Increased consumer interest in mobile banking - particularly when facilitated by cellular technology - was one of the key findings of The Mobility 2014 research study, conducted by Arthur Goldstuck's World Wide Worx with the backing of FNB.

That's according to Dashboard Marketing Intelligence joint managing partner, Peter Searll, who is responsible for the fieldwork that provides the data for analysis.

The study highlighted substantial shifts in the banking environment. The majority of South Africans access their bank accounts through ATMs, 97% in 2012 and 94% in 2013, and branch visits, 83% in 2012, 84% in 2013.

The biggest shifts however - albeit off small bases - were the decline in internet banking on laptop/PC (11% in 2012, 15% in 2013) as well as the growth in three channels that are facilitated by the cellphone - USSD (26% in 2012, 32% in 2013), internet banking on cellphone (11% in 2012, 12% in 2013), and apps (1% in 2012, 9% in 2013).

"When it comes to banking, mobile has become mainstream and is still the major growth space," said Searll.

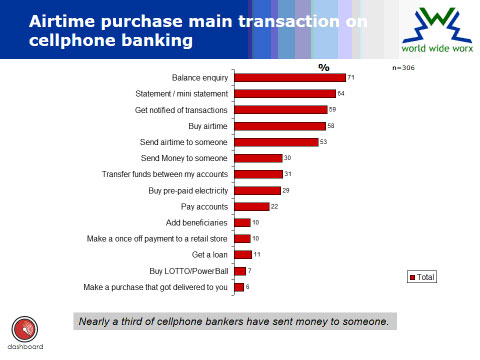

"As the slides below show, the channel utilised depends on the transaction type and that consumers are still more prepared to use cellphone banking for information purposes than actually transact.

"Airtime - with 58% of users claiming to have bought it - is the main purchase while only 10% of users claim to have made a once-off payment to a store and only 6% have bought something delivered to them later.

"But, while it will perhaps take a while for cellphone bankers to feel comfortable and make more payments and purchases, I think it very positive that nearly a third has sent money to someone.

"This becomes even more important when read in conjunction with the fact that 37% of non-cell phone bankers claim they would use cellphone banking in 2014. If they do, that will represent a growth rate of 33% and could have major impact on the banking industry - and retailers linking with the industry - in years to come," he said.

No change in use of financial institutions' mobile money facilities, but...

The proportion of respondents who claimed to have used mobile money facilities provided by the financial institutions in the past 3 months totalled only 9% of the interviewees. This is the same percentage as in 2012.

However, respondents who claimed to have used mobile money facilities provided through retailers in the past 3 months totalled 21%. The difference between the two groups is that 73% of those transacting through the financial institutions (mobile money) are also cellphone bankers compared to 30% for those transacting through the retail outlets.

"I can see why the Mobility 2014 report would fascinate businessmen from all consumer sectors, not only bankers. Investigating consumers' relationship with their mobile devices, it reveals shifts in consumption and usage patterns. Astute businessmen will read these and see opportunities a plenty."

Another key finding of the study was that cellphone usage in South Africa underwent a dramatic shift between 2012 and 2013 with spend on voice dropping from 73% of mobile budget to 65% and spend on data increasing from 12% to 16%. At the beginning of 2010, voice stood at 77% and data at 8%.

The most significant tool driving the mobile economy is the app, and the use of apps on phones shot up from 24% of adult cellphone users in cities and towns in mid-2012 to 43% in late 2013.

Addressing cellphone usage and mobile banking trends as well as exploring online trends, Mobility 2014 is based on face-to-face interviews with a nationally representative sample of South African adult cellphone users living in cities and towns.

Notes:

USSD (Unstructured Supplementary Service Data) is a Global System for Mobile (GSM) communication technology that is used to send text between a mobile phone and an application program in the network. Applications include prepaid roaming, mobile chatting, or banking.

Financial institutions providing mobile money: ABSA CashSend, FNB eWallet, M-Pesa, Standard bank Instant Money, MTN Mobile Money, FNB Geopay and FNB Pay2Cell

Retailers providing mobile money: Shoprite Checkers Money Market, Spar Instant Money, MoneyGram, and ABSA Western Union.

More about Dashboard Marketing Intelligence

More about World Wide Worx