From online shopping to financial transactions to e-learning - just about all aspects of life are feeling the march of technology advances. Well-established brands that were built on their physical and market presence are forced to adjust to potential disruption.

It is a concept that has become more obvious and concerning to South Africa’s banking sector, where an increasing proportion of transactions done by customers occur online, in the cloud, and in a seamless and almost invisible manner. The need to visit a branch has become near obsolete in recent years, more so now in our current pandemic reality than ever before. The big question on the minds of banks is how to remain relevant and ‘present’ in the lives of customers when so much of what happens in their transactional lives becomes increasingly invisible, behind the scenes and requiring a minimum, if any, conscious intervention?

The banks that will win this race will need to strike the balance between being visible and present when customers need them the most, and invisible and providing seamless transactional capability when customers simply want to get on with their day-to-day transactions. The path to achieving this balance however is tremendously complex.

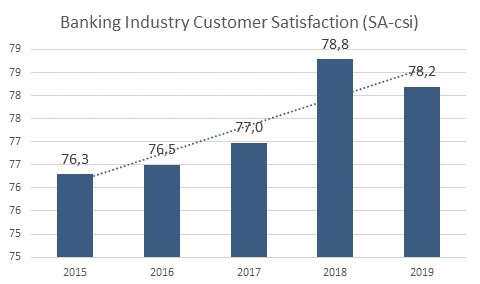

South Africa has one of the most sophisticated financial services sectors in the world, and our banks, by world standards, are top class when it comes to customer satisfaction and meeting customer expectations. Each year, the South African Customer Satisfaction Index (SA-csi) for Banks undertakes a study of the customer satisfaction levels of South Africa’s leading banks. And each year, this industry sector is the top performer of all industries and economic sectors measured, clearly holding itself to exceptionally high standards when it comes to the experience of customers.

This is evident if one considers the four-year trend of the index – customer satisfaction levels with their banks has consistently increased year-on-year, and this is despite the fact that at the same time, customer expectations have also increased. In essence this means that maintaining high levels of customer satisfaction has become increasingly more difficult as customers expect much more from their transactional banks – and this is off an already high standard. Despite this, South African banks have consistently risen to the challenge and consistently outperform their global counterparts.

The major driver of customer experience for banks is a continual struggle to remove any kind of friction between the customer, the bank and any third parties that the customer needs to transact with in terms of payments and receipts. Friction means disruption to customers’ daily lives, and this in turn translates to dissatisfaction with their bank. This is what banks have sought to avoid as far as possible.

The logical conclusion of this drive for increasingly frictionless banking leads to the inevitable outcome of what is referred to as ‘invisible banking’. Invisible banking occurs where consumers continue their daily lives, interact, transact, buy and sell and utilise banking services without being aware of the complex financial transactions, facilitation, security and compliance taking place in the background. Think about buying on Amazon, listening to Apple music or taking an Uber ride – there are no deliberate banking processes that take place – it all happens in the background and integrates seamlessly into the life of the consumer.

The reality is that in creating this seamless, frictionless transactional environment for customers, banks and the sophisticated systems and platforms behind all this transactional super-efficiency have now become increasingly commoditised to consumers – this efficiency is expected by consumers and is no longer perceived as a differentiator.

Benefits of invisible banking

The benefits of ‘invisible banking’ for customers are myriad from a time, convenience and location perspective. Lives and banking transactions continue with very little conscious intervention required.

And herein lies the rub. This is a balancing act that banks will have to navigate. The greatest challenge facing banks is that as customers go about their lives, with banks mostly invisible and requiring little conscious engagement with any particular brand or provider, how will banks compete for the minds and hearts of their customers? If the end goal is to become increasingly invisible as far as banking transactions go, how will banks make themselves visible and attractive to consumers and engender brand loyalty?

The importance of being the main transactional bank of consumers has never been more pressing. Once banking becomes invisible and so fully integrated into people’s lives, it will become increasingly difficult to attract customers from competing banks. The race to capture new customers and on-boarding them as young as possible now becomes more urgent, coupled with providing a differentiated and value-adding product journey that meets all their life stage needs with their chosen banking partner.

As the march of technology and digitisation becomes increasingly omnipresent, banks will need to find innovative ways of remaining relevant and visibly present in the lives of their customers, at a time when they want increasingly invisible, seamless and fully integrated brand engagements with zero hassle factor.