Top stories

More news

ESG & Sustainability

#Sona2026: President announces crisis committee to tackle SA's water challenges

There is still a long way to go before the BIG is implemented, with many aspects still be to be ironed out. One of the many questions being asked is how much recipients will receive? The answer depends largely on the objectives of the grant.

A recent green paper (Green Paper on Comprehensive Social Security and Retirement Reform (2021)), compiled by the Department of Social Development (DSD) outlined the monthly amounts required to achieve the following:

The BIG will impact all South Africans, both employed and unemployed. You’ll either be on the side that receives the grant, or the side that is funding it through increased taxes (assuming that’s the solution to the funding quandary).

This amount is more than just financial assistance to unemployed South Africans, it could also be their doorway to a world of products, brands, services and aspirations they had never considered before. A person who earns R20 to R50 a day, doing odd jobs, is only thinking of their day-to-day struggles. Do I have enough money to feed myself and my family? Can I afford some kerosene to keep the house warm? Do I have enough for the taxi ride home? They are thinking short-term, in the ‘now’. Tomorrow takes a back-seat because today is not guaranteed.

We wanted to find out, so we surveyed potential BIG recipients to ask them what they would do with a monthly grant of R1268. Our poll included unemployed consumers aged 18 to 64. We gave them an extensive list of options, from buying a new cell phone, contributing to a stokvel, renovating their home, opening a savings account, to eating out at restaurants.

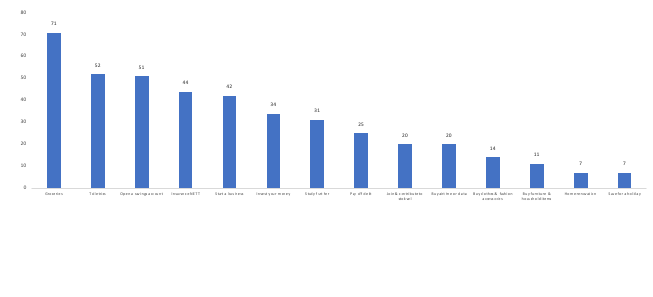

While basic needs like groceries or toiletries were considered important, with 71% and 52% saying they would spend more on these items respectively, there was a clear indication that consumers want to be responsible with their money, demonstrating a future-focused mind-set. They are thinking of ways to save and grow their money to create financial stability through various means.

More than half the sample (51%) would open a saving account to save their money, 20% would join and contribute money to a stokvel, while another 34% would opt to invest money in investment vehicles such as unit trusts, endowments or even shares and bonds.

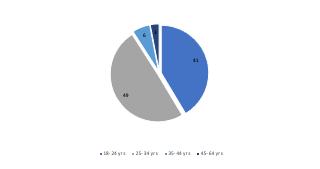

The desire to save and invest was strongest amongst younger consumers, with 18 to 34 -year-olds showing the most interest.

Will invest in UT, endowments, shares or stocks etc.

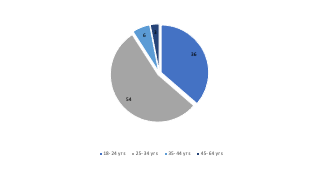

A quarter (25%) of the sample would look to pay off debt and unshackle themselves from past financial obligations. This was particularly important to 25–34-year-olds, with this age group making up 53% of those who would use the money for this purpose.

Interestingly, 44% chose some form of insurance for themselves, either funeral cover, life cover or medical aid. Of these insurance options, most (20%) opted for funeral cover, with 13% choosing life cover and 11% selecting medical aid.

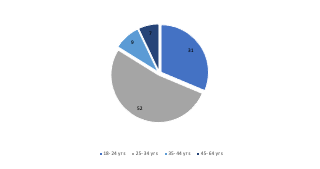

There is a real need for progression and to improve quality of life. This is clear when we see that a significant number (42%) would like to start a business, something that is especially important for 25-34 year-olds. 31% would use the money to study further, an option that was particularly enticing for younger consumers, 18-34 year-olds.

Entrepreneurship and education for many is a path to financial advancement and independence. Both are highly aspirational goals, and a small business can be an asset to pass down to the next generation.

Education empowers individuals to secure permanent employment, a potential promotion or even a better job, which all translate to a financial step up.

Will study further/ sign up for a course

Will start your own business

Consumers are looking for greater financial stability and a way to stretch their money as much as possible.

It is clear there is interest in financial products that either ‘protect me and my family’ or ‘grow my money’. The financial services sector needs to meet this interest with accessible, user-friendly information and affordable options.

Investing and saving products need to be demystified for this consumer and explained in a language that is consumer-friendly, on a platform that is accessible and convenient. There is a need for investment or savings products that are affordable but also offer tangible benefits. So, while long-term goals are achieved, day-to-day needs are also met through relevant value-adds and rewards.

The need for support and advice on starting a business or courses to study is important, and this could come from any brand in any sector, provided it’s accessible. For a brand to position itself as a partner on the journey to success is highly compelling and can build real brand loyalty as long as this is done with authenticity.

While the BIG has potential to change recipients’ lives, brands have the potential play a critical role in getting this money to go even further by partnering with consumers in a supportive and accessible way. In turn, brands would access a new cohort of consumers who previously might have not been able to consider their products. For more information, visit www.kla.co.za.

The survey was fielded at the end of August 2021, on KLA’s YourView panel as well as a partner panel, accessing South Africa’s adult population. We specifically included only unemployed consumers earning an income of less than R1000. A sample of n=300 was achieved. We asked participants the following question: If the SA government gave you R1268 every month, what would you do with the money?