Related

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

The Reserve Bank would have had to grapple with an unusually complex set of circumstances when making its decision to hike the rate by 75bps, with the impact of a series of hefty petrol price increases still to be felt, an ongoing war in Ukraine and the growing risks of a global recession.

Of even more concern to the Reserve Bank is the emerging evidence that price pressures are beginning to become entrenched – higher input costs being passed on to consumers and rising living costs resulting in higher wage demands.

While these developments made a clear case for raising interest rates, the bank no doubt remains mindful of the weakening growth outlook both globally and locally. South Africa is having to contend with the negative impacts of the flooding in KwaZulu-Natal, severe national loadshedding and a household sector whose finances are under intense pressure from rising food and energy prices – notably petrol.

However, it is relevant to bear in mind that although interest rates may be rising as the bank normalises monetary policy after the remaining restrictive regulations associated with the pandemic were removed, they still remain below pre-Covid levels (of 10%) and as a consequence, are still attractive for homebuyers.

More significantly, banks retain their appetite for extending mortgages to homebuyers, which is providing a solid underpinning for the local housing market even as we move into an era of gradually rising interest rates and increasing pressure on household finances.

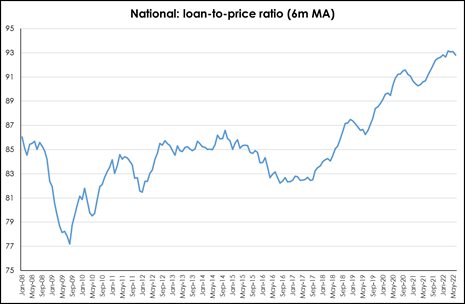

The banks’ appetite to extend mortgages is reflected in the latest ooba data which shows that mortgages as a percentage of purchase price have risen to a level of 93% in recent months (six-month moving average), which is the highest level in well over a decade.

Furthermore, the banks are pricing those loans at an attractive 0.3% relative to prime rate on average – a level last seen in mid-2010.

As a result of this, activity in the SA housing market remains buoyant with properties sold during the first half of 2022 almost matching the number of transactions recorded during the first half of 2020 and remaining comfortably higher than during the first half of 2019, prior to the pandemic.

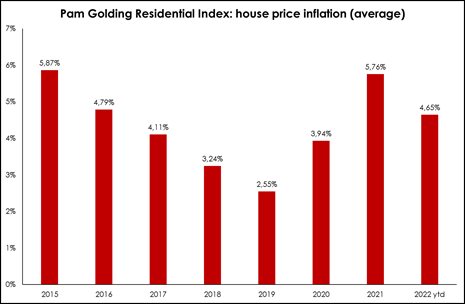

Similarly, house price inflation remains similarly buoyant. Despite a slowdown in house price inflation from a high of 6.04% in mid-2021, house price inflation has averaged 4.65% during the first half of this year. While lower than the 5.76% registered last year, this year’s average increase in house prices is the highest recorded since 2016 (excluding the post-pandemic boom).

What we are seeing is that residential property is increasingly being seen by South Africans across all walks of life, and in particular the younger generation, as a sound investment class. Encouragingly, the demand for investment (or buy-to-let) properties continues to rise, increasing to 7.8% of total loans in June 2022, according to ooba, which is the highest level recorded since May 2010.

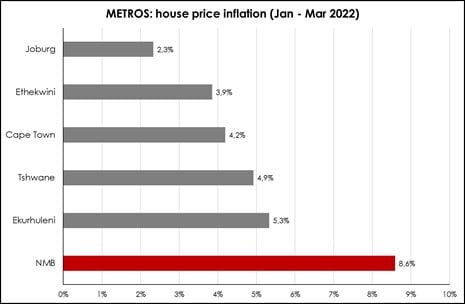

Price growth has now peaked in all major regional markets, with the Western Cape remaining strongest at +6.3% in June, followed by KwaZulu-Natal (+5.4%) and Gauteng (+3.6%). The fact that the sub-R1m price band continues to outperform other price categories is indicative of the high demand in this lower end of the market, while price growth appears to be stabilising in the R1m to R3m band.

Coupled with this, 100% bond applications have quickly returned to – and remain at – pre-Covid levels of around 60% of applications, according to ooba, while the approval rate eased to 80.7% in June, not far off the pre-Covid record high of nearly 85% in February 2020. Meanwhile, first-time homebuyer approvals for 100% loans stand at 80%, with prices paid by first-time buyers currently averaging at R1.14m according to ooba’s most recent stats.

Another interesting trend (noted in Lightstone data) is the continued acceleration in coastal house prices, with the price premium compared with non-coastal property widening to +3.1% which is the highest since mid-2005. Coastal prices have risen by +8% in March 2022 (latest available statistics) compared to +4.9% for non-coastal (Lightstone statistics). Notably, Nelson Mandela Bay remains the top performing metro and coastal market with a recent data revision (by Lightstone) reflecting a renewed acceleration in house price inflation of +8.9% in March 2022.

In summary, while there may be headwinds facing the housing market - such as rising inflation, increasing interest rates and a sluggish local and global economy, an ongoing positive underpinning for the market is the appetite of financial institutions to extend credit. Not only are they pricing home loans competitively, they are also requiring lower deposits as a percentage of selling prices than we’ve seen in over a decade.

And, as always, there are high demand areas in various regions, plus the semigration trend continues to coastal and more countrified areas for a variety of reasons, as well as sought-after metros and commercial hubs. We remain optimistic in regard to the ongoing resilience of and confidence in South Africa’s residential property market in 2022.