Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

The Top Million research report into South Africa’s "Upper Middle Class" households in 2019 was released by the UCT Marketing Institute and ad agency M&C Saatchi Abel, in both Johannesburg and Cape Town this week.

This is the long-awaited in-depth research into South Africa’s transforming middle class segment – in particular the upper earners who are arguably the most influential when it comes to brand buying power and impact on our economy.

It also debunks many of the former ‘Black Diamond’ research myths and stereotypes of the past decade, as this diverse, savvy, value-driven consumer class comes of age. What is absolutely fascinating is that this segment also includes many new entrants into the "Upper Middle Class" – who have leapfrogged ‘normal middle class’ direct into this demographic from the poorest segment.

This powerful Upper Middle Class group are described as “key influencers with the power to make or break brands”. There has been massive change in South Africa’s middle class which is growing exponentially, particularly in the “upper middle class” segment, which has been notoriously difficult for marketers to access. They have massive buying power, complain and exert pressure on brands.

The UCT Marketing Institute delves deep into their aspirations, finance, shopping, entertainment and leisure, food and health, media consumption and how they feel about their future in South Africa; as well as what their non-negotiables are in terms of what they do not cut spend on, despite downsizing in other categories. Additional sponsors included Engen, Liberty and Telkom.

These are some of the major shifts:

The research was presented in three tranches in both Johannesburg and Cape Town this week by strategic marketer Martin Neethling, currently director of groceries at Pioneer Foods and a research associate at the UCT Institute for Strategic Marketing; Dali Tembo, managing director at Instant Grass International; and Makosha Maja-Rasethaba, strategy head at M&C Saatchi Abel.

Neethling focused on providing an overview of the vital discoveries from this latest research, pointing out that South Africa remains a dual economy with one of the highest inequality rates in the world and for the average Top Million household, income is 20 time larger than the rest of South Africa. The reason is economic: professionals in South Africa are high earners due to skills shortages and a consequence of supply and demand. This group has also focused on education and entrepreneurship to increase their financial security and economic aspirations.

“This group has grown, even as South Africa has drifted sideways. The tax base has increased on the richer side of our economy, and the Top Million group has enjoyed the benefits of rising affluence,” Neethling said.

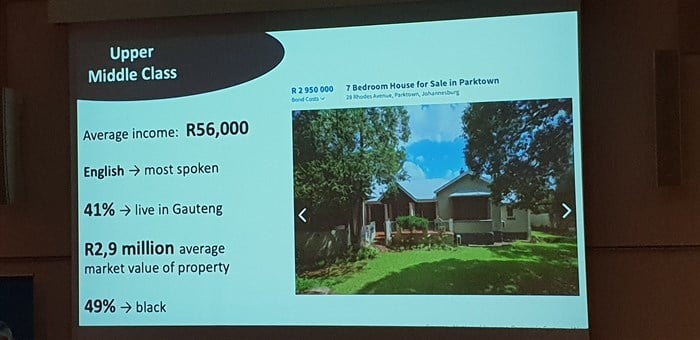

This is the Top Million group in numbers:

In terms of this research study, the categories of South Africa’s households are divided up into: ‘Ultra-Poor/Survivors’ (earning less than R8000 p/m); ‘Skilled Strugglers’ (earning less than R22 000 p/m); ‘Middle Class’ (earnings R22 000 – R75 000 p/m); ‘Affluent’ (earning more than R75 000 p/m). Earnings are net and per household combined income, not individual income.

The opportunity this study presented, said Neethling, was to break apart the middle class group and focus on the ‘Upper Middle Class’ segment that have the most spending power and impact on brands.

There are two significant factors that researchers uncovered, Neethling explained:

This group are happy, living their ideal life. They don’t care who is in power, as long as they can achieve their aspirations and maintain their lifestyle. However, they do also feel vulnerable, are feeling the pressures of the economic slowdown in SA, and many are one financial setback from moving out of this Upper Middle Group downwards, which is uniquely South African, Neethling said.

While 80% are still optimistic about what the future holds in South Africa in the long term; 75% also think their kids may have a better future outside of South Africa; and less than 40% are confident about the South African economy right now. They are also concerned about crime, road safety and their kids’ future.

They are great planners in order to meet their aspirations and are investing in property and their own and their kids’ education. These are their strategies for success:

Strategy #1 - Get educated: Better educated means better income. Also, there is a perception that just a regular degree is not enough. The reality is that an established affluent home is also much more likely to have children that are more likely to have the skills to be entrepreneurs, or seek out a degree, says Neethling.

Strategy #2 - Be highly motivated: They work on their careers subconsciously, all the time. They are self-directed and self-actualised. They say they need passion, energy, drive, willpower, confidence self-belief and motivation: “It’s up to me”. 18% of these Top Million household heads are self-employed. They work day and night to achieve their aspirations.

Strategy #3 - Work as a team: 50% of the Top Million households have two or more earners in the household. They work together to get what they want. They won’t date “down” – they are not a “fan of potential”, said one respondent. They would like to meet someone equally motivated as a life partner. Only 22% of the top earners are female – but watch this space, there will be significant moves here in the future. A third of the Top Million households have two incomes.

Strategy #4 - Make a plan: None of this is arbitrary or random. They have a vision and a plan. 80% say their life goals are clear and they take clear steps to achieve their “break”. They are educated, have high levels of motivation, and work in teams.

Strategy #5 - Get niche: Find a gap in the way that people think and be knowledgeable about that gap and be the known expert about the subject matter. You need to build a personal brand, as being better than the next person means so little, said another respondent.

Strategy #6 - Hyphenate: Salaries haven’t kept pace with economic reality, so it’s about the hustle and the side business to up earnings and afford luxuries.

Strategy #7 - Think positive: You have to have self-confidence to make the most of life. They have a glass half-full approach to life. It is not all doom and gloom.

Strategy #8 - Building social capital: They know people and nurture relationships to make their dreams come true. Respondents advised: “Social capital is important. You need to present as someone who is not reckless…”; “When you sell yourself, sell yourself in the right spaces…”; “You need to have people of substance around you…”

Strategy #9 - Using the ‘Bank of Mum & Dad’: Get support from parents to study further or launch a business.

*Next Top Million article: What drives the Top Million; what are they spending on; where have they cut back; and how can marketers reach this group?