Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest SA Sports and Energy Drinks Industry Landscape Report 2017 carefully unfolds the sports and energy drinks markets based on the latest information and research. It discusses the latest industry trends, drivers and restraints, whilst also analysing the latest available stats to understand the market for both sports and energy drinks.

In 2017, the global energy drinks market is estimated to be US$55bn and is projected to grow at a compound annual growth rate (CAGR) of 3.7% during the forecasted period of 2017-2022. Across the globe, sports and energy drinks remain refueling winners. This continued popularity is evident in given the fact that Energy Drink launches grew 29% in the five years between 2010 and 2015. Furthermore, the global sales volume of energy drinks is forecasted to grow from 11.5 billion litres in 2015 to 14.7 billion litres in 2018!

Here in SA, the sports and energy drinks market is currently also going from strength to strength. The retail sales volume for energy drinks increased by 8% in 2016 due to factors such as the expansion of smaller brands that target lower LSM consumers not previously catered for. Similarly, the sports drinks market in SA experienced a 7% retail volume growth in 2016. Reasons for this increase include intensified obesity prevalence campaigns (leading to increased sports activities and thus an increased consumption of sports-related food and drink).

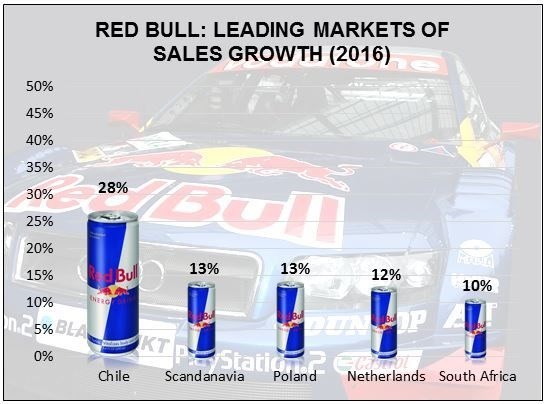

This local popularity of sports and energy drinks can even be seen in international companies’ sales growth. The graph above indicates the sales growth of Red Bull’s outstanding markets worldwide in 2016, compared to the prior sales year. Sales growth in South Africa were fifth highest on Red Bull’s list of international markets, indicating a continued local loyalty to this energy drinks brand.

A number of trends and drivers are also contributing to the popularity of these types of drinks. Continuous innovation and new products are coming to the fore, including sugar-free options, fortified drinks, bolder flavours and more organic varieties. It is also interesting to note that different LSM groups are being targeted: from 7 Stars focusing more on the lower LSM consumers, to brands such as LOAD that very much caters to the upper LSMs willing to spend more for their consumables.

It is not all good news for this market, however: even though many South Africans view sports and energy drinks as a more fashionable, healthier alternative to soft drinks, many are still unable to afford what they perceive to be a luxury item. Even SA’s middle class is struggling to survive, with approximately 75% estimated to be under financial stress. Our difficult economic climate, along with the impending Sugar Tax, as well as continuing health-related concerns regarding sports and energy drinks (e.g. high sugar and caffeine content) could prove to be challenging for this market in the future.

The SA Sports and Energy Drinks Industry Landscape Report 2017 (125 pages) provides a dynamic synthesis of industry research, examining the local and global sports and energy drinks industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to retail, pricing analysis and consumption trends.

Some key questions the report will help you to answer:

Please note that the 125-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R9,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni, directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: http://www.insightsurvey.co.za/south-african-sports-energy-drinks-industry-report.

Insight Survey is a South African B2B market research company with more than 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.