Africa is undergoing rapid transformation, shaped by distinct socio-economic dynamics across its regions. The shift in the retail landscape reflects the expansion of local operators like Naivas in Kenya, and the influx of international players like Amazon in South Africa.

Christele Chokossa. Image supplied

As the sector becomes increasingly competitive, retail businesses need to adjust their approaches to include providing more value propositions for their main audience, localised e-commerce solutions and engaging more with a younger generation of consumers.

Affordability will continue to resonate despite slower inflation

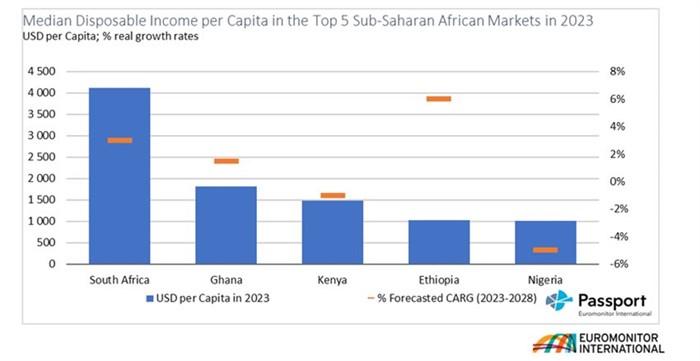

Africa's consumer spending has been dominated by essentials like groceries, with an average household disposable income of $4,221, significantly lower than the global average of $27,653 in 2022. The persisting income divide across social groups has been worsening the situation.

For instance, despite South Africa recording the highest disposable income per capita across the region, according to the latest Gini index, the country remains one of the most unequal markets across the region.

Although some improvements are anticipated in the coming years especially across emerging countries like Ethiopia, lower-income households will continue dominating the African social group landscape.

The trend is illustrated by Euromonitor's latest economic research, which indicates that the combined bottom of the pyramid in Nigeria, Kenya, South Africa, and Cameroon is set to reach 168 million adults with a total disposable income of $672bn (in PPP terms) by 2030. For retailers, such dynamics imply that the mantra of value offerings will continue to resonate with shoppers' needs.

As a result, betting on economies of scale and strong relationships with suppliers to provide affordable goods will remain an essential competitive tool for retailers targeting the mass market.

Likewise, improving private label offerings while boosting their visibility through dedicated online spaces will enhance penetrations beyond physical stores. In parallel, more retailers should consider leveraging data harvested from various sources, like loyalty or machine learning programs, to implement targeted marketing and promotional campaigns.

Additionally, diversifying offerings to include the purchase and/or sell of sale of second-hand items offers a unique opportunity for non-grocery retailers to tap into a widespread market dominated so far by informal traders across the continent.

Investing in e-commerce in underdeveloped areas

While urbanisation has recently helped drive economic growth, Euromonitor estimated that 52% of Africans living in cities are based in informal settlements in 2022.

In comparison, 53% of households were still located in rural areas. Such conditions provide a unique opportunity to tap into niche segments like rural and township (lower income) e-commerce as they remain significantly underpenetrated in 2023 despite improvements in internet access in such areas.

Likewise, introducing click-n-collect services through strategic partnerships with existing networks of small and medium businesses will also help mitigate fulfilment costs while facilitating access in areas with geo-mapping issues.

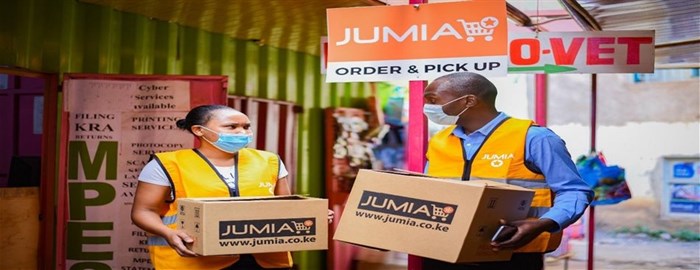

A prominent example can already be taken from Jumia, which successfully piloted a rural e-commerce campaign on the Ivory Coast. The company also expanded its pick-up and order points in Kenya by partnering with small businesses in high-footprint areas.

Source: Jumia AG

In parallel, retailers can expand their online consumer base further by embracing innovative payment innovations such as Mukuru Pay, which is tailored to meet the needs of the prevailing unbanked African population by facilitating cash transactions.

Furthermore, incorporating the practice of online community group buying, a trend that has seen significant growth in recent years in Asia Pacific markets, particularly China, offers a distinctive chance to engage community leaders as business partners. Their collaboration holds the potential to enhance drive conversation and re-ordering rates while broadening the customer base at the same time.

Better engagements with the youth will support sustainable growth

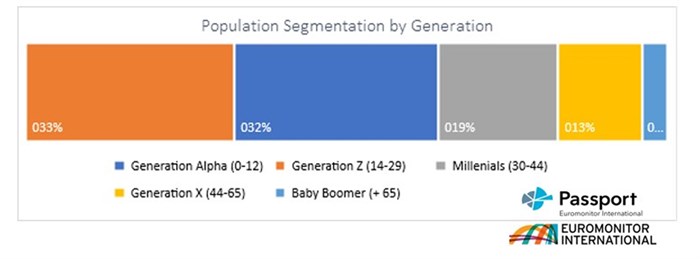

Sub-Saharan Africa is home to one of the youngest populations, with 62% being under the age of 25 years - more than in the US (31%) and Europe (27%). For retailers, dealing with a younger population translates into a need to differentiate offerings through improved customer engagement.

As a result, reimagining retailing services to create immersive and memorable experiences should remain an integrated part of business strategies.

As Generation Z Shoppers demand a more inclusive approach to business strategies, embracing Crowd-sourcing ideas could be a viable strategy to help develop innovative solutions meeting the market's needs.

Similarly, aligning corporate values with this new generation of shoppers will remain an ultimate tool to strengthen brands' equity.

Africa's diversified cultures, landscapes, and traditions affect the retail landscape. As a result, defining lines between winning and losing will continue depending on businesses' abilities to adapt to evolving consumer preferences.

Therefore, in this increasingly complex operating environment, gaining a competitive advantage in the years ahead will involve providing value offerings, leveraging e-commerce and new technologies to expand the consumer base and building long-standing brand equity.