Think audio, not radio; video, not TV; and news, not print. Refine your business strategy by clicking on the media consumption and planning trends of today set to maximise your brand ROI across Africa.

Three of the top questions we get asked are: ‘What has been happening to media consumption?’, On which channels are consumers most receptive to receiving advertising?’ and ‘How can we maximise our media ROI?’ Luckily, we have the answers. They’re detailed, encompassing data and insights curated from across Kantar’s CrossMedia, Connect, C-19 Barometer and Media Reactions databases, the last of which covers claimed media consumption habits from 14,500 consumers, covering 290 brands in 23 markets, as well as 900 senior marketers around the world.

To start with the basics, we need to touch on both sides of the consumer-marketer divide, on how media consumption has changed globally vs in Kenya, Nigeria and South Africa, as well as how marketers have shifted their investment and where they are focusing right now and into the future. There is some overlap in terms of reach and chasing consumers where they are, but marketers need to ensure the audience in a specific media channel is receptive to advertising messages.

We’ve been tracking consumers’ media consumption in the Kantar C-19 Barometer study since March 2020. Unsurprisingly, wave 9 of the study, conducted in April 2021, shows that consumers are spending even more time engaging across media platforms, with the average percentage increase of claimed media consumption up 25% globally. Interestingly, this is substantially higher across certain African countries, at 31% in South Africa, 33% in Nigeria and 34% in Kenya. While this doesn’t necessarily mean there’s more reach, it does mean it’s time to think about cross-media planning and the frequency of campaigns, as media frequency is higher when all touchpoints are considered.

The consumer effect: Linear and digital media-planning considerations in Africa

Drilling down into which media consumers are spending more time consuming, whether watching, listening or reading, there’s a clear shift from linear to digital. This doesn’t mean people aren’t listening to the radio or watching TV – they’ve just changed the way they do so as they’re streaming it now. The trend for newspapers is similar, with a move from picking up printed copies to getting that news fix online. It’s the biggest notable shift in media consumption: Audio, video and ‘print’ news are seeing growth across digital platforms.

That’s not to say there’s been a drop in traditional consumption. At an absolute level, linear TV and radio see definite skews on the continent. Because while linear TV is up 23% globally, it’s at 22% in South Africa, 27% in Nigeria and 28% in Kenya. Linear is up 11% globally yet jumps to 28% in South Africa, 34% in Nigeria and 35% in Kenya. And while cinema and magazines are in decline globally, newspapers are now teetering back on the brink of normality and up 6% in Nigeria.

Despite the digital connectivity and internet access issues on the continent, the pandemic has also accelerated digital consumption. The growth of digital video, especially YouTube (54% globally, 59% in South Africa, 62% in Nigeria and 67% in Kenya), is particularly impressive. Then there’s Facebook and WhatsApp. With an increase in consumption of 40% and 35% respectively across the globe, the figures are far higher in Africa, at 49% for Facebook and 58% for WhatsApp in South Africa, 51% for Facebook and 64% for WhatsApp in Nigeria, and 57% for Facebook and 69% for WhatsApp in Kenya. These media channels are therefore very important to consider in our media planning across Africa.

Kantar’s CrossMedia database, with insights into the actual reach or effectiveness percentage across multimedia campaigns, confirms digital’s dominance for the decade ahead. Back in 2015 and 2016, campaigns’ average reach on TV was 84%, with 12% duplicated reach with digital, and just 1% reach from digital video only. If we fast-forward to 2020 and beyond, the unique digital audience has grown to 12%, with the overlap of duplicated reach, where people are exposed to content both on TV and digital, double that of five years ago, as digital itself now offers much larger unique audiences than ever before.

The marketing perspective: Where are marketers focusing their investment?

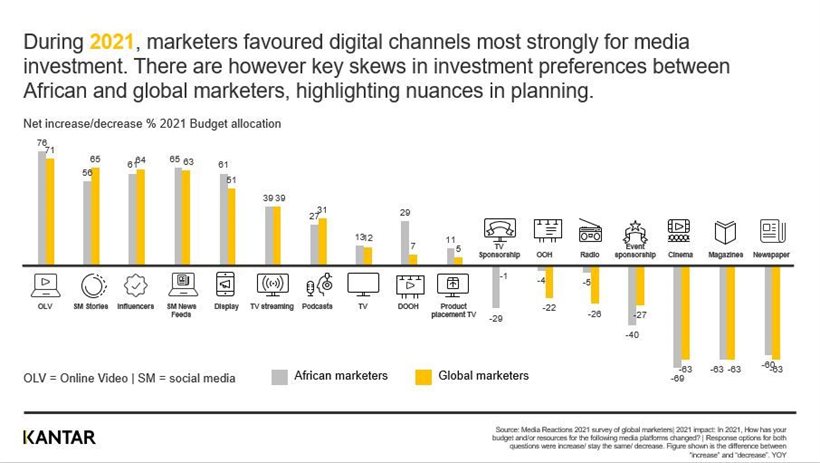

Kantar’s Media Reactions 2021 survey of global marketers across agencies and brands shows they favour digital channels for media investment, with TV streaming and podcasts topping the watchlist. Investment preferences for marketing in Africa show greater optimism for radio, out-of-home (OOH) and digital out-of-home (DOOH) channels with greater caution over event sponsorship. These trends are set to continue in the next year, with almost all platforms across the globe set to recover to some extent. Cinema and newspaper have largely fallen off the marketing budget allocation for the next year in Africa, with linear TV, radio, and OOH important for media strategy into 2022.

That said, beware the consumer and marketer divide. The top five channels where consumers are most receptive to advertising are offline, ranging from OOH to sponsored events, TV, TV sponsorship and radio. Consumers are especially receptive to advertising messages in magazines, cinema, and newspapers, while marketers think it’s all about today’s top digital channels like online video, display, social media stories and video streaming. This discrepancy means digital creative must be relevant, targeted, and enjoyable because consumers are much less forgiving in the digital environment than in linear.

This leads to one of the most topical questions of our times: How do marketers maximise media ROI and make today’s tighter budgets work harder than before? The answer is simple: Overall campaign ROI success is driven equally by creative cut through quality (50%) and exceptional media planning (50%), comprising reach (25%), frequency (16%) and media synergy (9%).

When we index the paid, owned and earned touchpoints from our global Kantar Connect database to determine which are best suited to deliver brand growth, we see that TV remains the most impactful paid touchpoint globally, far exceeding every other brand touchpoint in driving brand equity and brand growth. Word of mouth (WOM) or positive advocacy for your brand from friends and family follows closely behind, but all channels across paid, owned and earned drive impact. So, while digital drives positive sentiment and advocacy, it’s all about understanding the role of the channel and the messages conveyed, as effective marketing today means doing a lot more with a lot less.

The synergy effect: How maximising content maximises in-market sales performance in Africa

Validated work from our Link creative database shows strong creative cut through is linked to strong short-term sales performance as well as long-term brand equity, especially for TV. The converse also holds true, as ads with poor creative cut-through tend to have much lower short-term sales impact.

But we need to think beyond one hero media. While 61% of marketers are confident that they have the optimal media mix when planning media campaigns, brands with smaller budgets really need to think about diversifying that investment into the channels that are important to consumers. Increasing the number of channels in your media plan enhances campaign ROI by as much as 35% vs just having one or two channels in play.

Ad Age’s summary of the ARF’s “How Advertising Works Today,” which analysed 5,000 campaigns for 1,000 brands in 41 countries, serves as further evidence that a multi-channel approach is most effective. Worried about clutter and cut through? It’s a common concern with so much consumption happening: we watch TV and video while listening to radio and streaming across both linear and digital. That’s where campaign synergy comes in to play, accounting for 34% of campaign ROI. Three conditions are required for synergy between channels:

- Overlaps in reach, with duplicate audiences

- Synchronous or overlapping phasing

- Creative synergy

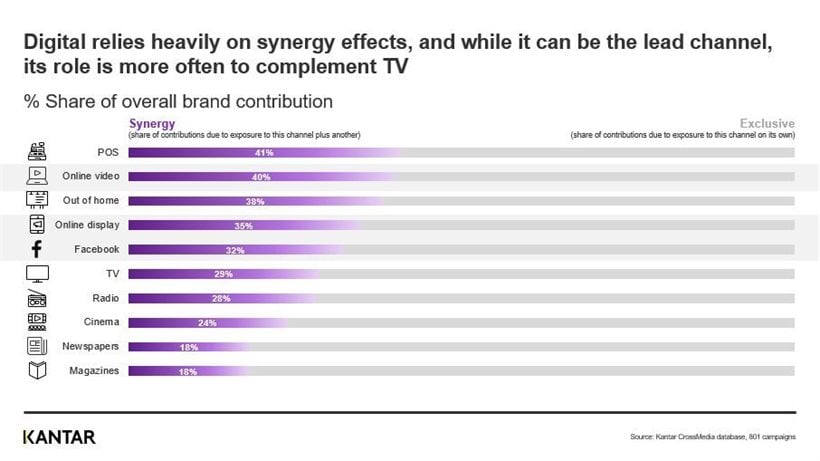

Are all your assets optimised for a particular channel? Are they all working hard at cutting through? Keep in mind that it differs by channel, so it’s best to look at synergy in terms of share of contributions due to exposure to this channel plus another. Point of sale (POS) is at 41%, while online video is 40%, OOH at 38%, online display at 35% and Facebook at 32%. In decoding this, digital clearly relies heavily on synergy effects. While it works well as the lead channel, its role is most often complementary to TV and other traditional channels.

On the other end of the scale, linear channels like magazines and newspapers (both at 18%), as well as cinema (24%), radio (28%) and TV (29%) rely less on synergy than new media platforms, as their campaign creative often stands alone and does the hard hitting. Those dabbling in digital therefore do well to rely on synergy from the bigger reach traditional media.

In assessing whether campaigns are well integrated, we index our entire database of 5,000 campaigns to the average campaign impact. There’s a 16% increase if the creative has a similar look and feel across all channels. Taking this a step further by customising and optimising the creative for a particular channel increases the overall campaign effectiveness by as much as 26%.

Choosing a multi-channel strategy and focusing on customising and optimising the creative within each channel is therefore the secret ingredient to delivering media ROI.

4 top take outs to maximise your brand ROI across Africa

- Plan across linear and digital. Think audio, not radio; video, not TV; and news, not print.

- While TV, radio and print remain more important in Africa than in global markets, it’s important that global brands think ‘glocal’ and take the nuances of our continent into account.

- Beware of the skews in ad receptivity between consumers and marketers. Balance reach and relevance, especially if you’re investing in channels where consumers are less receptive to advertising.

- Media ROI is about more than reach and spend. When measuring your media success, remember that campaign ROI comes from the creative, media integration and synergy.

That’s how you find certainty in uncertain times through measurement.

Rewatch the PAMRO session and find out more about the Media Reactions findings in South Africa. Data is available for purchase across different categories in SA so reach out moc.ratnak@scitanafdnarb with any questions and follow us on LinkedIn and Twitter to keep up to date with our communications.