Both globally and locally, the plant-based food trend is continuing to gain momentum across various categories, particularly as consumers become more health-, environment- and sustainability-conscious, in terms of the food that they eat. This trend is gaining significant traction within the fast food industry, reflected in the large variety of new and innovative plant-based offerings being introduced by global and local fast food/QSR market players, to meet the capricious demands of millennial consumers, in particular.

Insight Survey’s latest SA Fast Food/QSR Industry Landscape Report 2022 carefully unfolds the global and local fast food/QSR markets (including the impact of Covid-19), based on the most credible intelligence and research. It examines the relevant global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African fast food industry environment and its future.

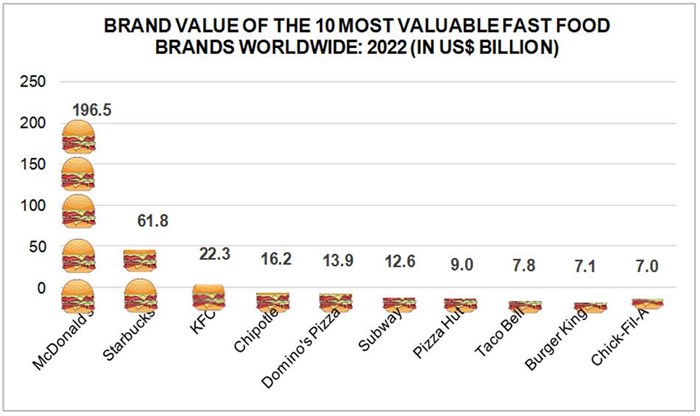

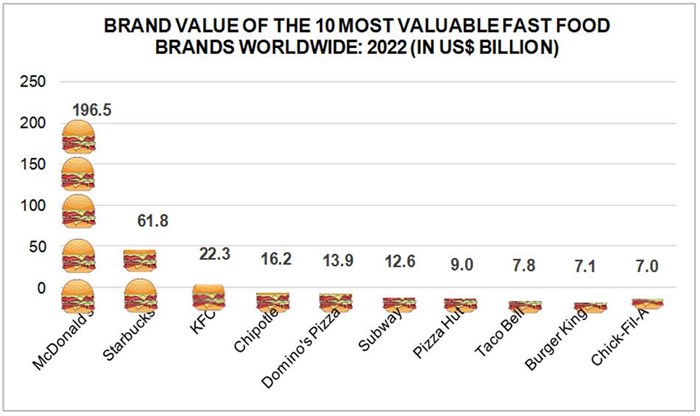

Globally, the fast food market is estimated to be valued at approximately US$728.0 billion in 2022 and is forecast to grow at a compound annual growth rate (CAGR) of 4.0%, to reach approximately US$964.6 billion by 2030. As illustrated in the graph below, McDonald’s remains the most valuable fast food brand in 2022, by a large margin, achieving a value of US$196.5 billion. Interestingly, Subway was the only brand that declined in value, from US$14.8 billion in 2021 to US$12.6 billion in 2022.

Source: Kantar; Graphics by Insight Survey In 2021, the South African fast food industry demonstrated resilience following the effects of the Covid-19 pandemic, reflected by a monumental increase of 27.5% between 2020 and 2021. This significant recovery (from the massive decline in 2020, due to Covid-19) is expected to continue, with an expected CAGR of 8.6%, between 2022 and 2026, driven by numerous factors, including the popularity and introduction of plant-based fast food menu items, which is catering to the increasing demand for these types of products amongst local consumers.

Specifically, according to the Uber Eats South Africa Cravings Report, there had been a 45% increase in the number of vegan restaurants on the Uber Eats app, as well as a 42% increase in orders for vegan fast food options. Additionally, vegan and vegetarian fast food alternatives were the third top concern in terms of consumer social media conversations, regarding fast food in 2021, only behind packaging and hygiene concerns, according to a report by Meltwater.

Moreover, according to the first Plant-Based Friendly Fast-Food Franchise Ranking report, which assesses plant-based offerings at top franchises in South Africa, up to February 2022, Kauai, Spur, and Panarotti’s were the top three, scoring of 10.5, 8.5, and 8, respectively. This was followed by Burger King and Simply Asia, which both scored a 7.

This growing popularity of plant-based alternatives is resulting in the introduction of new and innovative plant-based fast-food offerings by some of the largest local market players, including Burger King, Spur, and Nando’s.

As an example of a market player capitalising on these opportunities, Burger King released a range of new and innovative plant-based offerings. This includes the Vegan Royale, Plant-Based Whopper, and Vegan Nugget products, utilising ingredients including soy protein, wheat protein, and wheat starch, in place of traditional meat, offering a taste and texture experience "as close to the real thing as possible". The Vegan Royale and Vegan Nuggets are also V-Label endorsed, adding to its vegan credentials.

Additionally, Spur has continued to add plant-based and vegan-friendly options to its local menu, including the Nachos Mexicana and Large Cheesy Quesadillas options to its starter’s menu, and the introduction of Greek salads and hot vegetables to its main menu. At the same time, Nando’s also launched its new vegan PERinaise product, which is a plant-based alternative to its traditional peri-peri sauce, without the egg or gluten.

Interestingly, although not plant-based, the future of animal-meat-based fast food alternatives could be in the process of being revolutionised by the South African company, Mzansi Meat. In particular, the company revealed its first cultivated meat burger, which is made by extracting cells from cows, that is then used to grow meat in bioreactors. Although currently relatively expensive, the company expects to achieve price parity within 10 years and plans to expand to produce nuggets, sausages, and steaks, given that 60% of South Africans have indicated they would be willing to try cultivated meat.

The South African Fast Food/QSRIndustry Landscape Report 2022 (182 pages) provides a dynamic synthesis of industry research, examining the local and global fast food industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – market size and forecasts, latest industry trends and innovation, industry drivers and challenges, Fast Food/QSR competitor analysis, latest marketing and advertising news, pricing and promotion analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global and South African fast food industry?

- What are the latest global and South African fast food industry trends, innovation and technology, drivers, and challenges?

- What are the market, food-type and off-line/on-line value trends in the South African fast food market (2016-2021) and forecasts (2022-2026), including the impact of Covid-19?

- Which are the key South African fast food market players and what is the latest marketing and advertising news for each of the competitors?

- What is the latest company news for key South African fast food players in terms of products, new launches, and marketing initiatives?

- What is the pricing and recent promotions of key fast food competitors by category: Burgers, Chicken, Pizza, Pies, and Others?

Please note that the 182-page report is available for purchase for R40,000 (excluding VAT). Alternatively, individual sections can be purchased for R20,000 (excluding VAT).

For additional information, contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140-5756.

For a full brochure, please go to: South African Fast Food/QSR Industry Report 2022.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.