Top stories

More news

ESG & Sustainability

#AGES2026: How to back Africa's next-gen green and blue entrepreneurs

Logistics & Transport

#Budget2026: Road freight logistics and what it means for consumers

We believe this elevation reflects the size and importance of real estate within today’s investment landscape. Furthermore, it underscores the fundamental differences—earnings and dividend stability, leverage and valuation methodologies—between equity real estate investment trusts (REITs) which tend to comprise the majority of the real estate exposure, especially in domestic US indexes, and financial companies like banks, insurers and asset managers.

The promotion of the real estate sector in GICS also reflects investors’ long-standing acceptance of liquid real estate as an asset class and their awareness of its appealing historical performance and risk characteristics. Additionally, the heightened visibility that should come from its own GICS sector classification should, in our view, lead to increased liquidity for real estate equities, while also promoting capital formation and growth over the intermediate to longer term.

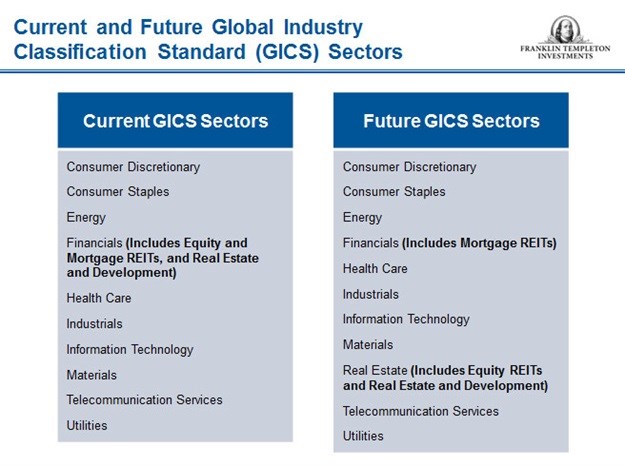

The tables below illustrate both the current classification system and the new classification once real estate becomes its own sector. The change will affect MSCI and S&P Dow Jones-sponsored indexes, but not the indexes sponsored by FTSE Russell.

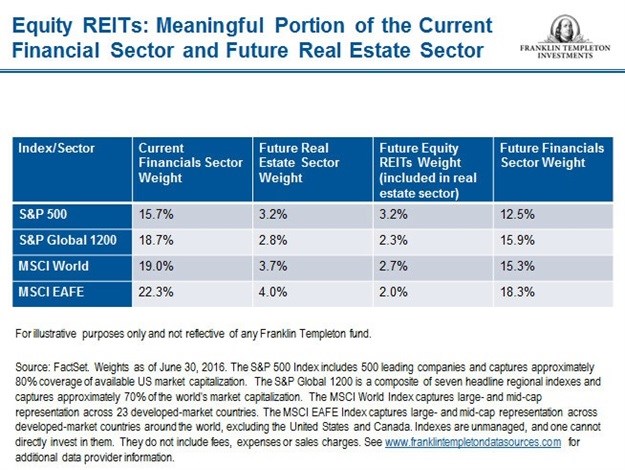

Real estate currently constitutes a significant portion of the financials sector across a number of frequently used benchmark indexes. As delineated in the first table below, the new real estate sector will include equity REITs as well as commercial real estate services and development companies. In most indexes, equity REITs will make up the majority of the new real estate GICS sector. An analysis highlighted in the second table below illustrates the current weightings and the resulting impact of the upcoming GICS change.

In our view, the implications for REITs are numerous, and the impact on potential demand for REIT equities resulting from this change appears high. We have seen reports indicating potential demand for REITs from US-domiciled mutual funds could reach as much as $100bn, significant potential demand given the $1.1tn equity market capitalisation for all US REITs. Even more potential demand may come from institutional separate accounts and other non-listed vehicles. From a market capitalisation perspective, a significant portion of large-cap growth and multi-cap core funds have no or low current exposure to real estate, suggesting to us that significant incremental capital could be allocated to the new sector.

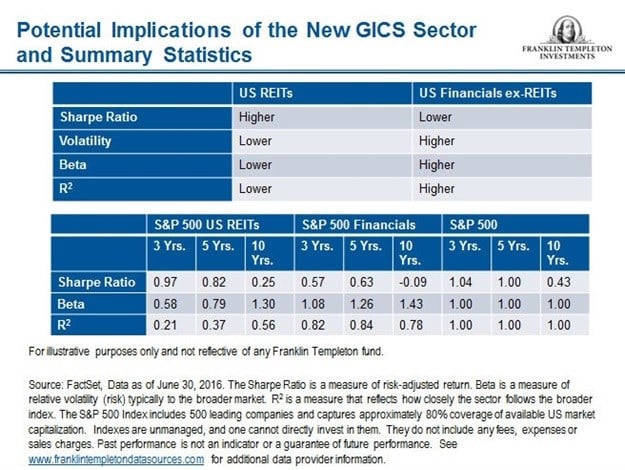

Equity portfolio managers will soon have to consider the differing technical and fundamental aspects of the real estate and financial sectors in their portfolio capital allocation decisions, and this analysis may further lead to increased capital flows for REITs. A historical analysis of constituents within the S&P 500 indicates that significant differences have arisen between the quantitative performance and risk measurements for REITs and the financials sector as a whole over the past three-, five- and 10-year periods. (See tables below.)

The Sharpe Ratio, a measure of risk-adjusted return, has been higher for REITs than for the financials sector (including REITs) over the past decade. In our analysis, removing REITs from the financials sector could have the effect of lowering the Sharpe ratio for the financials sector.

Beta, a measure of relative volatility (risk) typically to the broader market, has been significantly lower for REITs versus financials (including REITs) over the past 10 years. In fact, in the three- and five-year trailing periods after the financial crisis in 2008-2009, the beta for REITs has been well below that of both the S&P 500 Index and its financials sector (including REITs), according to data from FactSet.2 In our view, the lower relative statistical risk in more recent periods is a better reflection of relative fundamental real estate risk than the 10-year beta due to the market dislocations that occurred during the financial crisis.

REITs also provide an opportunity for equity managers and investors to diversify their portfolios.3 A measure known as R2 reflects how closely the sector follows the broader index, and indicates that historically REITs have provided a much greater diversification benefit than financials (including REITs). In our opinion, lower relative risk and portfolio diversification look hard to argue with so long as performance is competitive.

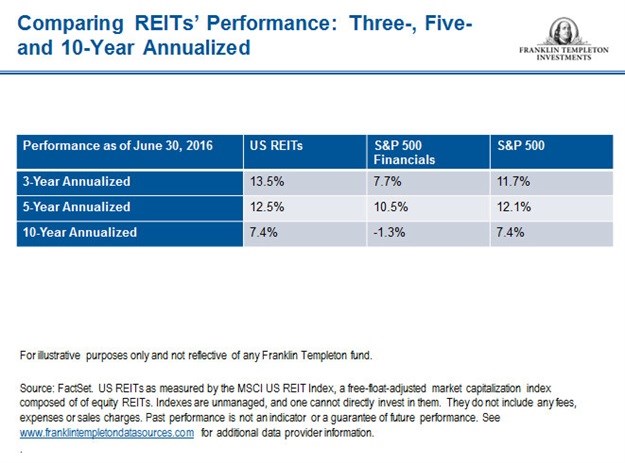

From a total return perspective, REITs have historically performed well over three-, five- and 10-year trailing periods as of June 30, 2016. (See table below.) REITs outperformed both the S&P 500 and the financials sector over the three- and five-year trailing periods. Performance was similar to the S&P 500 for the 10-year trailing period and well above the negative performance of the financials sector (including REITs).4

Furthermore, REIT performance has been reasonably consistent. REITs have outperformed the S&P 500 in 12 of the past 15 calendar years and the financials sector in 13. During that 15-calendar-year period, REITs have posted negative total returns in only two calendar years versus three for the S&P 500 and six for the financials sector. (See table below.)

The elevation of real estate to become the 11th headline GICS sector both acknowledges and underscores the asset class’s increasing importance within the investment world. And, with history suggesting REITs can potentially offer appealing performance, risk and diversification characteristics, we believe real estate’s new sector status will encourage many investors to consider real estate equities when building a well-diversified portfolio.