The overall consumer standing has an untold impact on sectors such as retail and consumables with shrinking disposable income leading to retail growth softening to 2.1%* in January 2024.

Source: © 123rf

123rf The

Deloitte South Africa Consumer Signal report for Q1 2024 says South African consumers remain under pressure

The Deloitte South Africa Consumer Signal report for Q1 2024 found that faced with a shrinking discretionary income, South Africans are prioritising expenses such as groceries – making it 14% of the share of wallet, followed by 13% on housing and a surprising 11% on entertainment and leisure travel.

“As South African consumers remain under pressure, most of their budget goes towards essentials; however, when consumers want to treat themselves, they often splurge on food and beverages,” notes Rodger George, consumer industry leader for Deloitte Africa.

Concerning is the shrinking budget allocation on critical items, with only seven per cent of the share of wallet being used for education and six per cent on healthcare.

Image supplied.

More financial literacy required

Alarming is that saving and investing remain at the bottom of consumers' priorities, only making up six per cent of spend.

According to an article shared by the Government of South Africa, this could be far less, with many consumers not being able to save resulting in the country having one of the lowest savings rates in the world – with household savings estimated to be 0.13% of Gross Domestic Product (GDP) in 2022.

Ordinary South Africans are allocating seven per cent of their income to saving while spending nine per cent of their income on clothing and footwear and eight per cent on electronics and home furniture.

According to the Consumer Signals report, consumers expect to spend more on essential and non-essential living expenses in the coming weeks and months, indicating that more financial literacy is required to support people in making smarter financial decisions.

Image supplied.

Escalating costs of everyday goods

Deloitte’s Consumer Signals indicate that 87% of South Africans are concerned about escalating costs of everyday goods, with many people resorting to cost-saving measures.

Frugal behaviour remains high, with consumers focusing on essential groceries, reducing food wastage, and 42% of those surveyed are cooking more meals at home.

Twenty-two (22) per cent of respondents indicated a growing interest in house brands, and consumers keeping to brands that they know provide value for money.

Food less affordable for some

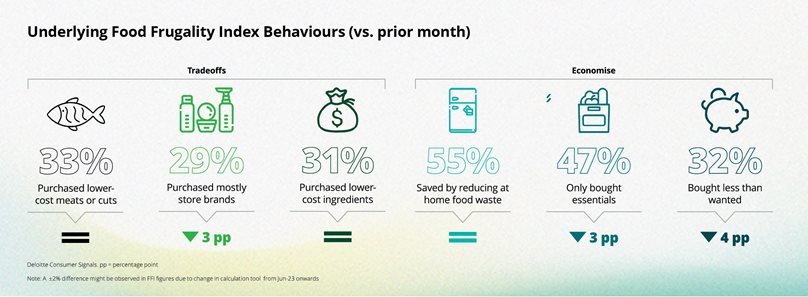

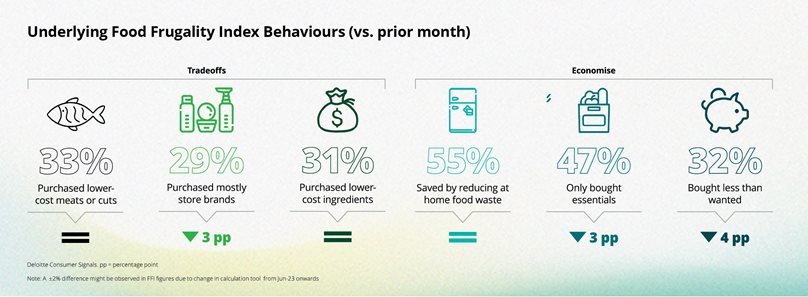

Insights extracted from the Deloitte Food Frugality Index (FFI) indicate that everyone needs to eat, but food is becoming less affordable for some.

The monthly index measures the behaviours associated with financial stress at the grocery store and how they may be shaping the way consumers shop for food.

George indicates that consumers food buying behaviour remains one of the strongest measures of economic health.

He adds that in the case of South Africa, it is facing a time of great uncertainty and growing economic hardship, which will impact the most vulnerable citizens the hardest, a concern already flagged last year.

Image supplied. Highlights from the February 2024 FFI

An increase in political uncertainty and an ongoing concern for the overall direction of the economy, job security and financial situation have made consumers more anxious in 2024 than in 2023.

Hannah Marais, (acting) chief economist for Deloitte Africa notes that these anxieties can be expected due to the looming elections in May 2024.

In addition, headline inflation remains stubbornly high with extra inflationary pressures still likely due to the impact of a weakening rand, coupled with potential food inflation and other hikes in living expenses brought on by further fuel increases.

“South Africa must move into an economic recovery mentality. The reality we as a country face is that the next 18 months will prove to be challenging, with consumer priorities and buying behaviour shifting,” says Marais.

“If the current situation persists, we are more than likely to witness a worsening economy and further growth stagnation, impacting investment potential and overall business confidence,” Marais adds.

Economic recovery

The focus must be to drive economic recovery by implementing solutions that will improve living standards for ordinary South Africans, followed by fuelling job creation through infrastructure projects.

Although the energy crisis is debilitating, it is not the only challenge facing the economy and these require immediate solutions.

Government will not be able to achieve this stability alone, stakeholders within the private sector will need to drive their reform initiatives and consider how to support employees and how to deliver value to consumers,” she explains.

*(Stats SA)