The costs of buying a property in South Africa include transfer duty, attorney's fees, and deeds office registry fees. As a rule of thumb, these costs amount to 8-10% on top of the purchase price of any property over R900,000. Given that buying property is likely the biggest financial investment that most people will ever make, these extra costs can be a burden and barrier to entry.

Paul Stevens, CEO of Just Property

Government has a responsibility to make South Africa an attractive investment option to both locals and foreigners. President Ramaphosa is acutely aware of this and is acting accordingly. Wednesday, 6 November, marked the official commencement of the second South African Investment Conference, a key event in the drive to secure over R1.2tn in investment commitments over the next five years. By the end of the conference R200bn had been pledged by local and multinational businesses.

Transactional costs are, most likely, lower down the list of concerns for foreign investors as they contemplate the greater impacts of our energy crisis, land reforms, fiscal and regulatory issues and more. And many locals are facing a credit crisis that means they can't, rather than don't want to pay an extra 20-25% on their assets, as Samuel Seeff, chair of Seeff Property Group has noted.

World Bank’s Ease of Doing Business Index

But I am optimistic that our government has the right focus. The president has said that his administration set itself the goal of progressing to the top 50 in the World Bank’s Ease of Doing Business Index (South Africa is currently at number 82 out of 190). A nation's ranking on the index is based on the average of 10 sub-indices, one of which is registering property (procedures, time, and cost to register commercial real estate).

In terms of African economies, Mauritius is currently ranked 20th worldwide. Amongst the four reforms that the World Bank said had facilitated Mauritius’s improvement across eight of the 10 rankings was “simplification of ownership transfers – with a reduction in transfer costs”.

Perhaps surprisingly, Rwanda is also in the top 30. Rwanda has an online property registration service, similar to that envisioned for South Africa, and it takes just seven days to transfer property there. Transfer costs are 0,1% of the property value and for this, Rwanda ranks second in the world for ease of registering property.

South Africa is ranked 82nd overall and 106th for ease of registering property - but procedures and time are already being addressed, for example:

- The Electronic Deeds Registration System Act was recently signed into law by President Ramaphosa. The Act will facilitate the development of an Electronic Deeds Registration System, known as e-DRS, which will enable the processing, preparation and lodgement of deeds and documents by conveyancers and the Registrar of Deeds via the internet. The system also aims to improve transparency and allow for greater accuracy of examination and registration.

- The Centre for Affordable Housing Finance in Africa (CAHF) and Seso Global (a blockchain property registry company) have partnered to develop South Africa’s first blockchain-based property register. The pilot study consists of almost 1,000 properties located at four sites in Makhaza, Khayelitsha. All of the properties are government-subsidised properties that have not yet been registered on the Deeds Registry. According to Daniel Bloch, CEO of Seso Global, this will be the first working example of a blockchain-based property registry in South Africa.

How do SA transactional costs compare to those abroad?

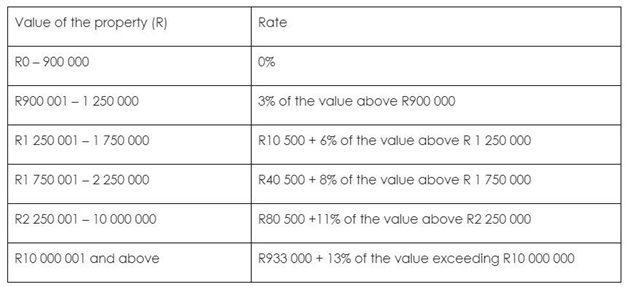

Transfer duty in this country, paid to the South African Revenue Services, is high compared to the rest of the world. For example, a person buying a property for R1.25m would pay R10,500 in transfer duty while someone buying a property for R3m would pay R163,000. This transfer duty table from SARS breaks it down:

Dr Sally Wallace, dean and professor of economics at the Andrew Young School of Policy Studies, Georgia State University, writes that available information suggests “that stamp duty levies are charged well above the cost of the service. In addition, coupled with property transfer taxes, the statutory cost of transfer of real property is very high in many countries and there is evidence that they disrupt real estate markets”.

Professional fees are also high in South Africa, with the benchmark for agent commissions being up to 7%+VAT. For a comprehensive analysis of property transaction costs worldwide (including illustrative conveyancer’s and agent’s fees), see www.globalpropertyguide.com.

According to this analysis, Qatar/Doha (0.25%), Uzbekistan (2%), Denmark (2.23%), Iceland (2.9%), Nepal (2.78%), Oman/Muskat (3%) and Fiji (3%) have the lowest transactional costs, compared to South Africa at 14.65%.

What other solutions could there be?

Blockchain technology will really improve the cumbersome and costly process that we currently have in place. With technology developments, come better processes and with that comes efficiencies and, we hope, a reduction in transactional costs.

While some worry that blockchain will remove the need for intermediaries, I believe that professional services will instead be restructured. Real estate agents and attorneys will deliver different services as the digital and legislative landscape changes. Fees, like agent commissions, will continue to come under pressure and the benchmark 7% will come down.

Another option that is not frequently considered, given South Africans’ desire for land ownership, is land rental. In Land Policies for Growth and Poverty Reduction (World Bank/Oxford University Press, 2003), Klaus Deininger notes that “in most industrial countries, land rental constitutes an important instrument for gaining access to land under conditions of often rapid structural change… In general, rental markets contribute to the intergenerational mobility of land, that is, shift it to younger producers, in addition to transferring land to smaller producers and to those with less land but higher capital endowments”.

However, Deininger notes that limiting zoning restrictions, securing predictable rents, and transferability of leases are “important conditions that need to be met for lease rights to provide incentives that are equivalent to ownership”.

Closing thoughts

As many have noted previously, property ownership is key to addressing poverty. And ease of doing business is key to securing foreign investment. Transactional costs form a small piece of that puzzle. So, pressure from businesses and individuals to keep this on the government's agenda is critical.