Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Analysis of the Kantar BrandZ Global brand valuations in 2021 shows that the most valuable brands start off with strong meaningful difference, then amplify that to grow.

But Stina van Rooyen, head of Brand, South Africa, Insights Division, Kantar, reveals that there’s more to it than that. In fact, the secret sauce to predisposing people to pick your brands over the competition lies in creating Meaningful Difference: “Ultimately, predisposed consumers end up buying with less reminding, because you have succeeded in building up a bank of cumulative associations on which they have come to rely. As a result, they don’t need to evaluate their options every time they make a decision because they have already created a mental shortcut, such as the Capitec Bank sound and distinctive logo. Of course, this predisposition isn’t open-ended or infinite; rather, you need to keep reinforcing it through marketing and brand experience.”

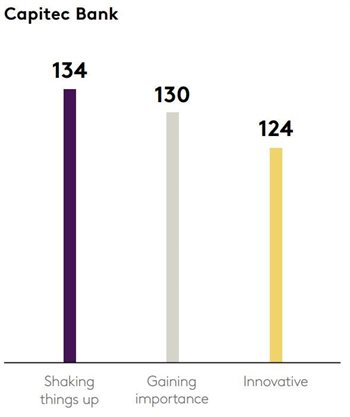

That’s why in addition to claiming #11th place in the ranking with a brand value of $928m in the challenging socio-economic climate, Capitec Bank stood out for making a meaningful difference in consumers’ lives and setting trends while meeting both functional and emotional needs.

Gerrie Fourie, CEO of Capitec Bank says it all boils down to agility, resilience and innovation. This focus on turning the economic crisis into an opportunity to bolster their digital offering while staying true to fundamentals of simplicity, affordability and personalised service has seen Capitec Bank’s active digital banking clients across the app, internet banking and USSD growing by 22% to 8.9 million to now comprise slightly more than half of its total 16.3 million customers.

The retail banking app’s remote onboarding feature allows customers to open a Global One account in real-time by scanning in their face and identity document, to use the free virtual card designed for safer online shopping, with no transaction fees. Clients can also use their app to scan and pay on Snapscan, Zapper or Masterpass making cashless banking easier and more convenient.

Fourie confirms: “We bolstered our digital offering while staying true to our fundamentals of simplicity, affordability and personalised service. This combined with our continued commitment to our branch network and call centres, resonated with South Africans from all walks of life. We’re seeing rapid growth in South Africa’s digital economy as clients also adopt contactless card payments and online shopping.”

In a competitive category, ramping up that difference is critical. A recent study by Kantar BrandZ looked at price elasticity for 700 different brands relative to their category peers and found that brands with lower Difference lose roughly 50% more volume for the same change in price, across categories and markets. That’s because a brand that is perceived as Different is much harder to substitute with a competitive alternative.

Difference therefore provides more than just a reason to choose at the time of purchase. It also helps justify the price asked, and offers strong justification post-purchase, as consumers perceive the brand as providing something distinct in the marketplace that they can’t get from anyone else. Brands can create perceived difference through innovation as well as disruption, by shaking things up in your own business or the category overall.

That’s why in addition to being most meaningfully different, Capitec Bank also tops the table for being both value- and difference-driven. That difference is linked to innovation and a strong drive towards positive disruption, with Capitec not only doubling down on all things digital but also having celebrated the opening of its futuristic new office in Stellenbosch in the heart of the industry’s pandemic panic in July 2020.

This physical flash reassured customers that the bank is not a digital flash in the pan. It has stable brick-and-mortar roots, giving more credence to Capitec’s standing as the first in the country to position itself as a digital bank. It has maintained its innovative positioning through initiatives like its virtual bank cards, scan-to-pay capabilities, and even a partnership with Shell. Recently, Capitec Bank has reported strong results and a user base that is growing by roughly 180,000 clients per month.

There’s also a focus on growing a strong savings culture in South Africa and fostering partnerships to create better value for clients, such as decreasing the cost of credit while creating bespoke purpose credit solutions that allow clients to access home loans with SA Home Loans, home improvements at CTM, vehicle finance at WeBuyCars, medical treatment at Mediclinic and education at Stadio. Capitec Bank has also partnered with Dis-Chem, Shell, Educate24, GetSmarter, Hello Doctor, JOOX, Rentalcars.com and Travelstart, ensuring clients receive cashback or discounts simply for activating a free Live Better savings account.

Fourie explains: “We are one of the few banks in the world that offers our clients interest on their main transactional account, and now that interest can work even harder for them in their Live Better Savings account. We’re going to continue expanding our Live Better benefit programme by partnering with other leading SA brands to create further benefit to our clients.”

Fourie says Capitec will maintain its focus on digitalisation to enhance clients’ banking experience and help South Africans live better.

“We believe our human connection and service ethos remains our key competitive advantage. We will use advanced technology, data, and AI to help scale our personalised banking experience for our clients while helping them to simplify their banking further. This strategy will be assisted by our strategic partnerships with some of the world’s best technology providers. We will also partner with more leading South African consumer brands to offer our clients purpose-designed credit solutions and more Live Better benefits.

We are committed to our purpose to help people improve their financial lives. We maintain our small company culture and entrepreneurial mindset and will continue to innovate in relevant ways that help South Africans simplify their banking so that they can live better.”

The acceleration of technology and digitisation has clearly changed the way we all do business. With technological advancements only set to accelerate in 2022, brands need to ensure they’re driving consumer demand in the digital-first era by providing superior experiences across all consumer touchpoints; communicating this through great advertising with memorable icons and messages; to promote their well-designed, innovative functionality that’s convenient and fits seamlessly into the everyday lives of users.

Learn more from South Africa’s most valuable brands, with a focus on how to build strong brands and engineer for growth in 2022 and beyond. Also reflect on SA’s most valuable brands from 2018 to date and what the top brands have been up to in the last year.

Bonus lesson: Download our comprehensive guide to brand equity and growth.

Kantar BrandZ is the global currency when assessing brand value, quantifying the contribution of brands to business’ financial performance. Kantar’s annual global and local brand valuation rankings combine rigorously analysed financial data, with extensive brand equity research. Since 1998, BrandZ has shared brand-building insights with business leaders based on interviews with 4 million consumers, for 18,000 brands in 51 markets, including opinions from 31,335 South African consumers on 660 brands in 47 categories. The ability of any brand to power business growth relies on how it is perceived by customers. Grounded in consumer opinion, Kantar BrandZ analysis enables businesses to identify their brand’s strength in the market and provides clear strategic guidance on how to boost value for the long-term. The eligibility criteria are: