Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

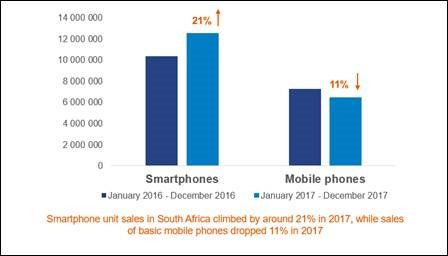

GfK South Africa’s data shows that smartphone sales in South Africa climbed from around 10 million in 2016 to over 12 million in 2017. Even though much of this growth was driven by adoption of entry-level smartphones from second-tier brands, the value of the smartphone market showed an increase of 22%. Sales of basic mobile phones dropped 11% in 2017, as users continued to migrate to smartphones.

"Electronics, telecommunications and information technology retail experienced a difficult year in 2017 as consumers tightened their belts in response to economic difficulties in South Africa,” says Nikolay Dolgov, general manager of point-of-sales tracking at GfK South Africa. “However, the smartphone market continued to show strong growth as more South Africans sought to get connected to the Internet and as smartphone prices continued to fall.”

Quarterly sales of mobile devices reached record levels in the fourth quarter of 2017, largely driven by Black Friday retail specials in November and robust sales during the December festive season. In addition to entry-level smartphones, the large-screen ‘phablet’ form factor also experienced significant growth.

“Consumers are looking for special deals and promotions when they’re ready to upgrade their devices,” says Norman Chauke, solutions specialist at GfK South Africa. “What’s more, we’re seeing the pace of the transition from basic phones to smartphones accelerate as the price gap between them narrows. Operators are nudging subscribers towards smart devices as they seek to grow their data revenues.”

Sales in the information technology segment – including tablets, desktops and mobile computers – declined by 25% in 2017. The sharp drop is largely due to a continued deterioration in sales of media tablets, with unit sales falling more than 40% to less than 1 million units. Large-screen smartphones are cannibalising tablet sales as users choose to buy a better smartphone rather than a new tablet.

Mobile computer sales dipped by more than 15% and desktop fell 29% as consumers held off upgrading as a volatile exchange rate continued to affect pricing. Desktop and mobile computer manufacturers continue to address weak sales of their devices by selling more affordable, lower-specced machines with older generation processors, less RAM and smaller screen sizes.

Storage saw good growth in 2017, with increasing shipments of mobile computers with SSD hard drives that have low storage capacities driving growth for external storage.

“Though low-end platforms such as the Celeron account for more than half of the market, sales of premium devices based on Core i5 and Core i7 grew during 2017,” says Chauke. “In line with established trends in market, we are seeing tech-savvy online shoppers, in particular, gravitate towards premium mobile computers.”

Turning to the consumer electronics market, panel television sales were strong in the fourth quarter of 2017, largely thanks to good sales during the week of Black Friday in November. Consumers snapped up large-screen TVs and premium models over the Black Friday period, translating into a healthy and high average price. Despite strong Black Friday sales, the panel TV market for the full 2017 year was flat.

Ultrahigh definition, 55-inch screens showed a significant decline in sales. Despite a negative growth for the consumer electronics segment, loudspeakers reached a record high in sales value during the fourth quarter of 2017. Audio home system sales, however, dropped significantly during the quarter.

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s long-standing data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices. www.gfk.com/en-za/