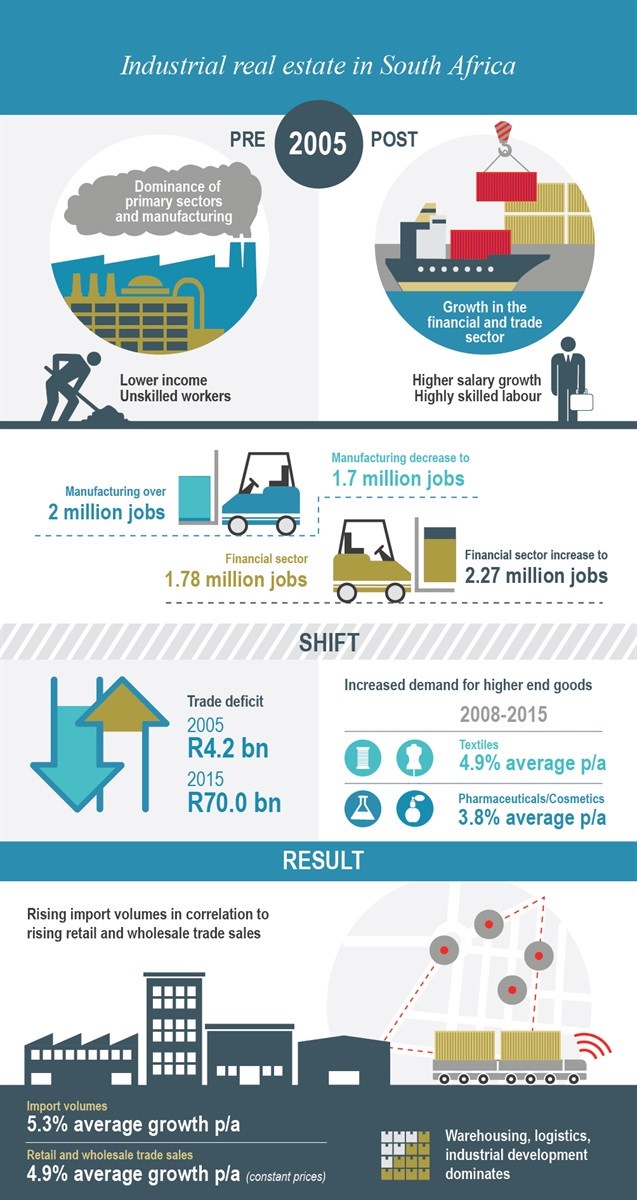

With the South African trade deficit increasing from R4.2bn in 2005 to over R70bn in just ten years, imports are playing a greater role in the economy. According to the head of research at JLL South Africa, Zandile Makhoba, this inflow of foreign, large consumer goods is creating escalating demand for storage, logistics and warehouse services.

JLL research considers the impact of trade trends on the South African industrial property market over the last ten years, as well as the opportunities and challenges in this sector.

Report highlights

• The decline of the primary sectors has had a significant impact on the manufacturing sector with the closure of numerous production plants over the years. Factory capacity utilisation and employment in this sector have declined with a knock-on effect in the type of property deals underway in the market.

• Trade, logistics and financial and business services are playing a far greater role. In the period 2005-2015 the significant de-industrialisation of South Africa is clearly visible with the development of some 11.9 million square metres of industrial and warehousing accommodation, compared to minimal hard industrial developments over this time.

• Trade is a significant contributor to local economic activity, accounting for 15% of Gross Domestic Product (GDP). This has supported the growth of the storage and logistics sector which accounts for 9% of GDP.

• The upward trend in industrial sector development can also be attributed to the increasing development activity in previously underserviced provinces. The Eastern Cape, Northern Cape, North West, Mpumalanga and Limpopo have all seen double-digit growth in industrial accommodation over the past ten years, highlighting the growth of logistics and distribution activity across the country.

Makhoba concludes, “There is a critical need for infrastructure upgrades to meet the demands of the expanding light industrial market. Reinvestment in and the upgrade of ports, rail systems and roads is crucial for improving efficiencies in the local trade sector and to enhance the growth outlook of the country”.