Related

Top stories

AutomotiveHilux Custom Builds offers purpose-built solutions for your business

Toyota South Africa Motors 16 Feb 2026

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

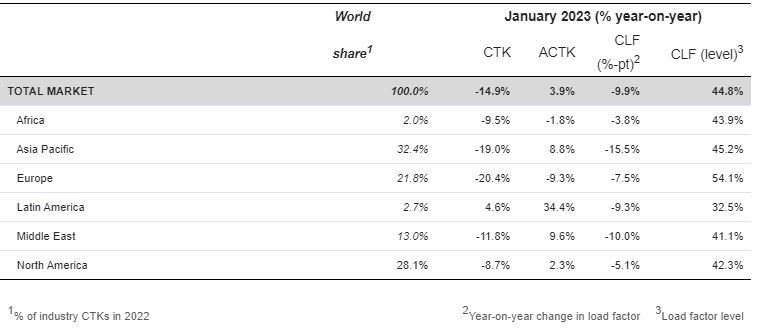

Global demand, measured in cargo tonne-kilometres (CTKs), fell by 14.9% compared to January 2022 (-16.2% for international operations). Capacity (measured in available cargo tonne-kilometres, ACTK) was up by 3.9% compared to January 2022. This was the first year-on-year growth in capacity since October 2022. International cargo capacity increased by 1.4% compared to January 2022.

The uptick in ACTKs reflects the strong recovery of belly capacity in passenger airline markets offsetting a decline in international capacity offered by dedicated freighters.

Several factors in the operating environment should be noted:

• The global new export orders component of the manufacturing PMI, a leading indicator of cargo demand, increased in January for the first time since October 2022. For major economies, new export orders are growing, and in China and the US, PMI levels are close to the critical 50-mark indicating that demand for manufactured goods from the world’s two largest economies is stabilizing.

• Global goods trade decreased by 3.0% in December, this was the second monthly decline in a row.

• The Consumer Price Index for G7 countries decreased from 7.4% in November to 6.7% in January. Inflation in producer (input) prices reduced by 2.2 percentage points to 9.6% in December.

"With January cargo demand down 14.9% and capacity up 3.9%, 2023 began under some challenging business conditions. That was accompanied by persistent uncertainties, including the war in Ukraine, inflation, and labour shortages. But there is solid ground for some cautious optimism about air cargo. Yields remain higher than pre-pandemic. And China’s much faster-than-expected shift from its zero Covid policy is stabilizing production conditions in air cargo’s largest source market. That will give a much-needed demand boost as companies increase their engagement with China,” said Willie Walsh, Iata’s director general.

African airlines saw cargo volumes decrease by 9.5% in January 2023 compared to January 2022. This was an improvement in performance compared to the previous month (-10%). Capacity was 1.8% below January 2022 levels.

Asia-Pacific airlines saw their air cargo volumes decrease by 19% in January 2023 compared to the same month in 2022. This was an improvement in performance compared to December (-21.2%).

Airlines in the region continue to be impacted by lower levels of trade and manufacturing activity and disruptions in supply chains due to the residual effects of Covid restrictions that were imposed by China. Additionally, the positioning of the Lunar New Year would have impacted cargo volumes in January. Available capacity in the region increased by 8.8% compared to January 2022.

North American carriers posted an 8.7% decrease in cargo volumes in January 2023 compared to the same month in 2022. This was a slight decrease in performance compared to December (-8.5%). Capacity increased by 2.3% compared to January 2022.

European carriers saw the weakest performance of all regions with a 20.4% decrease in cargo volumes in January 2023 compared to the same month in 2022. This was a decrease in performance compared to December (-19.4%). Airlines in the region continue to be most affected by the war in Ukraine. Capacity decreased by 9.3% in January 2023 compared to January 2022.

Middle Eastern carriers experienced an 11.8% year-on-year decrease in cargo volumes in January 2023. This was an improvement from the previous month (-14.4%). Capacity increased by 9.6% compared to January 2022.

Latin American carriers reported a 4.6% increase in cargo volumes in January 2023 compared to January 2022. This was the strongest performance of all regions, and a significant improvement in performance compared to December which saw no growth. Capacity in January was up 34.4% compared to the same month in 2022.