Related

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest SA Coffee Landscape Report 2018 carefully unfolds the global and local coffee markets based on the latest information and research. It examines the market drivers and restraints as well as global and local market trends to present an objective insight into the South African coffee industry environment, market dynamics and its future.

Worldwide, the production of coffee had only increased marginally in the last year. For 2016/17, global production reached 157.7 million 60kg bags of coffee compared to 157.6 million 60kg bags in the previous year. Globally, the coffee market is valued at an estimated US$105 billion and is projected to grow at a robust rate of 5.5% per annum up to 2021.

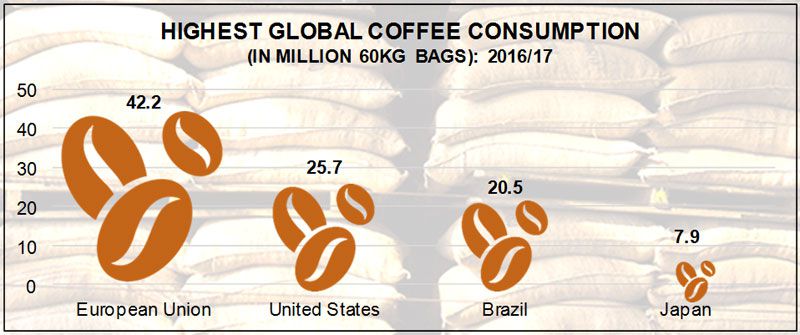

The four key global markets for coffee consumption include the European Union, USA, Brazil, and Japan. In terms of consumption, the European Union is still responsible for the highest consumption of coffee worldwide with 42.2 million 60kg bags of coffee in 2016/2017.

After years of strong growth, there was a slight decline in South African coffee consumption in the past year (in 2016/17 550,000 60kg bags were consumed compared with 557,000 60kg bags in 2015/2016). However, more interestingly, there has been a similar trend towards South African consumers being more discerning in terms of the coffee they consume.

According to Dylan Cumming, managing director of Beaver Creek, there is growing demand for high-end specialty coffee in South Africa. Cumming is of the opinion that consumers want a coffee that is distinct in its character, and they want to know where the coffee is grown. The demand for premium and specialty coffees is clearly increasing in South Africa as consumers’ interest in Nespresso and other capsule and pod-based coffee offerings continue to grow. Specialty coffee preparation methods, such as Aero press are also attracting the attention of many consumers.

Furthermore, the majority of consumers’ interest has moved beyond simply just drinking coffee. Many consumers want to have a coffee experience. Ryler Masterton, from Masterton’s Coffee and Tea Specialists, says that South African consumers want to know more about coffee, experience greater varieties, and enjoy different experiences.

Younger consumers are increasingly more interested in coffee as well. Rising affluence and changing consumer tastes have increased the demand for high quality and specialty products, such as flavoured coffee, amongst this group. Millenials are also more likely than other consumers to experiment with new drink types, brands, and flavours.

Most consumers foster their coffee dependency every single day. As the demand for premium coffee continues to increase in South Africa, it is important for manufacturers, suppliers, and retailers to ensure they keep track of both industry developments and changes in consumers’ needs and preferences.

The South African Coffee Industry Landscape Report 2018 (128 pages) provides a dynamic synthesis of industry research, examining the local and global Coffee industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing and importing to retailing, sustainability, pricing analysis, consumption and purchasing trends.

Some key questions the report will help you to answer:

Please note that the 128-page report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R9,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: South African Coffee Landscape Report 2018.

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.