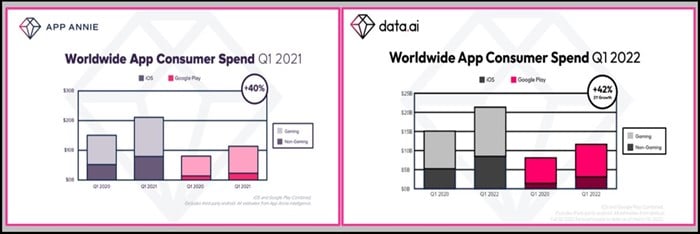

In Quarter 1 (Q1) 2021, after almost a year of the Covid-19 lockdowns, global spend on in-app purchases surged 40% year-on-year (YoY) to $32bn, as the lockdown world turned to the digital world for social media interaction, streaming and games.

Source: © ra2studio

123rfA year later, and almost two years into the pandemic, the massive 2021 Q1 YoY growth surge has disappeared, with total growth over the past two years at just over the 2021 Q1 YoY growth surge at about 42%.

Spend for Q1 2022 is estimated at $33bn, with a surge in video editing tools, thanks to TikTok. Gaming also scores big on both iOS and Google Play, and overall spend continued the trend of 65% iOS vs 35% Google Play.

The biggest markets are India, the US, Brazil, Mexico, Turkey, and Brazil.

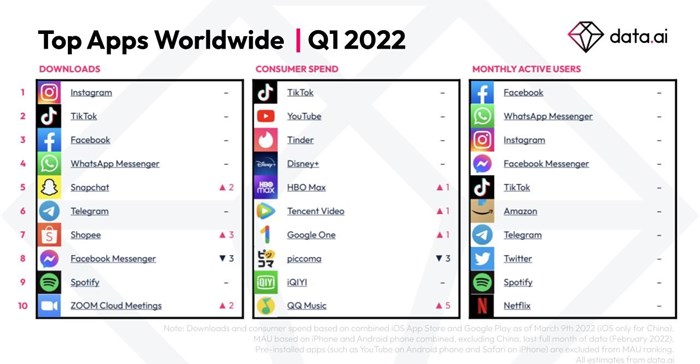

So, the jockeying for pole position by the apps continue. The latest data for 2022 Quarter 1 2022 from Data.AI (AppAnnie) shows data for three metrics consumer spend, downloads, and monthly active users.

Consumer spend

This money ranking shows that in Q1 2022 TikTok moves up one spot to take pole position, pushing YouTube back a spot to second. (The TikTok data includes Chinese users on iOS.)

Tinder and Disney+ are still running in third and fourth, respectively. HBO Max made a big run into fifth on the list, pushing Tencent Video down one spot to sixth). Google 1 is still running in seventh.

Piccoma gained a position – moving up to eighth, while iQiyi moved up into the ninth spot. QQ Music moved to 10th, while BIGO Live and Twitch fell away.

Downloads

If we compare the Q1 2022 rankings to Q1 2021 the data shows that, in terms of downloads, Instagram moved from third into pole position pushing out TikTok to second and Facebook to third.

WhatsApp moved up one spot to fourth, while Snapchat moved up three places - from eighth to fifth. Snapchat is used for more private communication than what is sent via WhatsApp or Messenger. Telegram fell back two spots, to sixth.

Shopee entered the list in seventh position. Shopee is a mobile commerce company based in Singapore that has been on the rise for some time and saw a big boost throughout the pandemic. It is active in 13 countries across Asia, South America, and Europe, and reported GAAP revenue of $5.1bn for 2021.*

Facebook Messenger moved up from ninth position to eighth. Spotify made a run, entering the list at ninth, while Zoom fell from sixth to 10th. MX Taka Tak and Cap Cut fell off the list.

Monthly active users

The rankings are somewhat different for monthly active users. Facebook retains pole position, with WhatsApp still the runner-up. Instagram moves up from fourth to third, at the expense of Facebook Messenger which drops from third to fourth.

TikTok climbs three positions from eighth to fifth. Amazon drops one spot (from fifth to sixth) as does Telegram (from sixth to seventh) and Twitter (from seventh to eighth).

Netflix also loses its position (ninth to 10th) which is claimed by Spotify (from 10th to ninth).

Read the full report here

*(Sources: All data, information and graphics were obtained from Data.AI and SocialMediaToday. Sources available on request.)