The rise of technology and digitalisation is fast becoming a significant driving force in several industries globally, including the short-term insurance industry. The industry and consumers are increasingly shifting from the traditional models of insurance, and gravitating towards more customer-centric, digital solutions that are being revolutionised through the Fourth Industrial Revolution (4IR).

Insight Survey’s latest SA Short-Term Insurance Industry Landscape Report 2019 carefully unfolds the short-term insurance landscape in South Africa based on the latest information and research. It describes the relevant global and local market trends, drivers and restraints as well as to present an objective insight into the South African short-term insurance industry environment, market dynamics, and its future.

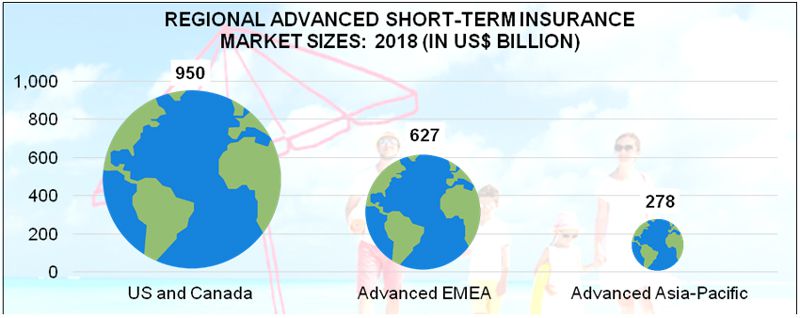

Globally, short-term insurance premiums grew by 3% in 2018, outpacing historic averages, to reach approximately US$2.4 trillion. North America (i.e. the US and Canada) remained the largest market in premium value terms as per the graph below, although, premium growth weakened marginally to 2.7% in 2018.

The South African short-term insurance market, by comparison, increased by a robust 4.8% in insurance premium volumes, between 2017 and 2018. Overall, the state of the market was good in 2018, achieving the highest underwriting and operating income for the past 14 years.

Worldwide, the rise of on-demand insurance and several artificial intelligence-related technological developments is already having a significant impact on the short-term insurance industry.

Insurtech (also referred to as insurance technology) currently represents one of the largest and most active sections with the realm of fintech. Since 2015, over US$7 billion has been invested in insurtech solution providers as insurance companies and investors seek to benefit from the significant impact new digital models are set to have on the industry. More specifically, investment in the insurtech industry doubled between 2017 and 2018, according to FinTech Global.

Some of the major global insurtech companies currently include the likes of We Sure, Shift, Lemonade and Zhong An, amongst others. Their offerings include full-service insurance platforms with direct insurance purchases, inquiries and claims through social media, recommended products based on a user’s behaviour and social media connections. Other solutions draw on artificial intelligence, big data analytics, and machine learning technology to identify patterns of fraudulent activity in insurance claims or that allow insurance claims to be approved (or rejected) within seconds.

The South African insurance industry has been relatively slow in terms of digital transformation. However, over the last few years, some of the key short-term insurance players have embraced technology to improve internal operations (digitalisation) as well as customer experience.

It is also predicted that emerging insurtech startups and companies will help revolutionise the South African short-term insurance industry. Some of the SA insurtech companies making waves include Pineapple, Naked, Yalu, Simply and Ctrl. For example, Naked claim to offer lower premiums through the use of AI chatbot and computer vision technology. By analysing a photograph of a vehicle, they claim to be able to provide a quote within 90 seconds, and cover within three minutes after it is accepted.

In addition, digitalisation is upending the traditional business model of the insurance market from a product-centric approach towards more of a customer-centric approach. As a result, more market players are making use of emerging technologies to centralise their product-offerings around the customer and to improve customer experience.

The SA Short-Term Insurance Industry Landscape Report 2019 (146 pages) provides a dynamic synthesis of industry research, examining the local and global short-term insurance industry from a uniquely holistic perspective – from global and local trends to analysing the key South African market players.

Some key questions the report will help you to answer:

- What are the current market dynamics (overview, market environment, and key regional markets) of the global short-term insurance industry?

- What are the latest South African short-term insurance trends (including tech and insurtech), drivers and challenges?

- How did short-term insurance companies perform in 2018/19, what is the strategic focus and expansion plans?

- How is each of the short-term insurance competitors positioned and what products do they offer?

- What are the latest marketing and advertising news for each of the short-term insurance players?

Please note that the 146-page report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased. For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140-5756.

For a full brochure please go to: South African Short-Term Insurance Landscape Brochure 2019.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 10 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.