Top stories

HR & ManagementNational minimum wage 2026: What workers (and employers) need to know

Danelle Plaatjies and Ludwig Frahm-Arp 10 hours

More news

The data covers key hotel performance indicators such as occupancy, RevPAR, booking lead time, length of stay, international and domestic travel, direct and OTA bookings, as well as upsell performance to forecast trends shaping the hotel industry in 2023.

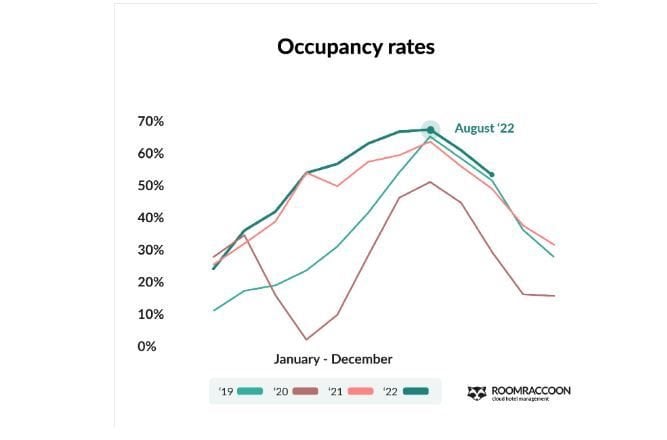

Highlighting the speed at which the sector has recovered from the pandemic, the report reveals that guests are returning in greater numbers, with occupancy levels reaching and exceeding parity with pre-pandemic levels. In August 2022, RoomRaccoon’s clients in Europe had record-breaking occupancy levels averaging 64% in comparison to 61% in August 2019.

Some of the findings include:

● Direct bookings are on the rise. Direct bookings have been on an upward trajectory, increasing by a staggering 169% from 2019. This reflects the continued desire of guests who want greater control over their accommodation bookings.

● Hotels are generating better revenue. Revenue per available room (RevPAR) in 2022 is up 46% compared to 2021. The data reflects a spike in RevPAR over the European summer season, hitting a record-breaking €105 on 13 August 2022.

● Memorable experiences outweigh rising inflation. In 2022, RoomRaccoon clients that use automated upsell technology received some of the highest ancillary revenue performances recorded with room upgrades, breakfast, early check-in/late check-out and a bottle of champagne among the top-performing add-ons.

● Domestic tourism is still going strong. Despite a 33% increase in hotel bookings from international travellers, domestic bookings account for 64% of bookings in 2022 and will continue to present significant business opportunities for hotels.

● Booking lead time returns to normal.The average hotel booking lead time is on par with pre-pandemic levels, measuring 30 days in 2022 in comparison to 31 days in 2019. This shows a shift in travellers’ confidence as restrictions are eased and the travel landscape stabilises.

Commenting on the data and the industry’s recovery, RoomRaccoon’s CEO and co-founder, Tymen van Dyl, says: "Despite predictions that hotel occupancy would not return to pre-pandemic levels until 2023, recovery has come sooner than expected. This will come as encouraging news to the industry. However, challenging economic times and soaring inflation could weigh the pace of recovery in the new year."

"For me, the importance of making decisions driven by data is more imperative than ever before. With the industry rapidly evolving and the dramatic shift in guest behaviour, analysing the numbers has become the most effective way to track patterns, develop appropriate strategies and understand where your efforts, and money are best spent.

"Going forward, it will be imperative that hotels use data to inform their marketing and commerce strategy to ensure they remain competitive and maximise revenue despite uncertain economic times," says van Dyl.

the full report here web.roomraccoon.com/Hotel-Performance-2022.