Research finds that a growing proportion of companies, who are still being led by their founders, make up 30% of IPOs and 7% of companies with market capitalisation above $500 million.

According to Ovidiu Patrascu, sustainable investment analyst at Schroders, “In those cases where track records are limited, the role and effectiveness of business leaders is often judged by intuition more than analysis.

“The issue is expected to become increasingly important. Companies can scale quicker than ever in capital-light, global industries. With venture capital war chests still strong, public market capital is little impediment to scaling a good idea quickly.”

He suggests that in addition to this, the prevalent internet usage enables companies to tap global customers, employees and suppliers quickly, bypassing the conventional expansion from local to national to international. “As a result, it is increasingly likely that the founder will still be in charge by the time IPO scale is reached.”

Methodology

“We set out to explore whether companies led by their founders tend to take a more long-term approach in capital allocation, enjoy superior profitability or perform better than peers. We examined 3,600 non-financial companies with market capitalisations over $500 million. Approximately 70% of founder-led companies are listed in the US, followed by China (8%), Japan (7%) and Europe (6%), and the majority operate in the technology, pharmaceuticals and retail sectors (source Bloomberg 31 Dec 2016).”

Founder-CEO companies outperform

According to Patrascu, the research demonstrates that in general:

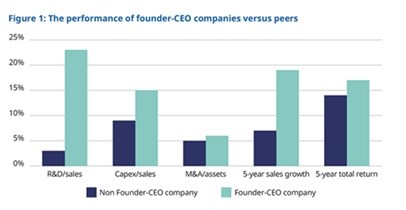

- Founder-CEO companies invest more aggressively than their peers in research and development (R&D), capital expenditure (capex), and mergers and acquisitions (M&A);

- They grow revenues at a faster pace; and

- Their share prices have outperformed peers over the 5-year period to December 2016

Sector-specific differences

However, Patrascu points out that the findings become more nuanced when looking at specific sectors in more detail. “Founder-CEO companies operating in innovation intensive sectors such as internet, software, biotechnology and pharmaceuticals tend to invest more in R&D, capex and M&A than their peers. This often leads to better revenue growth, but not to share price outperformance.

“In more capital intensive industries, such as hardware and semiconductors, founder-CEO companies tend to allocate capital more conservatively and their share prices have generally outperformed their peers.

“In some mature but profitable industries, such as electronic and electrical equipment, founder-CEO companies allocate more capital but at relatively high levels of profitability. This leads to strong compounding power and share price outperformance.”

Enabling better research focus

“Founder-CEOs are often found in the most exciting areas of the market. By objectively examining their influence on capital allocation and investment performance, Schroders’ investment teams are better able to focus research efforts into specific sectors where founder-CEO companies are more likely to outperform their peers,” concludes Patrascu.