After an extended contraction in 2015 and 2016, the South African agricultural economy grew by 17.7% in 2017. This was boosted by strong output in almost all the subsectors, such as field crops, livestock and horticulture, amongst others. In fact, this is also clear from trade data, where the country's agricultural exports grew past the $10 billion mark for the first time.

A closer look at the data shows that the agricultural GDP grew by 37.5% quarter to quarter (q/q) in the fourth quarter of 2017, following 41.1% q/q growth in the third quarter. This was against our expectations of a moderate growth pace at levels below 20% q/q, as the last quarter of the year is typically characterised by limited activity in the crop and horticultural sub-sectors (see Chart 1 below).

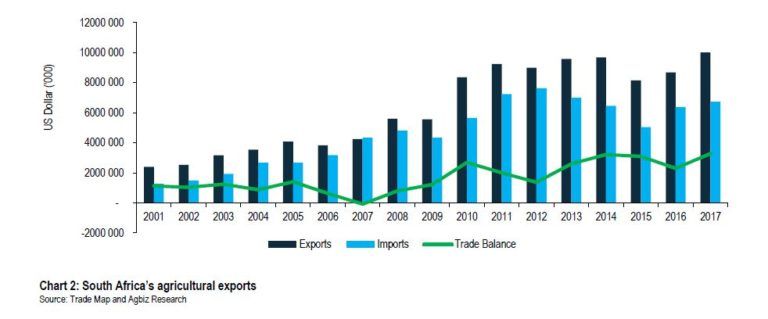

Following a rebound in South Africa’s agricultural production, the exports also lifted past the $10.0bn for the first time, up 15% year-on-year (y/y), boosted by growth in exports of edible fruits, beverages, spirits, vegetables, grains and other agricultural products (see Chart 2 below).

It is also worth noting that in the past few years, the Agbiz/IDC Agribusiness Confidence Index proved to be a good leading indicator of agricultural GDP performance (see Chart 1). However, the recent notable deterioration in confidence might not be followed by a similar magnitude of a decline in agricultural GDP, as factors driving each variable are quite distinct at the moment.

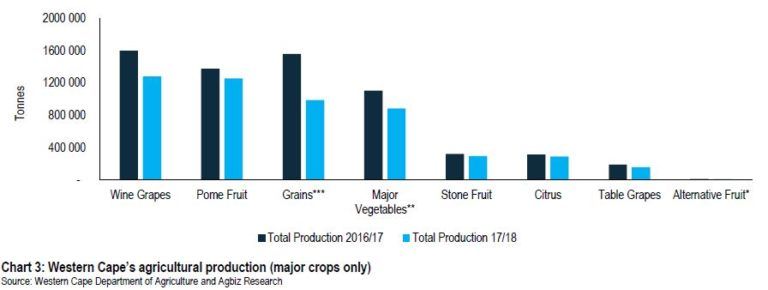

Confidence is mainly pressured by uncertainty regarding land reform, but this hasn’t had a material impact on agricultural investments yet. The agricultural sector could slow in performance in 2018 owing to a 5% y/y decline in area planted to summer crops to 3.8 million hectares, as well as an expected decline in Western Cape agricultural production (see Chart 3 below).