Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 12 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

A sectional title levy is typically made up of the contributions required for the reserve fund, the admin fund and the Community Schemes Ombud Service (CSOS).

The reserve fund is used to cover expenditure for the maintenance, repair and replacement of capital assets, such as roofing, exterior walling, roads, driveways and other common property structures. Also known as planned or preventative maintenance, the goal is to prevent deterioration and extend the life of these capital assets.

In theory, the reserve fund levy amount for the current financial year is determined as follows:

Reserve fund levy = [cost of planned maintenance activities] – [the reserve fund opening balance + interest earned on the reserve fund account]

When planning the levy for the current financial year, one should take a long-term view and ensure that it is sustainable from an inflation perspective but also sufficient for planned maintenance activities. The goal should be to plan ahead to avoid erratic levy fluctuations which can be caused by special levies. At the same time, the annual reserve fund contribution must meet the minimum amount prescribed by the Sectional Titles Scheme Management Regulations.

For optimal long-term financial management, trustees should draw up a cashflow projection that is based on the 10-year maintenance plan - this will indicate how much money will be available at the end of each financial year.

With a regularly updated long-term cashflow forecast in hand, the need for special levies or bridging loans can be eliminated.

The administrative fund is used for operational expenses such as management fees, insurance premiums, salaries and routine (not planned) maintenance activities. Routine maintenance includes activities such as replacing light bulbs, fixing a leaking tap, repairing a faulty gate motor, cleaning the pool, garden services, elevator maintenance and other related tasks. Other admin fund expenses typically include water and sanitation, electricity, refuse removal, bank fees, accounting, the insurance valuation, the 10-year maintenance plan, CSOS levies, etc.

These expenses must be budgeted for and approved at the AGM. Trustees can also take the same long-term approach as recommended for the reserve fund, i.e., projecting the cashflow for the admin fund over a 10-year period. This, together with the reserve fund cashflow forecast, will help the scheme to manage its finances successfully.

Bodies corporate are obliged to collect a monthly CSOS levy from owners which is equal to 2% of the amount by which the monthly admin levy exceeds R500, but not more than R40. (Note that the 2% is based on the admin fund levy and excludes the reserve fund portion.)

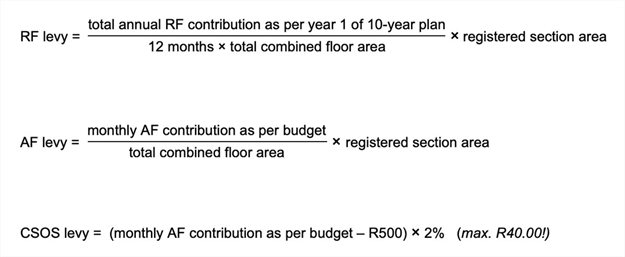

To calculate the total monthly levy for your unit, apply the formulas for each portion as illustrated below and add these together:

Understanding the various components that comprise the levy will help owners to appreciate the purpose of the levies while keeping trustees accountable for fiscal management. As a paying owner, it is your right to know how the body corporate funds are being spent and how your life investment is being maintained.