Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

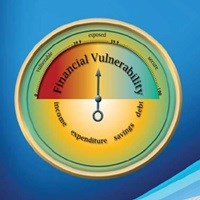

The CFVI declined to 48.9 points in 2013 from 51.4 points in 2012. The decline could have been more had it not been for some improvement in the fourth quarter of 2013 (Q4 2013). The CFVI increased from 45.9 points in Q3 2013 to 52.0 points in Q4 2013 meaning that consumers felt slightly more secure in Q4 2013.

The Q4 results mean that on average consumers experienced their cash flow situation to be very exposed in 2013 compared to mildly exposed in 2012. Similarly, they perceived their cash flow situation to be mildly exposed in Q4 2013 compared to very exposed in Q3 2013.

"All four subcomponents of the CFVI (income, expenditure, savings and debt servicing) improved during Q4 2013 (compared to Q3 2013) thereby combining to reduce consumers' overall state of financial vulnerability," said Professor Bernadene de Clercq who headed the analysis on behalf of MBD.

"Further analysis showed that seasonal factors play a major role in determining consumers' perception of their cash flow vulnerability status."

A comparison of the actual CFVI and the seasonally adjusted CFVI shows that consumers' cash flow vulnerability is most affected during Q3, when seasonal factors combine to increase their income, savings and debt servicing vulnerability. Put differently, had it not been for seasonal factors, consumers would have been less financially vulnerable during Q3. One particular seasonal factor negatively affecting consumers' perceived state of cash flow during Q3 is labour strikes. During times of labour strikes workers normally are not paid, which sets in motion a domino effect as their income vulnerability results in them also becoming more savings vulnerable as well as debt servicing vulnerable.

The Bureau of Market Research (BMR) at Unisa did the CFVI analysis on behalf of MBD. The analysis looks at income, expenditure, savings and debt servicing subcomponents and uses a 100 point scale with scores between 0 and 20 indicating extreme vulnerability and scores between 80 and 100 indicating extreme secure. Copies of the comprehensive CFVI report are available on request from MBD, email az.oc.scdbm@1maqnasmahT.