Stats released by online payment gateway, PayFast show that Generation Z, aged 18 to 24, is paving the way for innovation in the e-commerce space, with Baby Boomers aged 55 to 64, not far behind.

©Dmitry Tishchenko via

123RFE-commerce adoption rates soar

E-commerce has fundamentally changed over the past few months. The Covid-19 pandemic has encouraged consumers to switch to online shopping and contactless payment alternatives to abide with social distancing practices and lockdown regulations.

“The e-commerce boom was bound to happen, but Covid-19 definitely accelerated industry growth. We’ve seen adoption rates soar following on from the lockdown, this has occurred across age groups. Habits formed now are going to continue in the future,” says Jonathan Smit, managing director and founder of PayFast.

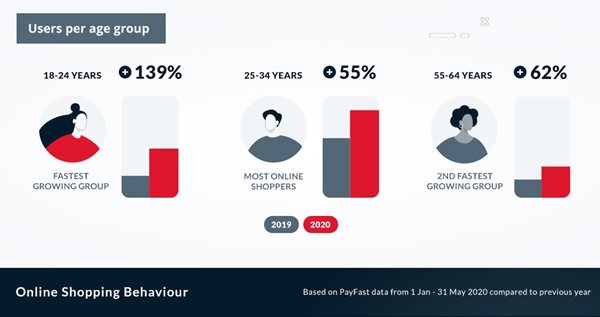

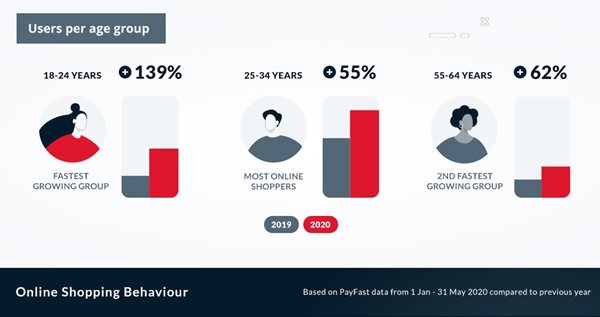

According to the company, Gen Z is the fastest-growing group of online shoppers, with a 139% increase in users compared to 2019. By comparison Millennials, aged 25 to 34, only grew by 55% but still account for the largest group of online shoppers. Millennials are also most likely to be using their mobile device, with 37% in this age group making payments with their mobile versus 28% on desktop.

Older generations who had previously shied away from online shopping have, effectively, been forced to change their habits in the face of social distancing measures. “Younger Baby Boomers make up our second-fastest-growing age group, with a 62% year-on-year growth,” says Smit.

PayFast users by age group

Rise of mobile

Despite many consumers working from home, lunch breaks remain the perfect time to browse and shop online, as data shows desktop payments peaking between 11:00 and 12:00. As expected, further online purchases occur in the evening, after work hours, with the majority of mobile payments taking place between 18:00 and 21:00.

“It’s likely that people are shopping on their smartphones, while watching series in the evenings on a separate screen,” says Smit.

Additionally, mobile usage for online shopping has grown by 159% year-on-year compared to desktop, which has only grown by 37% year-on-year. “Over the lockdown period, we saw mobile payments increase by as much as 42% compared to the same period before lockdown started. Desktop sessions only increased by 22%, showing that most consumers resorted to using their smartphones for online shopping while in lockdown,” says Smit.

Through increased access to smartphones and alternative online payment options to credit cards, more consumers are able to shop online. To help merchants manage the influx of new customers, PayFast says it supports multiple popular payment methods, such as Instant EFT and QR Code Payments, and integrates with over 80 different e-commerce platforms and custom integration.