Both globally and locally, consumers are increasingly demanding premium bottled water products that are more appealing in terms of design and packaging, specific mineral contents, or offering a variety of health benefits. This is resulting in a wave of innovative, premium bottled water products flowing into the local and global markets, as manufacturers try to meet this rising demand by offering region-specific mineral water, and even elevated bottled water experiences, to quench the thirst for premium products.

Insight Survey’s latest South African Bottled/Packaged Water Industry Landscape Report 2022, carefully uncovers the global and local bottled/packaged water market (including the impact of Covid-19), based on the latest intelligence and research. In particular, it describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African bottled water industry environment and its future.

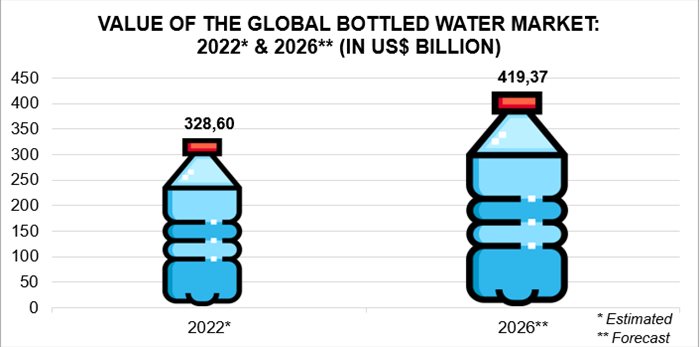

In 2022, the global bottled water market is expected to reach an estimated value of approximately $328.60bn. Furthermore, the market is projected to increase at a compound annual growth rate (CAGR) of approximately 6.29% to reach a value of approximately $419.37bn by 2026, as illustrated in the graph below.

In terms of the South African market, the local bottled water market achieved growth of 6.7% year-on-year, in current prices, between 2020 and 2021. Moreover, the market is predicted to grow at a CAGR of 7.2%, over the 2022* to 2026* forecast period.

This growth in both the global and local bottled water markets can be attributed, in part, to the rise in premiumisation, with numerous market players offering elevated products and experiences that cater to the growing demand for premium products.

Globally, consumers are becoming increasingly selective in terms of the taste, temperature, and mineral content of the water they consume. This has resulted in the introduction of high-end bottled waters offering region-specific mineral contents, such as Fiji Water, and evian, which is sourced from the French Alps. In terms of elevated experiences, water sommeliers are also becoming increasingly popular, offering Bottled Water evaluations and recommendations based on consumers’ needs.

Demand for premium bottled water products and experiences are also growing within the South African bottled water market. This premiumisation is evident in the growing presence of water sommeliers, as well as restaurants dedicated to top-quality bottled water offerings. As an example, the KōL Izakhaya restaurant in Hyde Park, Johannesburg, has a dedicated premium bottled water menu, including products priced at up to R650 per bottle.

Increasingly, local consumers are perceiving bottled water products as having different benefits, and tastes, and being of a certain quality, depending on where the water is sourced from. Local players, including Mountain Falls, Lofoten Arctic Water, Perlage, and Nevas Water, have responded to this expectation by promoting both the source and mineral content of its water.

In particular, Mountain Falls sources its bottled water from the Klenrivier Mountain Range in the Western Cape; Arctic Water from the Arctic Circle; Perlage from the Nałęczów Spa area; and Nevas Water gets its water from two artisan sources. Many of these products are also taste tested by accredited sommeliers, contributing to its premium positioning.

Further adding to their premium status, these brands are also incorporating high-end packaging and design for their bottled water products. As an illustration, Mountain Falls now offers its bottled water products in premium glass bottles, whilst Nevas Water has incorporated a popping cork into the design of its bottled water product packaging. Some bottles of premium bottled water are even adorned with precious stones.

The South African Bottled/Packaged Water Industry Landscape Report 2022 (115 pages) provides a dynamic synthesis of industry research, examining the local and global bottled water industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as manufacturer, distributor, retailer, and pricing analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global and South African bottled water industry?

- What are the latest global and South African bottled water industry trends, innovation and technology, drivers, and challenges?

- What are the market value and volume trends in the South African bottled water industry (2016-2021) and forecasts (2022-2026), including the impact of Covid-19?

- Which are the key manufacturers, distributors, and retail players in the South African bottled water industry?

- What is the latest company news for key players in terms of products, new launches, and marketing initiatives?

- What are the prices of popular bottled water brands and products (still, carbonated, and flavoured and functional) across South African retail outlets?

Please note that the 115-page full report is available for purchase for R35,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R15,000.00 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: South African Bottled Water Industry Landscape Brochure 2022.