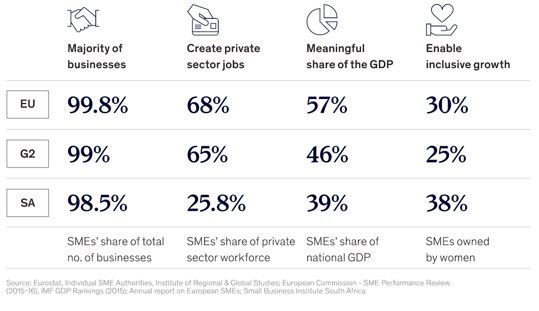

Prior to the onset of the Covid-19 pandemic, Small, Medium and Micro Enterprises (SMMEs) made up 98.50% of businesses in South Africa, employing an estimated 26% of the country's labour market and contributing approximately 39% to the country's GDP.

Covid-19 has caused economic devastation for small businesses around the globe with governments having to introduce significant relief packages in order to sustain this sector. South Africa has been no exception, but the limited resources available to the government and the lack of effectiveness of some of the relief measures implemented have exacerbated this situation.

The future for small businesses in this country is dire unless government and corporate South Africa give this serious attention and co-ordinate efforts to mitigate the impact of the pandemic and provide mechanisms for these businesses to be sustained and to grow.

Using Enterprise and Supplier Development as a strategy

Enterprise and Supplier Development (ESD) can be used as a strategy to promote economic growth and poverty reduction by establishing, sustaining and growing small businesses.

Financial investments made in ESD by corporates should yield tangible and visible results in helping black-owned SMMEs to scale. Furthermore, for the successful implementation of ESD programs, monitoring and evaluation measures must be put in place enabling businesses to measure the true impact of their investments.

Localisation should be used as a catalyst for the growth of SMMEs with a greater emphasis on innovation, as well as a practical approach to driving localisation throughout the value chain.

Additionally, localisation that merely increases costs in supply chains and reduces our international competitiveness is unsustainable and damaging to the economy. “Local procurement will help grow the economy, create more job opportunities, and broaden the markets and create numerous opportunities for business expansion in South Africa”, stated President Cyril Ramaphosa.

Soromfe Uzomah 23 Jun 2021 As SMMEs grow and develop, they provide a customer base to larger companies across the supply chain and supply vital goods and services to businesses and households. Added to the above, SMMEs can use their agility to create and incubate new technologies and business models for a brighter and better South Africa. Recent data shows that 49% of South Korea’s SMEs are currently using new emerging technologies to remain globally competitive in the market by adapting to the new Fourth Industrial Revolution (4IR) technologies.

Reduction in labour supply

The pandemic has resulted in a reduction in labour supply due to the impact on the health of employees and severe liquidity shortages for small businesses. A recent survey conducted by McKinsey & Company highlights that 70% of SMEs had reduced business spending and laid off employees due to the health risks presented by the pandemic. Moreover, measures to curb the spread of the virus through lockdowns and quarantines led to severe drops in capacity utilisation. Supply chains were interrupted which lead to shortages of intermediate goods- which are goods that are used to produce a final product such as; wood and steel.

The Covid-19 economic shock has been unprecedented in both its complexity and severity, causing many SMMEs to shut down their operations. This has resulted in job losses, a large drop in productivity and employee pay cuts. According to Stats SA, in the first quarter of 2021, South Africa’s unemployment rate increased to 32.6%, around 28 000 people lost their jobs between the fourth quarter of 2020 and now.

The SMME sector is still under severe strain. Many small businesses continue to face liquidity issues because of having to cover fixed overheads costs while income has significantly reduced. Research shows that 76.2% of businesses experienced a significant decrease in revenue in the first five months of lockdown, only 35.2% of SMMEs had cash reserves, whilst only 62.6% of these SMMEs believed that their cash reserves would last between one and three months.

Furthermore, the virus has caused potential spillovers into financial markets, resulting in further reduced confidence in, and credit for, SMMEs. According to a recent TransUnion survey, 50% of SMMEs had listed access to funding as the main barrier to growth.

When financial institution's lending is reduced smaller firms become more affected than larger corporations. To date, small business owners still have limited access to funding opportunities. Evidence shows that poor consumer credit score remains one of the reasons banks reject funding applications for small businesses.

Determining the businesses’ credit worthiness

The 2020 SA SMME Covid-19 Impact Report suggests that banks need to re-invent and develop new credit score assessment models that primarily focus on the re-payment history of the business itself, rather than focusing on the business owner’s personal credit record to determine the businesses’ credit worthiness.

A recommended strategy for supplier development includes preferential payment terms for small suppliers which enables them to manage their cash flow more effectively. Corporates should provide advice and knowledge to small suppliers in areas where they may be lacking, such as procurement, and compliance. Provision of expert development support through credible incubation programs and access to finance should be made available to bridge the skills gaps within these businesses and provide the necessary skills transfer, knowledge, and expertise SMMEs require. It is important to create an enabling environment for South African small businesses as part of a responsible business strategy.

Corporate South Africa must band together to use ESD as an enabler for economic revitalization and open up more opportunities for small businesses to play an effective role in supply chains. Many small businesses in South Africa have untapped potential that can be realised through partnerships that enable equal and sustainable economic access and participation.