Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 2 hours

More news

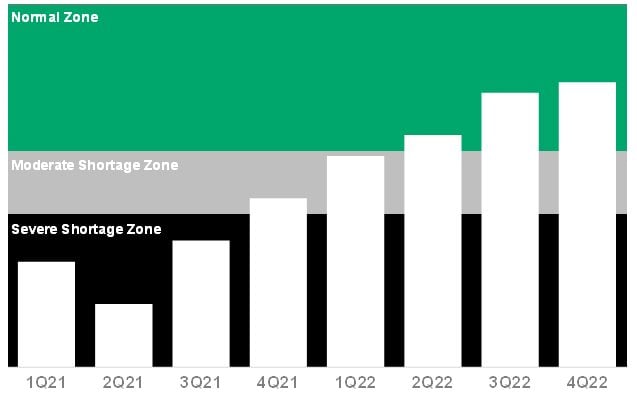

Kanishka Chauhan, principal research analyst at Gartner, said: “The semiconductor shortage will severely disrupt the supply chain and will constrain the production of many electronic equipment types in 2021. Foundries are increasing wafer prices, and in turn, chip companies are increasing device prices.”

The chip shortage started primarily with devices, such as power management, display devices and microcontrollers, fabricated on legacy nodes at 8-inch foundry fabs, which have a limited supply. The shortage has now extended to other devices, and there are capacity constraints and shortages for substrates, wire bonding, passives, materials, and testing, all of which are parts of the supply chain beyond chip fabs. These are highly commoditised industries with minimal flexibility/capacity to invest aggressively on short notice.

Across most categories, device shortages are expected to be pushed out until the second quarter of 2022, while substrate capacity constraints could potentially extend to the fourth quarter of 2022.

Gartner analysts recommend that OEMs dependent directly or indirectly on semiconductors take four key actions to mitigate risk and revenue loss during the global chip shortage: