Top stories

More news

Even before Covid-19 struck, Lightstone forecasted that annual house growth was going to drop from 1.4% at the end of 2019 to about 0.3% at the end of 2020. “We took this view because of low economic growth forecasts of about 1% for 2020 and the generally weak housing market conditions that were expected to continue from 2019 into 2020,” says Paul-Roux de Kock, analytics director for Lightstone.

As news of the economic impact of the coronavirus outbreak filtered through international media towards the end of 2019, its true impact was only really felt in Europe in the first quarter of 2020, and in South Africa in the second quarter.

Apprehension turned to panic in many quarters as Covid-19 worked its way into South Africa and the impact of the economic lockdown was assessed. Economic forecasts were hurriedly adjusted downwards and even the most optimistic economists were predicting an economic decline of around 10%. “As it happened, this was not far from the -7.3% expected for 2020, however house prices did not follow economic growth as expected,” says de Kock.

Lightstone, along with other economic commentators, did not anticipate the resilience of the house price market with even the most optimistic scenarios forecasting negative house price growth.

During the last couple of years, the economic environment in South Africa did not change that much from one year to the next, and typically house prices followed that same trend. A ‘Black Swan event’, which lead to the largest annual decline in economic growth since the Reserve Bank started recording statistics, makes looking ahead even more difficult.

De Kock says, “To try and make sense of the impact of the economic lockdown, we looked at the financial crisis of 2008 where we also experienced a sudden drop in GDP growth. At the lowest point of the 2008 recession, the South African economy shrunk by -1.5% while house prices shrunk by -5.4%. Using a simple rule of thumb, it seemed safe to predict that if the economy was to decline by 10% in 2020, house prices would drop by the same percentage or more.”

Personal asset markets tend to respond differently from other basic commodity markets through a short-term economic crisis. In most commodity markets, an oversupply would, for example, quickly lead to a decrease in the price of the commodity like seen with the oil price during the pandemic. This is because oversupplied stock needs to move quickly to avoid inventories piling up at great cost, or in the perishable goods market, going bad.

“Property stock, on the other hand, doesn’t play by the same rules,” advises de Kock. These assets transact much slower and are largely financed by personal debt. During a pandemic or similar crisis, debt providers can – and did – plan with homeowners, providing a short-term shield to the market.

In addition to debt relief, De Kock says that the cuts in interest rates made a significant difference to homeowners and potential home buyers. “It was serendipitous that interest rates were already relatively low before the pandemic, so when the Reserve Bank dropped interest rates by 300 basis points, it effectively decreased the debt service costs as a percentage of household income by 15%.”

A third and possibly the most unexpected part of the safety net that emerged during the lockdown were new consumer routines. One of Lightstone’s assumptions when forecasting is relatively consistent consumer behaviour and, of course, the pandemic and the ensuing lockdowns fundamentally changed the way many people think about homeownership and mobility.

For example, much of the downward pressure experienced in house price inflation across the luxury house segment might have been buoyantly affected by the lockdown as many of the homeowners and potential buyers in this property bracket had the ability to work from home, placing a premium on luxury properties with features which support a work-from-home environment.

Following an out-of-the-ordinary year, it would be wise to view any economic forecast with some caution. The turnaround in luxury house price inflation - which usually leads the housing market through upturns - from -0.5% per annum to 2.5%, could potentially be temporary as the market catches up on pent-up demand following the lockdown. Initial results indicate that the number of transactions are on their way to returning to pre-Covid-19 levels, but the full effect of the recovery will only be clear in the latter half of 2021 as the full impact of some of the bad news is still to be fully felt. 600,000 people have lost their jobs, new investments (gross fixed capital formation) have reduced significantly, and government debt is expected to grow to 81% at the end of the fiscal year which would require major reform and more taxes, as suggested in the 2021 Budget Speech.

The Lightstone forecast for 2021, in the graphic below, is based on three scenarios:

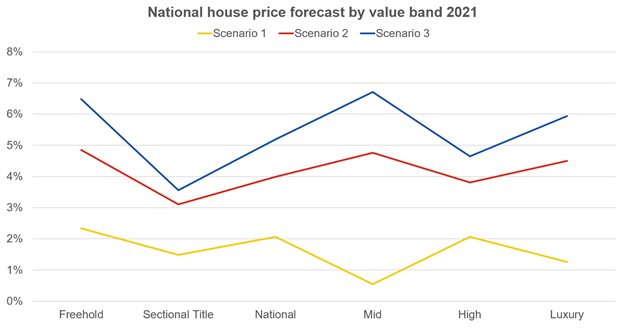

In the graphic below, sectional title properties perform the least well in terms of Scenarios 2 and 3 (between 3.1% and 3.5% respectively), while the mid segment – which is more dependent on GDP growth and so more susceptible to growth or crashes – performs worst in Scenario 1 at just around 0.5%.

Scenario 1 forecasts high value properties to peak at 2% and luxury properties at nearer 1% - but in Scenarios 2 and 3, both are anticipated to perform strongly, with luxury at 6% in Scenario 3, and high value at 4.5%

The freehold forecasts tend to track inflation while sectional title properties are influenced by other factors.

“2020 has thrown some interesting curve balls our way as unprecedented circumstances have kept us analysts on our toes. In saying this, however, it has been interesting to see how a year marred with such negative sentiments can open new doors for the housing market,” concludes De Kock.