In October 2017, YouKnow Digital, in partnership with consumer insights platform Crimson Hexagon, launched an extensive South African Consumer Trends Report, focused on four key industries undergoing significant change: Travel and Hospitality; Technology and Entertainment; Fitness and Sport; and Automotive. Compiled from a dataset of approximately 1.5bn public posts, they looked at local data from 2012-2016, across Twitter, Facebook and Instagram, as well as blogs and forums in some cases.

Kelvin Jonck, MD at YouKnow Digital

We asked Kelvin Jonck, MD at YouKnow Digital, to unpack the report focusing on the travel and hospitality findings.

Why was travel one of the key industries focused on in the South African Consumer Trends Report?

South Africa is famed worldwide for its tourist attractions, with optimal temperatures and a vast geographical landscape allowing our tourists to enjoy beautiful beaches, sunsets over the African bushveld and lush natural forests all within South Africa’s borders. South Africa also enjoys a rich cultural heritage and young democracy, the must-sees include both historical and natural sights, from Mandela’s prison on Robben Island to the stunning views of Table Mountain.

Thanks to these, South Africa attracts millions of overseas and local tourists every year. The latest figures show that South Africa has had “almost 3.5 million travellers passing through South African ports of entry in August 2017.”

It is an obvious and natural choice as a key focus area in the South African Consumer Trends report. With 151,742 posts recorded between January 2012 and September 2014, travel and tourism is a definite social trend recorded over many social platforms, with rich data available for marketers to make use of to attract and target the correct audiences.

What is the value of social listening to the industry, particularly in identifying trends? Why should companies in the industry have an ear to the social media ground?

There is no better way to gain honest feedback than through a social network. Both brands and organisations are being spoken about – like it or not – and this is a great thing. Instead of paying exorbitant amounts of money on focus groups and surveys, marketers have massive amounts of unsolicited, nuanced opinion right at their fingertips.

While a focus group or survey is built to capture the opinions of initiated and uninitiated consumers, online opinion analysis targets the initiated and the honest, unsolicited opinions they spread across the web. Those who choose to express their brand opinions via social media touch on a variety of different topics and have the potential to inspire or prevent those they influence from becoming future customers. Therefore, it is vital to know what they are saying, who they are, and who they are talking to.

When companies measure the themes that comprise the broader conversation, marketers can monitor the day-to-day or hour-to-hour trends that each theme follows, offering insights that guide advertising, PR, and customer service response strategies.

What were some of the key findings on travel and hospitality?

Key findings include:

Why do people travel?

Family holidays are a central feature in the discussion around travel, with 26% of the discussion followed by friends (18%) and business (12%). Interestingly, the intersection between family and friends only accounts for 5% of the conversation.

Topic wave: Why do people travel 5/1/16 to 8/31/16

Travel: Why do people Travel - Topics from 1/1/12 to 12/31/16

Travel: Why do people Travel - Words from 1/1/12 to 12/31/16

While (almost) all tourism sectors are represented in the conversation, the largest reflection of travellers on social is related to their family travel. At its core, social media is inherently social and this strong willingness to share intent and experiences while on (or planning for) a family holiday presents a potentially easy conversation to both stoke and join as a brand.

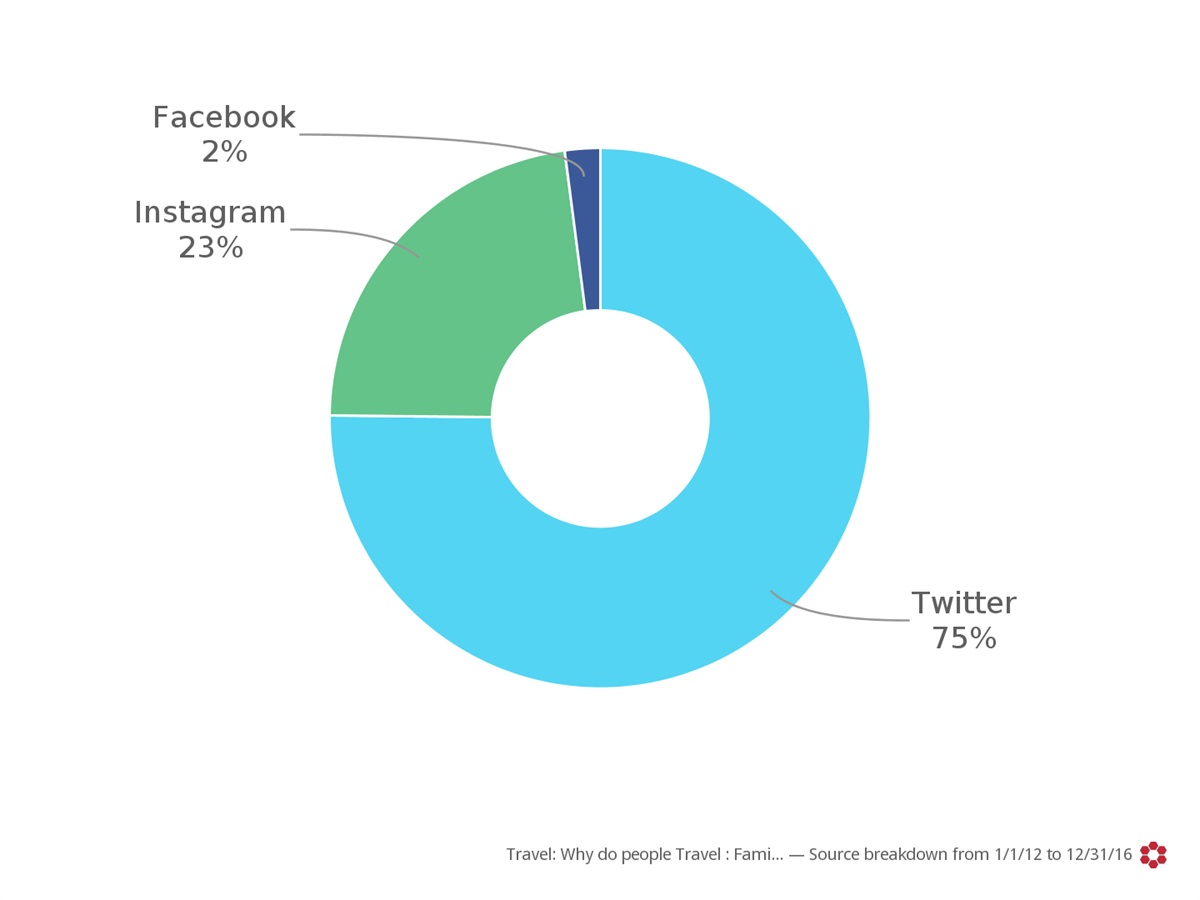

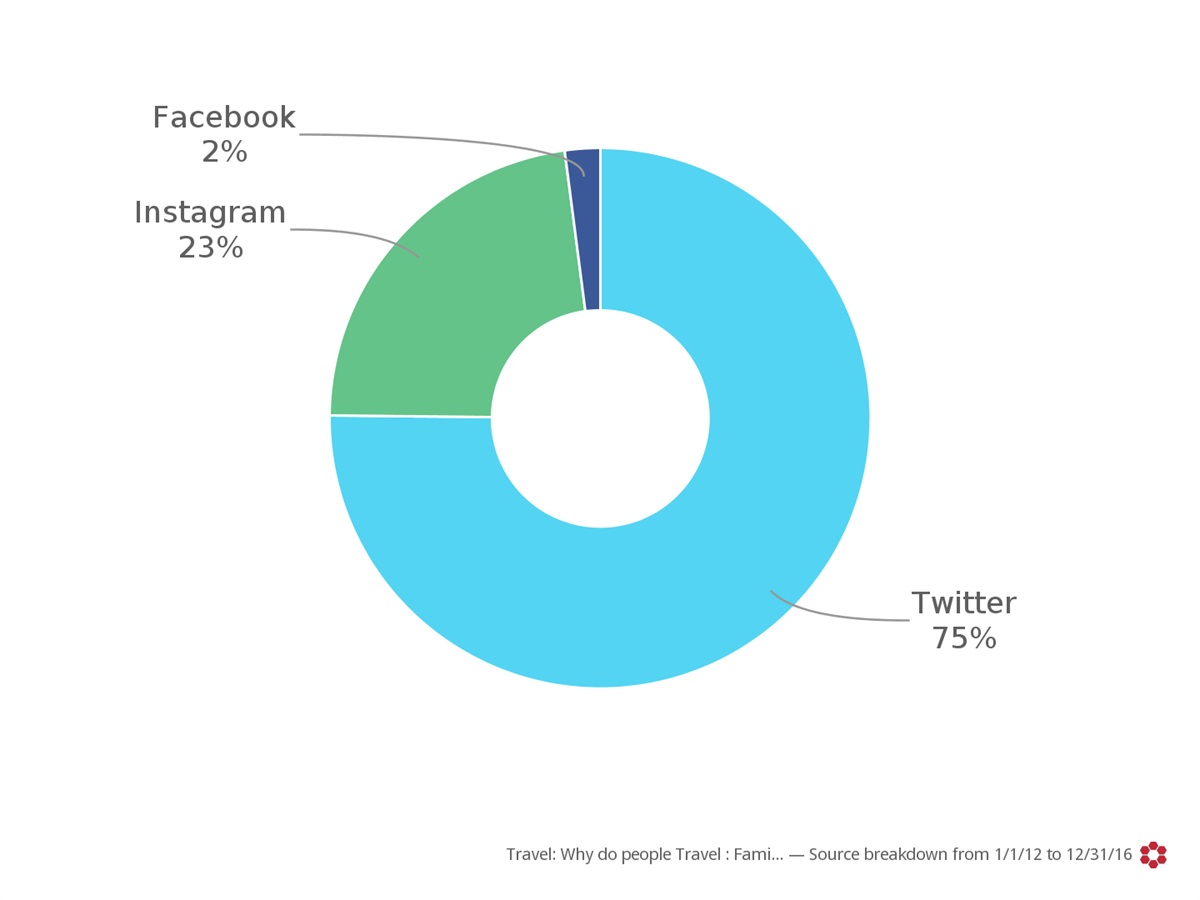

Where is the conversation taking place?

76% of the discussion around holiday and travel intent is happening on Twitter (period Jan 2012 - Dec 2016). Twitter contributes three times any other social network in South Africa for holiday and travel intent discussion.

Twitter should be seen as the engine room of where consumer conversations relating to their intention to travel will take place. That said, much of the visual content gathered during the exploration, planning and actual holiday itself are captured on Instagram.

Travel: Why do people Travel - Source breakdown from 1/1/12 to 12/31/16

However, Instagram is on the rise…

From May 2016, Instagram has been the fastest growing content source for intention to travel, growing by 32% compared to the previous year.

The Twitter contribution trended a 30% drop between 1 May 2016 and 31 December 2016.

Travel is an inherently visual experience and, as a result, the specialist visual platform has been selected by the community as the ideal place to discuss and record their experiences. Social media users will indeed migrate to the platform which assists them to best express themselves.

Travel: Why do people Travel - Volume of content from 9/1/14 to 12/31/16

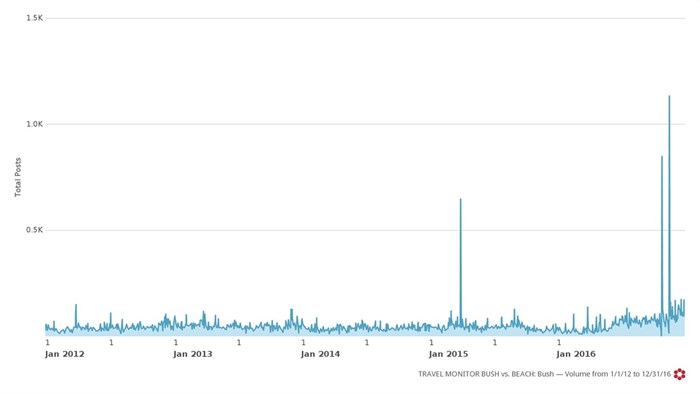

Local holiday destinations: Safari vs. Beach

Beach-related conversation outdid bush-related conversation by a ratio of 2.7 to 1. Volumes are significantly higher, year-round, for the beach destination discussion. Tourists and South Africans love our coastal destinations. Beach received far higher interest as a destination of choice. In the South African context, however, it should be noted that for the socio-economic cross sections that is South African social media beach travel tends to be far more accessible - both geographically (we’re one big coastline) and economically (bush holidays are only available to the higher LSM groups).

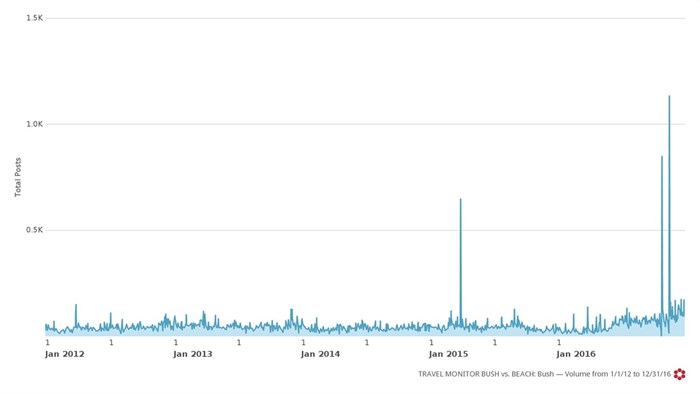

Travel Monitor: Bush vs Beach from Jan 2012 to Dec 2016 - Bush

Travel Monitor: Bush vs Beach from Jan 2012 to Dec 2016 - Beach

Is there anything about the South African travel consumer that stands out? Did the data indicate any concerns, grievances, requirements, etc. that should be addressed?

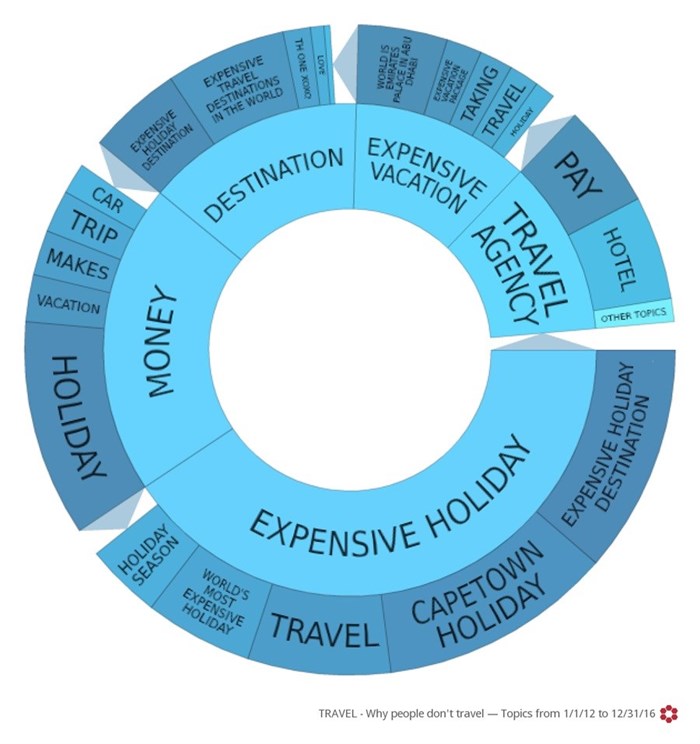

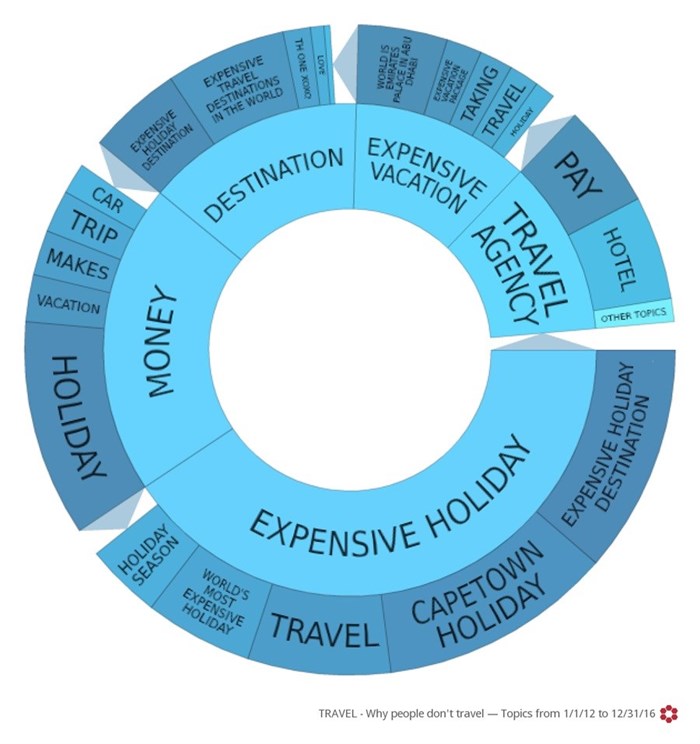

Money/price is the biggest barrier to local travel. Across the entire reporting period, money and expenses were the greatest consistent barriers to individuals travelling more.

Travel Monitor: Why do people travel, Topics from Jan 2012 to Dec 2016 - Beach

Looking at just the cost related conversation, a wide range of associated terms are noted:

Travel Monitor: Why do people travel, Clusters from Jan 2012 to Dec 2016 - Beach

In the short-to-medium term, marketers would be wise to consider those discussing expensive holiday destinations and directly targeting these individuals with low-cost alternatives. Specific times of the year (January and July) receive the highest volume of conversation pertaining to the cost of travel in particular - largely as a result of them returning from a holiday or having leave but no money to enjoy it.

What, in your opinion, and based on the available data, will be the most influential trends in the tourism and hospitality industry? What should the industry take note of?

Travellers want to visualise potential new travel experiences and as Instagram content sharing is on the rise - what better way for the travel and tourism industry to engage with their audiences than through shared visual content.

Although one should not discredit the power of various social platforms, travel agencies should pay particular attention in engaging their audiences with competitions and rewards for sharing visual travel experiences online, in order to promote various travel destinations organically.

Holidays are becoming far too expensive and with South Africa’s current economic situation, travel is now seen as a luxury and many families are opting for inexpensive weekend getaways or to stay at home. Regional and national tourism offices would do well to directly engage individuals with unique but free activities for individuals and families to participate in aiming to stimulate local travel.