Top stories

More news

Insight Survey’s latest South African Cough, Cold and Flu Remedies Industry Landscape Report 2022, carefully uncovers the global and local cough, cold and flu remedies market (including the impact of Covid-19), based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African cough, cold and flu remedies industry environment and its future.

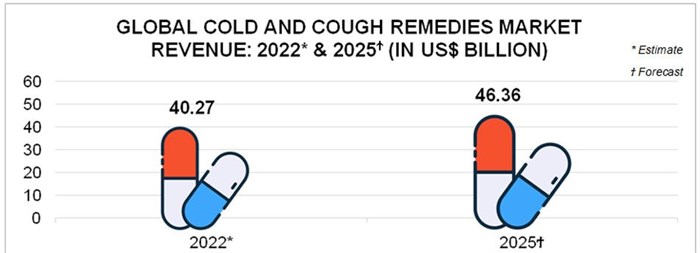

In 2022, the global cold and cough remedies market, which forms part of the global OTC pharmaceuticals market, is estimated to generate revenue of approximately US$40.27 billion. Furthermore, the global cold and cough remedies market is forecast to increase at a compound annual growth rate (CAGR) of 4.81%, to reach approximately US$46.36 billion by 2025, as illustrated in the graph below.

In terms of the South African market, the local cough, cold and flu remedies market, which includes antihistamines/allergy remedies, achieved growth of 9.8% year-on-year in retail value terms, between 2020 and 2021. Moreover, the market is predicted to experience robust grow, achieving an estimated 10.4% CAGR until 2026. Factors driving the cough, cold and flu remedies market include the arrival of the Omicron and the expected arrival of the Deltacron variants of Covid-19 in 2022.

Additionally, the NICD has predicted that the country will continue to see a rise in flu cases, and experience a more severe flu season in 2022, compared to previous years. This expected surge has also been attributed to the relaxation of Covid-19 restrictions, as well as weakened immunity against flu, due to the reduced transmission of, and exposure to, the virus over the past two years.

Globally, there has been an increasing preference for OTC cough, cold and flu remedies, as consumers around the world are opting to treat their symptoms at home, using OTC pharmaceutical products or even natural home remedies, rather than consulting healthcare professionals. This is largely due to the increasing costs of healthcare, and the fact that OTC medication is widely available, and often cheaper, than prescription medications.

Interestingly, the rise of the ‘flu bomb’ trend is a further example, demonstrating the preference of OTC medication in the treatment of cough, cold and flu symptoms at home. More specifically, ‘flu bombs’ are trending as a novel method of consuming OTC cough, cold and flu remedies in South Africa. This takes a form similar to that of a ‘Jager bomb’, which is made by dropping a shot of Jagermeister into an energy drink, typically Red Bull. In a similar manner, the ‘flu bombs’ are prepared by dropping a shot of Benylin 4 flu syrup, into dissolved Corenza C.

In South Africa, companies such as Adcock Ingram and Reckitt have reported growth attributed to the increased sales of OTC products. In particular, for the six months ended 31 December 2021, Adcock Ingram reported an increase in turnover of 16% to R4.3 billion, and an increase of 25% in trading profit to R543 million, which the company attributed to increased demand for OTC cough, cold and flu remedies. Moreover, Reckitt detailed that its health business saw strong growth of 18%, led by growth in its OTC portfolio.

Furthermore, the preference for at-home treatment of cough, cold and flu symptoms has been supported by a boom in e-commerce and home delivery services, largely driven by Covid-19 lockdowns. For example, Dis-Chem’s online sales have surged, now comprising 18.1% of the company’s sales for the six months ended August 2021. In response, the Dis-Chem group deployed 44 new e-commerce hubs and increased investment in its e-commerce platform. Furthermore, the launch of home delivery services, such as PharmaGo and Dis-Chem’s Deliver D, offer a convenient means of obtaining cough, cold and flu remedies, further supporting the preference for at-home treatment in the local market.

The South African Cough, Cold and Flu Remedies Industry Landscape Report 2022 (109 pages) provides a dynamic synthesis of industry research, examining the local and global cough, cold and flu remedies industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as manufacturer, distributor, retailer, and pricing analysis.

Some key questions the report will help you to answer:

Please note that the 109-page report is available for purchase for R35,000 (excluding VAT). Alternatively, individual sections can be purchased for R15,000 (excluding VAT). For additional information, contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140-5756.

For a full brochure please go to: South African Cough, Cold and Flu Remedies Industry Landscape Brochure 2022.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions, to help you to successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment, through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.