Ask Afrika is the only research company in South Africa which has consistently tracked Covid-19 related fears, behaviours and beliefs with brand persona’s and psychographics since the beginning of the lockdown, allowing marketers to compare consumer attitudes during the different lockdown phases. The company’s Target Group Index (TGI) survey, a large-scale single source probability survey, offers the most comprehensive database of products, brands and media habits in South Africa and includes both pre and current Covid-19 data. The study highlights the extent to which consumer spending and consumption patterns have changed since the beginning of the lockdown, ultimately, allowing for more effective diagnostic testing. Founder and CEO of Ask Afrika, Andrea Rademeyer reveals some of the insights from the study and what brands need to do to retain a share of the consumer’s wallet.

Both businesses and consumers have been severely impacted by the lockdown imposed in response to the Covid-19 pandemic. For many small-, medium- and micro-sized businesses, the lockdown, combined with limited trading hours and reduced consumer disposable income, has meant that many of them are struggling to survive currently. Around half of these businesses consider themselves to be in a make-or-break period until December 2020.

The challenge for many SMMEs in this new Covid world is how to attract new customers and improve cash flow (59%), followed by new customer segmentation (29%) and how to adapt their marketing strategy (24%).

SMMEs, however, have an advantage over larger corporates given that most already have agility and flexibility built into their DNAs. In order to survive, many have diversified their product ranges (31%), implemented salary cuts (18%) and tried to reduce their overheads (15%). Other strategies to ensure their sustainability include moving their businesses online (13%) and adjusting their pricing in order to attract customers (10%).

Important to note, though, these initial strategies were internally focused. SMEs are urged to continue their innovation drive by being customer-centric and customers need more online engagement models and creative pricing.

Many large corporates, on the other hand, are hindered by their lack of agility and flexibility. The only large companies that will thrive post Covid-19 are those which are able to think like SMMEs.

To succeed going forward new models of collaboration between government, business and NGOs are required in order to yield new markets, sustainable cash flow and real value to consumers and society.

Consumers too are feeling the impact of the lockdown on their wallets with approximately 90% already defaulting on credit. Around 40% of citizens are considering downscaling substantially in the short term. Half of citizens have already changed their shopping habits, with 53% shopping less frequently, 25% reducing their basket size, 38% switching to a more affordable grocery store and 34% shopping at discount or bulk supply grocery stores. Across the board grocery expenditure has declined with a 36% decrease in day-to-day shopping, a 19% decrease in weekly top-up shopping and a 4% decrease in regular monthly shopping.

Given these changes in consumer behaviour, retailers can expect that they will have to fight to maintain their consumer segment. Price will continue to play a significant role in the choice of grocery store. Currently, 67% of citizens are influenced by price when shopping for groceries. Other factors which influence their choice include whether the retailer offers Covid-19 hygiene practices like sanitising (45%) and special offers (41%).

The pandemic and lockdown means that online has become the new de facto model of engagement. More than 60% of people say they are watching more online videos and TV on demand than ever before, while social platforms like Facebook and Instagram have become more important to 59% of people, which means digital needs to be factored into brands’ media spend.

Online purchases grew during lockdown, particularly groceries (56%), clothing (52%) and personal care items such as toiletries (41%). However, the expectation is that online shopping will not completely replace physically shopping. In fact, of the 32% who shopped online during the lockdown, 89% said they would still go to the store to buy groceries.

A differentiating opportunity for retailers will be delivery mechanisms. While 23% of respondents said they shopped online and picked up in store, 45% said they preferred delivery to their door, and 32% preferred curbside pickup.

What our various studies have proved is that loyalty towards brands is on a downward trajectory, both in the overall market and in the kasi market. In order to reverse this trend, brands need to become more successful at communicating relevant and current benefits to customers and strive to be of greater value to their customers.

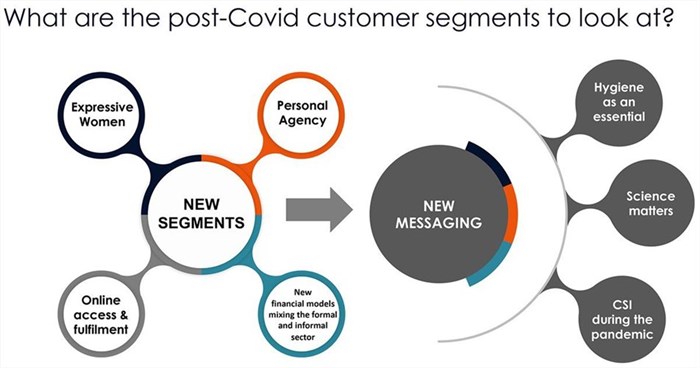

In a post-Covid world, the customer segments to look out for will include women, online access and fulfilment, increased personal agency and new financial models that combine the formal and informal sectors.

Effective messaging will include mentions of essential hygiene, science and the CSI efforts made by the brand during the pandemic.

To thrive going forward requires that marketers recognise the opportunities and look at data in a different way. As Tony Robbins so succinctly put it: “Expect change. Analyse the landscape. Take the opportunities. Stop being the chess piece; become the player. It’s your move.”

Post-Covid, new drivers of customer segments consider expressive women, customers shopping online with a need to secure access and to achieve fulfilment, customers prioritising personal hygiene/care and customers engaging in new financial modes, mixing both formal and informal sectors. Consider these as your next move.

Find out how marketers can best navigate amidst the myriad of complex new challenges by registering for our upcoming webinar on https://www.crowdcast.io/e/branspositioning

About The Abstract Club

Started by Karen Dyke and Joanne Scholtz, 10 years ago, as a support forum for freelancers, The Abstract Club is a platform for independent professionals to connect and grow. Our speaker mandate is to expand our thinking and understanding with thought provoking interactions and insights to inform the work we do for our clients.

For more information about The Abstract Club – contact Karen Dyke (moc.liamg@ekyd.nrk/ 0824955872) or Joanne Scholtz (az.oc.roirrawlatigid@ennaoj/083 461 6850)

About Ask Afrika

Ask Afrika is a decisioneering company. We support our clients’ decisions through facts. Typically, our clients’ require information around social research and philanthropy, experience measures and consulting, and brand dynamics.

Social research decisions are required around HIV/Aids and, more recently, Covid-19. Educational and early childhood development, fair-trade shopping, media and financial research are some of the areas we love to work in. NGOs, public and private sector clients choose to work with us to get the pulse of the nation.

Besides being decisioneers in brand and customer experience research, Ask Afrika is well known for creating some of the most useful, go-to industry benchmarks, including the Ask Afrika Orange Index®, the Ask Afrika Icon Brands®, the Ask Afrika Kasi Star Brands and the Target Group Index (TGI). Ask Afrika’s knowledge of brands is extensive. The Target Group Index (TGI) survey, which measures psychographics, service, products, media and brands, has been used by the majority of the top 50 advertisers and media owners in South Africa for nearly two decades.

Our clients operate across various industries, including retail, telecoms, finance, and the public sector. We offer tailor-made and ready-to-use offerings for all our clients regardless of the size of project.

In addition to being brave, agile, vibrant and experimental, we apply deep thinking to every research project. Our aim is to be great at everything we do and to make a meaningful impact.

Partner with Ask Afrika in order to confidently make game-changing business decisions that grow your business.

Contact us today and speak to Maria Petousis (az.oc.akirfaksa@sisuotep.airam/az.oc.akirfaksa@tcennoc)

www.askafrika.co.za