In a constantly evolving retail landscape, understanding consumer behaviour is paramount for home brands seeking to stay ahead. As consumers demand seamless experiences across online and in-store channels, the interplay between the two has never been more vital. Discover the insights that shape the future of home retail from consumer insights agency, KLA's latest study.

“South African consumers expect frictionless experiences from brands, with seamless transitions between offline and online experiences.”1

Online insights

According to the KLA’s YouGov Profiles tool, a staggering 74% of South Africans begin their shopping journey online to explore product options, but only 40% ultimately make the purchase through the same medium. Surprisingly, 42% discover products online but prefer to make the purchase in-store, underscoring the value of in-person experiences. With 56% of consumers favouring in-store exploration, this translates into nearly 3 in 10 consumers making their final purchase decision in physical stores.

The rise of click and collect

Over the years, the click and collect model has gained significant traction, with 37% of South Africans opting to order items online and pick them up from a physical store or designated location. This convenient option bridges the gap between online and offline shopping, offering a smoother, more convenient shopping experience for a wider audience. A larger range of consumers can now shop online effortlessly and affordably, and instead of waiting for delivery, they can pick up their purchases in-person from large businesses2.

The power of communication methods

When influencing purchase decisions, social media takes the lead, with 41% of consumers swayed by offers via platforms like Facebook and Instagram. According to Business Line (2023): “Many consumers are planning to shop on their smartphones, therefore mobile is the most crucial channel for brands this festive season”3. Television commercials follow closely at 32%, while branded emails secure a spot in the top three at 30%.

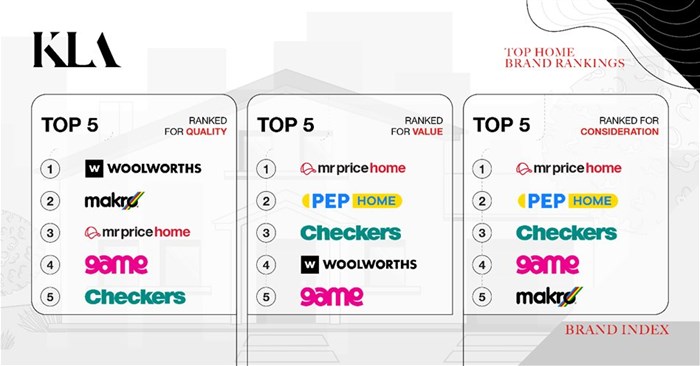

Top-performing home retail brands

KLA’s YouGov BrandIndex tool provides valuable insights into the top-performing home retail brands in South Africa:

Consumer preferences

In the next 12 months, 41% of South Africans intend to purchase bed and bath items (sheets, pillows, towels, etc.), 38% plan to buy homeware or soft furnishings (curtains, cushions, plates, etc.), 37% are in the market for kitchen and home appliances (fridges, washing machines, dishwashers, etc.), and 35% are looking to invest in furniture (chairs, bed frames, couches, etc.).

As South Africa's home retail market continues to evolve, brands must closely monitor consumer preferences and adapt to the ever-changing dynamics between online and offline shopping channels. Armed with the right strategies and a deep understanding of consumer behaviour, home brands can continue to thrive in this dynamic market.

Methodology

Profiles: Segmentation and media planning YouGov tool. Data is collected daily. YouGov Profiles makes it simple to find and understand the audience that matters most to you. It gives you the power to build and customise a portrait of your consumers’ entire world with unrivalled granularity. More than 12,500 variables are available in South Africa.

BrandIndex: The real-time and continuous monitoring tool for brands and all the speeches dedicated to them. In South Africa, more than 200 brands are assessed on a daily basis via our panel of approximately 123,034 respondents.

We track 23 general home retail brands.

Dataset: 2023-09-10

Population: South African adults with access to the internet aged from 18 years and older.

N ~ 2388

For more information, visit www.kla.co.za.

References:

1. Omnichannel strategies: One size does not fit all in South African retail https://www.bizcommunity.com/Article/196/87/242007.html

2. Hate waiting all day for your online order? Click-and-collect is solving one of the biggest bugbears of ecommerce — delivery https://www.dailymaverick.co.za/article/2023-06-18-hate-waiting-all-day-for-your-online-order-click-and-collect-is-solving-one-of-the-biggest-bugbears-of-ecommerce-delivery/

3. Majority of consumers prefer hybrid shopping for festival season: Report https://www.thehindubusinessline.com/news/variety/majority-of-consumers-prefer-hybrid-shopping-for-festive-season-report/article67255880.ece