First National Bank (FNB) is the top South African brand with a brand value of $3.4bn. The financial services category is the largest in this year’s Top 30, featuring 11 brands and a total brand value of $13.6bn. As South Africa’s oldest bank, FNB continues to successfully reinvent itself, remaining relevant to existing and new customers and maintaining a point of difference over others in the category. The first bank to offer consumers the opportunity to switch banks by taking a ‘selfie’ and having won accolades for its mobile app, technology is at the forefront of the brand’s success, with FNB setting the market pace on innovation.

Standard Bank ($3.0bn) is the second most valuable brand, with telecoms brands, MTN (No.3; $2.8bn) and Vodacom (No.4; $2.7bn) and alcohol brand Castle (No.5; $2.0bn) completing the top 5 in this year’s brand ranking.

Ivan Moroke, CEO, South Africa, Insights Division, Kantar, comments: “As the number one brand, FNB continues to raise the bar despite being the oldest brand in the Top 30 and operating in a highly competitive sector that includes some of the hottest fintech startups. With its focus on innovation and building connections with customers, especially younger people, FNB features high on our Future Power Index, while its work with communities, helping to drive societal change, has seen FNB feature high on our Brand Purpose Index.”

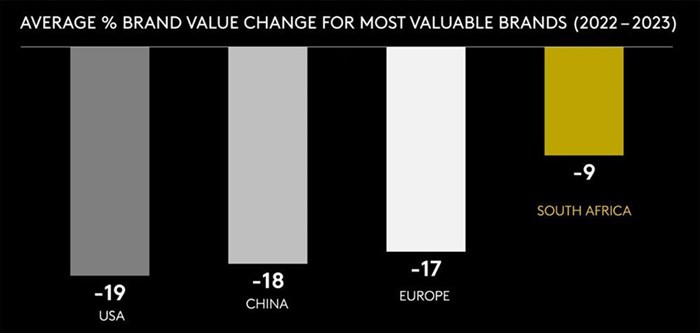

While the overall value of the Top 30 declined by $3.3bn (-9%) versus last year, against a backdrop of high inflation, rising petrol prices and load shedding, South African brands performed better than those in many other markets. A fifth of brands in the ranking showed positive growth, finding new ways to build value, despite challenging conditions.

Finding growth through international expansion and branching out into new categories presents huge opportunities. This includes Vodacom offering financial services, Dis-Chem Pharmacies (No.29; $299m) moving into medical insurance, and Checkers (No.20; $525m) offering cell phone services, while several major retailers have entered the baby category.

The practice of taking a strong brand in one area and using it to expand into adjacent categories helps create value for the brand and value for consumers.

| Rank 2023 | Brand | Valuation Category | Brand Value 2023 (USD mil) |

| 1 | First National Bank | Financial Services | 3 402 |

| 2 | Standard Bank | Financial Services | 2 991 |

| 3 | MTN | Telecom Providers | 2 810 |

| 4 | Vodacom | Telecom Providers | 2 651 |

| 5 | Castle | Alcohol | 2 010 |

| 6 | Nando's | Fast Food | 1 792 |

| 7 | Absa | Financial Services | 1 643 |

| 8 | Woolworths | Retail | 1 198 |

| 9 | Capitec Bank | Financial Services | 1 189 |

| 10 | DStv | Media and Entertainment | 1 166 |

| 11 | Discovery | Financial Services | 1 080 |

| 12 | Nedbank | Financial Services | 893 |

| 13 | Shoprite | Retail | 792 |

| 14 | Mediclinic | Hospitals | 704 |

| 15 | Investec | Financial Services | 695 |

| 16 | Sanlam | Financial Services | 578 |

| 17 | Old Mutual | Financial Services | 564 |

| 18 | Flying Fish | Alcohol | 554 |

| 19 | Pick n Pay | Retail | 547 |

| 20 | Checkers | Retail | 525 |

| 21 | Sasol | Energy | 472 |

| 22 | Clicks | Retail | 459 |

| 23 | Takealot | Retail | 434 |

| 24 | Mr Price | Retail | 422 |

| 25 | Brutal Fruit | Alcohol | 417 |

| 26 | Cell C | Telecom Providers | 371 |

| 27 | Liberty | Financial Services | 328 |

| 28 | Life Healthcare | Hospitals | 316 |

| 29 | Dis-Chem Pharmacy | Retail | 299 |

| 30 | OUTsurance | Financial Services | 271 |

Download the full report at www.kantar.com/campaigns/brandz/south-africa

Creating pricing power through difference – South African brands that have improved their Pricing Power have seen the least brand value decline. This includes Woolworths (No.8; $1.2bn) one of the fastest risers in this year’s ranking, which performed well on Pricing Power, a major driver for creating value and business growth.

Brands, however, need to support this by creating meaningful difference to justify higher prices when times are tough.

Ecosystems can deliver growth – South African retailers and banks are partnering more and more to help deliver greater value, evident by the number of loyalty and rewards programmes where customers can earn or spend points at selected partners.

For example, FNB eBucks gives its customers 40 stores to choose from, including retail brand Clicks (No. 22; $459m) where customers can earn 15% back on total purchases both in-store and online.

Delivering value beyond their business – sustainability has become a fundamental requirement for doing business and it is also an enormous opportunity for brands. Woolworths continues to lead sustainability initiatives in South Africa with their “good business journey” and are closely challenged by FNB.

We do see a shake up this year with Sasol (No.21; $472m) making big strides to contend with Capitec Bank (No.9; $1.2bn) and Checkers. What all of these brands have in common, is that they are seen to behave in a socially responsible way and treat employees well.

Financial services brands re-enter the ranking – following its merger with Standard Bank in 2022, Liberty (No.27; $328m) re-entered the Top 30, alongside OUTsurance (No.30; $271m), which performed well on being meaningful, different and salient to customers.

The Kantar BrandZ Top 30 Most Valuable South African Brands 2023 ranking, report and extensive analysis are available now at: www.kantar.com/campaigns/brandz/south-africa. Missed the launch webinar? Find it on demand here.

The Kantar BrandZ valuation methodology starts with the brand’s financial value (the proportion of a parent company’s dollar value that can be attributed to a particular brand) and is then multiplied by the brand contribution. The brand contribution is the part that is unique in that it is based on consumer research and takes into account the demand the brand creates among consumers.

Strong brand demand is determined by looking at three key criteria: salience (coming easily to mind), difference (being unique vs. competitors and/or setting trends) and meaning (meeting people’s needs in relevant ways and/or building affinity). Brands can then identify what is driving their brand demand and what they need to change or do differently to build stronger connections with customers in the future.

For an overarching view of brand performance, Kantar has launched a new, free interactive tool powered by BrandZ’s wealth of data and the Meaningful Different Salient framework. Kantar BrandSnapshot delivers intelligence on 10,000 brands in more than 40 markets, offering a quick read on a brand’s performance in a category. Explore for free on Kantar Marketplace today.

About Kantar BrandZ: Kantar BrandZ is the global currency when assessing brand value, quantifying the contribution of brands to business’ financial performance. Kantar’s annual global and local brand valuation rankings combine rigorously analysed financial data, with extensive brand equity research. Since 1998, BrandZ has shared brand-building insights with business leaders based on interviews with 4.2 million consumers, for 21,000 brands in 54 markets. Discover more about Kantar BrandZ here.

The Kantar BrandZ Top 30 Most Valuable South African Brands report is the most definitive and robust ranking of the country’s brands available. The 2023 ranking draws on opinions of more than 42,000 respondents on 844 brands across 56 categories. The ability of any brand to power business growth relies on how it is perceived by customers. Grounded in consumer opinion, Kantar BrandZ analysis enables businesses to identify a brand’s strength in the market and provides clear strategic guidance on how to boost value for the long term.

The brands ranked must meet these eligibility criteria:

About Kantar: Kantar is the world’s leading marketing data and analytics business and an indispensable brand partner to the world’s top companies. We combine the most meaningful attitudinal and behavioural data with deep expertise and advanced analytics to uncover how people think and act. We help clients understand what has happened and why and how to shape the marketing strategies that shape their future. Find out more: www.kantar.com.

For further information about Kantar BrandZ please contact:

Stina van Rooyen

Head of Brand, South Africa, Insights Division, Kantar

moc.ratnak@neyoornav.anits

Ilse Dinner

Marketing director, Middle East and Africa, Insights Division, Kantar

moc.ratnak@rennid.esli