Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

"We are increasingly more open to try new things and brands, which has significant implications for brand loyalty. Loyalty is the lowest it has ever been since we started measuring the Ask Afrika Icon Brands. Always is now only sometimes, but also due to an increased likelihood and willingness to try new brands or products. We are in fact raising disloyalists, by encouraging children to just enjoy things, try everything they want, try out various activities with no performance pressure, but just to be explored and enjoyed," says Sarina de Beer, MD of Ask Afrika.

"Economic pressure is influencing loyalty, as well as a range of social influencers. The quest for loyalty is becoming more complex, it is now about ticking all the boxes - the loyalty principles need to be reconsidered. Values are still a key driver as is authenticity and trust. According to the survey, the bar has just been raised - 46% of the respondents said that they were experimenters, only 5% said that they did not experiment with brands, and the rest were somewhere in between."

Personal expression is still a strong influencer behind consumption. Generational trends also reflect clear differences between groups emphasising the requirement to go social and sensory. For Boomers (55-plus), the ideal shopping experience is about getting a good deal on a decent product.

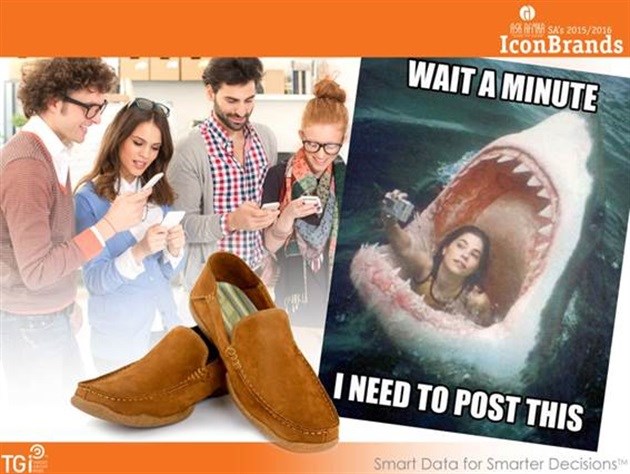

For Generation Y (18-34), it is more about a stimulating, sensual, 'sharable' experience. Sensory appeal and the ability to 'make me smile' are one-third more important to Generation Y than to Boomers. Practical decisions drive choice of retailers for 8 out of 10 Boomers, but only half of the Generation Y respondents. According to Jerry Johnson, an ideal shopping experience for younger people is less functional and much more social, expressive and sensory-driven. Retailers who want to appeal to Generation Y consumers should concentrate on the social aspects of the shopping experience as well as brands with which younger consumers would want to associate.

According to the McKinsey study and Target Group Index (TGI) research experimenters are both embedded in less-loyal segments and very present in the loyal segments, sustainable loyalty is at risk across segments, generations and typologies. The McKinsey study showed that when price, brand, freshness and quality, and experimenting were considered as choice drivers for grocery shopping, experimenting or trying new things received the highest cumulative index score across segments. Experimentation matters across segments, even if you place a premium on brand through quality or price, it is still relevant.

Experimenters expect value, non-experimenters rely more on brand satisfaction in developing brand loyalty. Loyalty perceptions are on the increase, but it is not reflected in usage. Consumers are extremely price sensitive with less money to spend.