Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

What was your initial response to the crisis/lockdown and has your experience of it been different to what you expected?

What was your initial response to the crisis/lockdown and has your experience of it been different to what you expected?

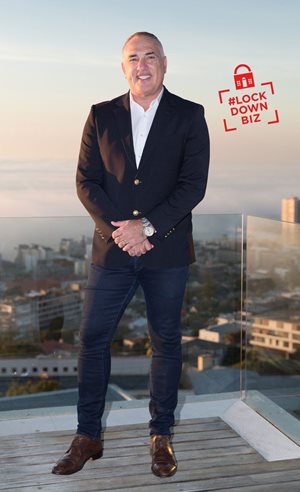

Samuel Seeff: The impact of the Covid-19 pandemic and lockdown combined with the latest Moody’s downgrades have been significant on real estate businesses and estate agents and continues to be a daily challenge.

The Seeff Group has implemented a multi-level approach to deal with this unprecedented time incorporating a Covid-19 Crisis Team and communication across all stakeholders. A Covid-19 Zone for staff and estate agents allows for access to vital information and communication tools and tips to assist with internal and external communications including clients, intensified training and assistance, facilitating the sourcing of PPE and for lobbying for relief. Seeff has made a significant contribution to submissions to the minister relating to the residential real estate sector and the opening of Deeds Offices along with businesses continuation and readiness protocols for every stage of the lockdown.

Seeff: Where we had looked forward to a much-improved market in 2020 and in fact had seen a higher level of buyer enquiries, the sudden onset of the pandemic and lockdown has been a significant setback for the economy and property market.

While the 2.25% interest rate cut is a welcome relief for consumers and homeowners, bringing borrowing costs down to a near five-decade low, it is not going to result in a major uptick in the market. That said, the lower interest rate has improved sentiment greatly, but largely in the middle and lower end of the market.

We do anticipate emerging from the lockdown with a level of pent-up demand, but this will be predominantly in the primary residential market to around R1.5m (up to R3m in some areas). The upper end requires a notable turnaround and positive economic and GDP growth outlook, a notable uptick in the JSE and an improvement in profitability.

Until then, demand in the upper end will remain muted and this is where sellers are likely to face substantial headwinds and pressure on prices. Higher stock levels will no doubt follow in the months to come as many sellers will be forced to put their properties on the market for financial reasons.

While we expect a significant uptick in movement in the rental market, this will be characterised by many tenants looking to downscale to cheaper accommodation and rental rates will come under pressure as a result of the financial difficulties that tenants will experience.

Seeff: The challenges for real estate professionals have been significant. Firstly, the effect of the sudden Deeds Office closure means that deals which had already been lodged but transfers not completed when the lockdown commenced caused a significant cash crunch in the industry.

While we look forward to the Deeds Offices opening under Level 4, the validity of various clearance certificates means that many of the “pending” transfers will in all probability need to be relooked unless measures are put in place from the municipalities.

Either way, there will be a delay in the registrations and the agents receiving their commissions. There may potentially also be additional costs for sellers.

A further challenge is that while the Deeds Offices will be open under Level 4, estate agents will in all likelihood only be fully operational under Level 2. That means that agents can only operate “digitally” at this stage and, while agents can operate and take offers digitally during lockdown, many contracts will have suspensive conditions which will need to be met before these transactions can move forward.

While technology and digitalisation has enabled real estate agents to deliver better and faster services to sellers, buyers, landlords and tenants, the need to physically see the property remains. There are very few sight-unseen deals that are done. The financial risks are just too big. These only really take place in the case of developments where you are buying off-plan or where they buyer knows the complex or particular property well.

Tenants are also not able to move and agents cannot do the necessary incoming and outgoing inspections. That means that the rental market remains in a holding pattern until agents are given the go-ahead for greater movement.

A great deal of people and businesses are dependent on property, not just buyers, sellers, estate agents and conveyancers, but government revenue, local municipalities, movers, decorators, renovators, electricians, plumbers and so on.

Seeff: While much of our business can operate online and we have implemented these very effectively, including communication and meetings, estate agents are severely affected in terms of their ability to conclude transactions and earn commission.

In terms of safety, Seeff has taken vital precautions and are currently looking into beefing these up in line with new regulations as these unfold.

Seeff: Seeff’s significant technological advances has meant that the group could quickly react to the “social distancing” and enable staff and agents to work from home making use of digital and online means of communication and liaison.

Seeff: More than anything else, the Covid-19 lockdown has highlighted how technology has become a catalyst in real estate. While physical viewings, bond applications and transfers are delayed, Seeff agents have not been sitting idle. To the contrary, they have harnessed the power of proptech to assist sellers and buyers with their property needs.

Digital is the future and the Seeff website and property portals are now the “go to” place for buyers to start their property searches. Digital has made it possible to provide significantly more information about the property, its location (often geo-mapped), an album of images and a video/virtual tour and immediate access to the respective estate agent.

Mobile and digital calling and video means that agents are available 24/7 and can quickly provide assistance and information. Virtual reality (VR) makes it possible for potential buyers/investors to even do a 3D virtual walk-through. Digital marketing has given agents more options to promote and market client properties via a wide range of digital tools, including digital newsletters such as this.

Virtual property valuations mean that sellers don’t need to wait and can list their properties so as not to lose out on any potential offers, but it’s important to work with a local area expert to ensure you get the right advice. At the same time, there is also no need to wait if buyers want to put in an Offer to Purchase. Although the Alienation of Land Act requires handwritten signatures on a Deed of Sale, the contract can be done digitally with suspensive conditions such as it being subject to a physical viewing etc. and then signed once the lockdown is lifted.

Seeff: Not at all, there is a perception that estate agents can be replaced by technology and nothing can be further from the truth. While technology is an enabler of property transactions, the estate agent provides the vital area insight, potential buyer pool and appropriate marketing tools for the property. The agent is the dealmaker who negotiates the best deal for both seller and buyer and then monitors and manages the transaction to its full conclusion when transfer is effected.

Seeff: The biggest trend has been the role that proptech plays in enabling estate agents to deliver a top-class service. The draw-back though remains Deeds Offices which need to be automated as matter of urgency, as well as the implementation of digital signatures. Currently, the Alienation of Land Act still requires physical signatures.

If the entire transfer process was automated, it would have made a notable difference during this time.

Seeff: Covid-19 is unprecedented, and we cannot predict anything. What we do know is that the global economy is on a significant downturn and the SA economy is facing a decline which is unprecedented in its history. The length of the lockdown will no doubt dictate the severity of the challenges.