WhatsApp solution developed for SA's largest retail bank aims to increase access to relevant financial education.

Many South Africans make everyday money decisions without having had the opportunity to learn about key money concepts and principles that can empower and protect them. Capitec’s WhatsApp solution, MoneyUp Chat, aims to make free, engaging and practical financial education available on an accessible platform.

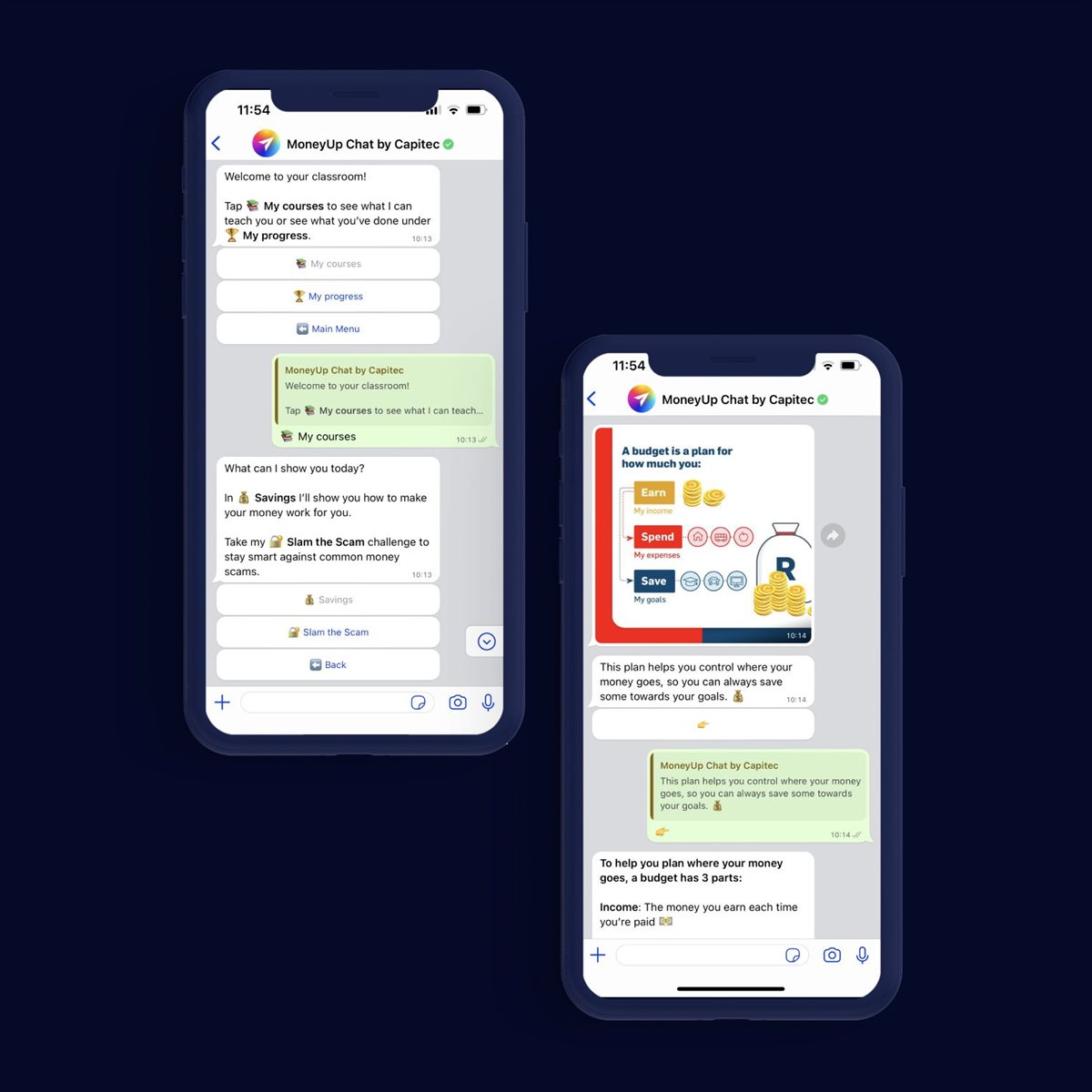

Created by Helm, the CX innovation experts who turn complex realities into simple customer experiences, the chat solution features an automated ‘financial friend' called Moola, who teaches South Africans about money on WhatsApp.

We hope that the solution will give many South Africans access to useful, simple explanations, and education that can help and protect them in their financial lives.

– Daniela BielskiMoola, the bot’s persona, guides users through an educational journey with short, interactive courses in the form of a WhatsApp chat, presenting complex financial concepts in an easy and digestible way. Topics such as budgeting, compound interest, inflation, retirement, and savings are covered as a series of chapters that the user can work through in their own time and at their own pace.

Moola is fun and interactive. The language is short, simple, and conversational, and users are able to reply using buttons and prepopulated options that include emojis.

Daniela Bielski, head of Client Success at Helm

Daniela Bielski, head of Client Success at Helm (previously Praekelt Consulting) says: “We worked with Capitec to put the information in the palm of all users’ hands. Anyone with WhatsApp can use MoneyUp Chat by Capitec and can look forward to expanding their knowledge even further as they release more courses through this new and exciting format.”

There are also quick interactive quizzes, which encourage users to test their understanding, with the chance to win data rewards for completing learning.

Bielski says digital literacy is now fundamental to financial literacy and is critical in helping South Africans keep their money safe and get the most value from the products and services they may use. That is why Capitec’s MoneyUp Chat is so exciting – it contextualises complex financial information in an easily digestible way, and through a fun and interactive digital experience.

“We hope that the solution will give many South Africans access to useful, simple explanations, and education that can help and protect them in their financial lives. Meet Moola and test your money knowledge. I believe everyone stands to benefit from this powerful platform.”