Shopping centre performance over almost five years to the end of the first quarter of 2023 has highlighted the value of a diversified retail property portfolio in countering the impact of economic challenges.

Source: ©Michael Turner -

123RFShopping centre performance over almost five years to the end of the first quarter of 2023 has underscored the value of a diversified retail property portfolio in countering the impact of social and economic headwinds.

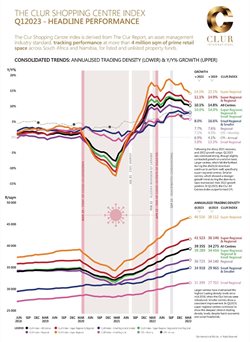

This emerges from the latest Clur Shopping Centre Index, which is derived from The Clur Report, an asset management industry standard, tracking performance for listed and unlisted property funds at more than four million square metres of prime retail space in over 100 centres across SA and Namibia.

The Clur Shopping Centre Index for all centres closed Q1/2023 at an annualised trading density of R39,355/m².

“Even though the period saw a further expected fall off in growth in trading densities, this is an increase of 10.1% year-on-year, beating the March consumer price index (CPI) by 3%,“ says Belinda Clur, managing director of Clur International, which produces the report. “This represents a 1.7% contraction from the updated 2022 full year growth of 11,8%.

“Larger centres have maintained the highest trading density levels since mid-2018. These centres, which fell the furthest during the 2020/21 downturn continue to perform well, with super-regional centres recording the steepest climb in trading density levels. Smaller centres, which showed a stronger growth trend during the downturn, have consistently improved their growth position,” she says.

“What is clear is that as we move through economic and property cycles, a diversified portfolio is beneficial to weather all seasons. We see this in the interaction of centre sizes, geographic locations of centres, rural versus metro mixes of portfolios as well as in category mixes. All of these show differing strengths at different times as we move through life’s ups and downs and economic cycles. And we certainly saw this in the interplay between larger and smaller centres during the Covid era.”

”We again see this differing behaviour between larger and smaller centres during the first quarter.”

Assessing assets outside of macro-economic influences

Clur said an overall positive movement in annualised trading density y/y% growth had been evident since May 2018, returning to negative territory in April 2020, hitting a low of -7.7% in February 2021, and moving back into positive territory in July 2021. The 2022 year closed at +11.8%, having hit a new high of +12.6% in August 2022.

She cautioned that the gap between CPI and annualised trading density y/y% growth, which showed a converging trend over 2021, and widened on a relative basis over 2022, has again converged during the Q1/2023 contraction.

Clur called for retail property assets to be judged on the basis of their own quality, positioning and performance, and not to be so dominated by country macro-economics when it comes to understanding market depth and dynamics and international and general investment decision-making.

“We have world-class shopping centre assets in this country that often thrive almost irrespective of the macro-economic circumstances. A good example is Sandton City, which is a diamond of an asset, irrespective of where it may be placed globally. Further, most of the world comes with its own set of macro-economic and political issues, so we must look to the important and often overlooked very powerful microeconomies that deliver performance and growth outside of this often unnecessarily overshadowing macro context.”

Agile approach to lettings

Clur said the growth surge of 2022 had encouraged a more courageous and sophisticated approach to lettings, with property asset managers showing remarkable agility in responding to consumer shifts and trends over the last few volatile years.

“The first quarter’s new lettings have shown the continuation of a lifestyle mix which has been fine-tuned with a more curated approach embracing consumer desire for physical shopping space, entertainment and mobility.

“Increased market braveness and innovation has seen several new creative brands emerge and enter the mix of the clothing, jewellery, homeware and technology spheres. Apparel continues to see new life, making up 26% of new lettings in gross lettable area (GLA), with a specific focus on unisex wear at 19%, most notably at a size range of between 250-500m² stores, men’s wear at 2.4% as well as women’s wear stores of less than 250m² and shoes.

“Motor-related sales and services came in at 11% of new lettings GLA, including car washes, indicating enhanced mobility of consumers in the post-Covid era.”

Health, beauty, fitness and outdoor categories made up almost 11% of the new lettings space, led by sports equipment and outdoor stores, at 5%, as well as hairdressers and hair accessories stores, cosmetics and perfumery, wellness stores and optometrists, Clur said.

Grocery stores and supermarkets accounted for almost 10% of new GLA lettings, and the ongoing trend of the home sanctuary saw homeware, furniture and interior stores making up 9% and discount department stores 8%. Bed and general furniture stores contributed 8%, with fewer soft furnishings stores being placed in the first quarter.

Speciality stores represented almost 9% of the new lettings, the focus being on toys, hobby stores, pet/vet stores, bakeries/patisseries, ice cream and frozen yoghurt stores as well as tobacconists and vape shops.

The food service category took over 4% in new lettings space. While fast food and fast casual dining formats tended to show an equal space split, a higher number of fast food stores were established along with coffee shops.

High-powered but naturally smaller store format categories, such as technology, came in at over 3%, and accessories and jewellery also provided important elements to the new mix. Cellphones and supporting services, as well as electronics and games stores of less than 100m² dominated the entries into this area. The rest of the new lettings were a blend of services, books, cards and stationery, luggage and leatherware as well as the returning entertainment category.

The entertainment and family activity centres category recorded the highest growth in trading density for 2022, with reactivated cinemas driving this trend.