Top stories

More news

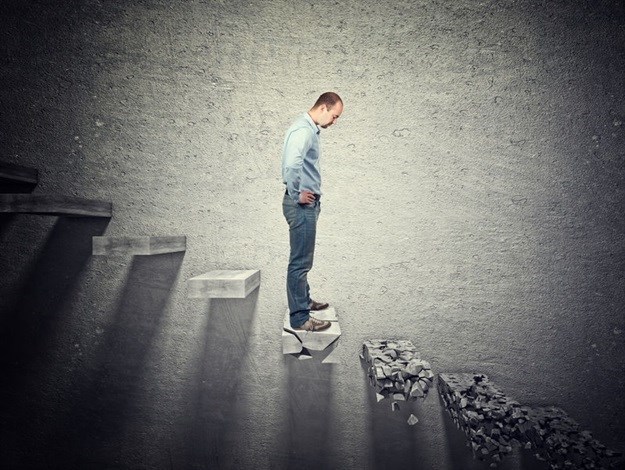

History shows us that the warning for an industry or business are often present 1 - 3 years before disaster strikes. The savvy entrepreneur or business owner pays attention to these kinds of warning signs and addresses them by taking strategic measures to shift course, but in many instances these signals are not paid attention to, and worst of all, ignored entirely.

Kodak is a well cited example whereby the process of digitization, and the lack of attention to warning signs within their industry eventually put them out of business.

Digitization is the process of taking something analog and converting it into a digital form. It is often referred to as the uberization of business. When something becomes digitized, it enters a period of deceptive growth. For example, when Kodak invented the technology for the digital camera it slowly evolved from 0.2 megapixels to 0.4, 0.6 and 0.8 megapixels, but it was deceptive because it all looked like zeros, and when it finally became truly disruptive as a technology, it exploded as a marketplace and eventually, it put them out of business.

In consulting with my clients, the story is typically the same. They have been selling the same product to the same customer for years, and largely driven by a maturing digitally-enabled economy; business models that used be competitive are slowly, but surely, becoming irrelevant.

This manifests into signals or warning signs like consistent declining revenues, sudden, significant loss of market share and many other attributes of a dying business.

While all businesses should look to adopt an agile philosophy, there are many that simply are not designed to be agile. Take the financial services industry for example: for the last 100 years or so, banks have largely existed to record the movement of money – essentially the custodians of trust between a buyer and seller. However, exponential technology is beginning to change this for the first time in a century and it’s causing a significant amount of upheaval in the financial services industry.

Imagine going to the local store in Wittenberg, Germany, in the mid sixteenth century and not having enough cash to pay for the pig you wanted to roast for dinner. You might have to borrow some money and, to record your debt, the person making the loan would use a tally stick like this one. The stick was notched in the presence of both the lender and the borrower and then split in two, so that each person retained half. You could only prove who owed who money by bringing the two different sticks together; hence the term “tally up”.

Then the gold standard was introduced in 1821 and we traded goods and services using gold. But then during the Great Depression in 1933, the gold standard was abolished to increase the money supply into the economy. Ever since then, banks have centralized control of the financial system.

But today, we are seeing the emergence of crypto instruments – an ingenious game changer that has the potential to make the banking industry question some of the basic assumptions of its current banking model and imagine a new system of banking – crypto banking.

The disruptive nature of exponential technologies like the blockchain and cryptocurrencies, cannot be overstated enough.

Research indicates that there are over 700 cryptocurrencies already in market and with central banks from around the world expressing an openness to blockchain, it is only a matter of time before Central Bank Cryptocurrencies (CBCC’s) are issued. This would drive the movement of equity and debt-based financial instruments to the blockchain, unlocking the means to significantly reduce fraud and improve organizational efficiencies for banks.

Blockchain as a technology was created as recently as 2009, but it is already putting a linear banking industry onto an exponential curve of disruption. Thanks to the blockchain, we now have an opportunity to rewrite the economic power grid and the old order of things by essentially redistributing trust – the foundation of any transaction – from a centralized institution and into the hands of financially distributed democracy.

While it is easy to use the financial services sector as the poster child of an industry that is being threatened by disruptive technologies, the fact of the matter is that no industry or business is immune. For another example, see my opinion piece on how the advertising industry is being disrupted.

Here are three questions that will help you understand how to future pace the impact of disruptive technologies:

The warning signs of disaster are always present in an industry or business. Take the retail industry for example. Amazon is disrupting the way that goods and services are bought using voice. By offering products at a cheaper price when ordered through Alexa, Amazon is fundamentally changing the consumer journey and the way that goods and services are bought. It also indicates the death of brands as we know it and democratizes the retail space in a way that we haven’t seen before.

This question is a difficult one to answer for most business owners, but these days we are living in an incredibly disruptive period so, it’s important to ask the question.

A simple way to get some answers is to ask: “What if?” For example, what if the consumer journey changed completely? Or what if a cheaper, more agile competitor entered your market?

Once you have identified possible answers to what could put you out of business, how would you respond to such a threat?

Market leadership is proving to be increasingly elusive. Advances in technology, the threat of new entrants and a digitally connected business environment is making it increasingly harder for companies to remain relevant.

Being clear about possible warning signs of disaster in your industry is the starting point, but careful scenario planning for new eventualities and the ability to adopt a new organization strategy in an agile fashion, will be critical component of the successful enterprise of tomorrow.