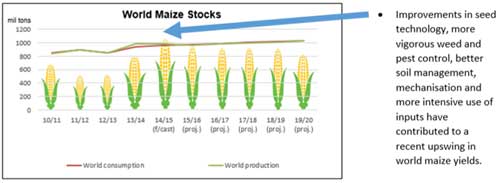

Despite strong growth in demand, global maize stocks have risen to multi-decade highs. Cumulative carryover stocks are forecast to reach a 27-year high by the end of 2014/15, led by strong gains in the major exporters and large worldwide harvests. However, according to Insight Survey's latest Carbohydrate Landscape Report this global production trend has been unable to gain traction in South Africa, as adverse weather conditions are putting strain on the local maize industry.

Source:

IGC; Graphics by Insight Survey

Insight Survey's Carbohydrate Landscape Report comprises extensive primary and secondary research (including in-depth interviews with leading industry experts) in order to provide detailed insight into the current state of woe in the local maize industry, and its impact on domestic market dynamics.

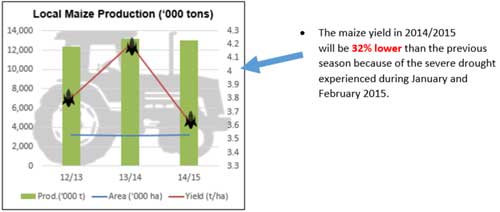

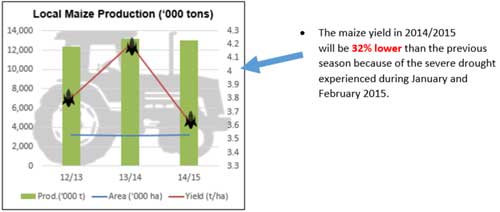

As the report indicates, it has been the severe droughts in two of the largest production areas (i.e. the Free State and North West provinces) which have resulted in the depletion of crops, and the subsequent halting of exports. The marked decline in yield is evident in the graph below:

Source:

NAMC; Graphics by Insight Survey

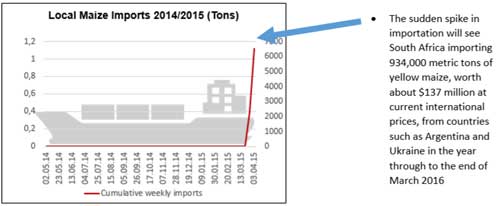

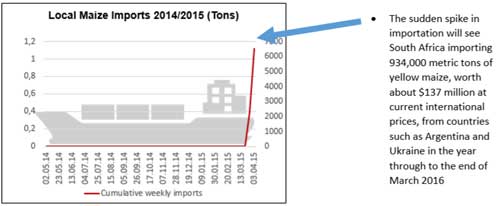

The extent of the drought has meant that South Africa has been forced to start importing maize, with imports due to increase to around 934,000 metric tons of yellow maize through to March 2016. This need for importation is reiterated by Funzani Sundani, Agricultural Economist for Grain SA, who during one of our interviews, explained that "the impact of the drought on the summer crops was severe and the importation of specifically yellow maize is unavoidable".

Source:

SAGIS; Graphics by Insight Survey

This increase in importation is having a significant knock-on effect for the consumer, as high inflation is resulting in maize becoming a less affordable staple food for South African consumers. As such, local maize consumption has steadily declined since 2013, as price-sensitive consumers turn to cheaper alternatives such as rice.

The Landscape Sector Report (124 pages) provides a dynamic synthesis of primary and secondary research, including extensive interviews with relevant stakeholders and industry experts across the value chain: from organisational bodies to manufacturers, retailers and leading academics.

Some key questions the report will help you to answer:

- What are the key factors that are restraining and driving the growth of the local and global markets?

- What are the local and global supply and production trends and predictions?

- What are the local and global demand and consumption trends and predictions?

- What were the Manufacturing and Retail sectors' overall financial performances for 2014?

- What are the consumption trends in the following carbohydrate sectors: rice; pasta; mealie meal; bread; potato chips; breakfast cereal; frozen potato products?

Please note that the 124-page PowerPoint report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni.

For a full brochure please go to: http://www.insightsurvey.co.za/2015-carb-landscape-report.

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business's competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.