The growth in South African hotel industry capacity is based extensively on the unprecedented economic growth experienced over the decade leading up to the global contagion, which was ignited in September 2008 and which resulted in the pent-up demand for hotel accommodation all but dissipating in the wake of the economic meltdown. It is a common misconception in the market that the 2010 FIFA World Cup has motivated this increase.

While the prevailing capacity growth in hotel rooms is widely reported on, with conflicting viewpoints being expressed, a major challenge is addressing the unsubstantiated and unspecified basis of commentaries and reports on the South African hotel industry inventory capacity. Generally these are fraught with inaccuracies and misrepresentations, presenting somewhat of a 'dog's breakfast' perspective on one of South Africa's hallmark industries that compares with the best the world has to offer.

As specialised consultants to the broader South African tourism and hospitality Industry, the group maintains an empirical database of hotels operating in the country.

Current data

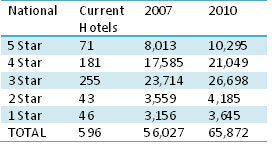

Its data is based on currently operating hotels that are larger than 30 rooms and excludes guest houses, lodges, hostels, bed-and-breakfast establishments and other 'short-term' accommodation establishments not specifically defined as hotels. In fully comprehending the current capacity in the hotel industry, it has also incorporated hotel projects currently under construction that will be coming on-line in the short-term.

Source: PGTHC Analysis

The table above reflects that inclusive of all hotel projects currently under construction, South Africa has approximately 66 000 rooms in the formal hotel sector. Data analysed over a period of nine years reflects that growth in capacity was static over the period 2002 to 2007 but accelerated over the period 2008 to 2010, with a substantial surge in 2010. Measuring the current inventory to 2007 levels reflects that there has been an overall increase of 17.4% with a substantial increase in the 5 Star segment (28.5%) and 19.7% and 12.6% respectively in the 4 and 3 Star segments. Albeit that the 1 and 2 Star segments come off an extremely low base, very limited growth is evidenced in these segments.

World Cup not the catalyst

It is naïve to believe that the World Cup has motivated the capacity increases and that an industry, which enjoys the typical life cycle of 20 years, would be as irresponsible as to create capacity for a 31-day event. The Achilles heel of the South African hotel industry is the demand-reactive nature of the industry - resulting in the prevailing growth spurt in capacity over the past three years. The hotel industry naturally enjoys a generally direct relationship to economic stability and growth being experienced both in South Africa and internationally.

Until the second half of 2008, South Africa's economy had been in an upward phase of the business cycle since September 1999 - the longest period of economic expansion in the country's recorded history. During this upswing (based on data for the period up to the fourth quarter of 2007), the country's annual economic growth rate had averaged over 4%. In the decade prior to 1994, economic growth averaged less than 1% per annum.

GDP impacts industry

Until the global economic crisis, South Africa's real gross domestic product (GDP) rose by 3.7% in 2002, 3.1% in 2003, 4.9% in 2004, 5% in 2005, 5.4% in 2006, the highest since 1981, and 5.1% in 2007. Economic growth in 2008 declined to 3.1% as South Africa entered a recession, however, from the first quarter of 1993 to the second quarter of 2008 the country enjoyed an unprecedented 62 quarters of uninterrupted economic growth. As the crisis made itself felt, GDP contracted in the third and fourth quarters of 2008, officially plunging the economy into recession. This contraction continued into the first and second quarters of 2009, with GDP growth at -6.4% and -3% respectively.

This translates into a compounded GDP growth of 29.7% over the period 2002 to 2008, with growth in hotel capacity over this period of 21.8%, as measured in 2010. While there is a prudent time lag between hotel inventory capacity reaction and the prevailing economic bullishness, it must be understood that the period from inception to planning and construction of a hotel project is typically between 30 - 36 months.

As a result projects initiated in 2005 after fair comfort that the economic bullishness was sustainable and that the prevailing pent-up demand was reaching saturation levels, only started coming on-line in 2008, resulting in the current accelerated increase in inventory. The additional inventory being introduced would have by most measures been absorbed by the pent-up demand, but for the economic downturn from late 2008.

Cape Town's growth

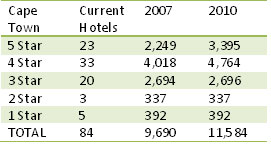

Source: PGTHC Analysis

The Greater Cape Town hotel industry experienced 19.5% increase in overall capacity with the strongest growth in the 5 Star segment at 51%. Growth at the 4 Star level was 18.6%, while the remaining segments were static. A major contributor to the growth in especially the 5 Star segment has been the large scale introduction of luxury hotel apartments. While a proportion of these were always planned as apartment hotels, a substantial proportion of these were conversions from planned luxury residential units to hotel apartments resulting directly from distressed residential developments due to the prevailing credit-crunch.

Interestingly, recent comments from Cape Town Routes Unlimited, the marketing arm for the city, on the Southern African Tourism Update Online (Wednesday, 19 May 2010) mentioned that capacity in Greater Cape Town increased by 40% compared to the group's measured and substantiated 19.5%. The article further referred to the Greater Cape Town hotel room capacity being 50 000 compared to the empirically substantiated capacity of 11 584 hotel rooms.

Johannesburg capacity

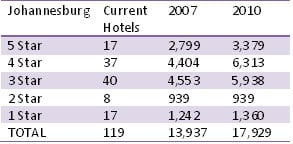

Source: PGTHC Analysis

The Greater Johannesburg hotel industry experienced 28.6% increase in overall capacity with the strongest growth in the 4 Star segment at 43.3%, while growth at the 5 Star level was 20.7%. The 3 Star segment increased by 30.4%, while the remaining segments were static.

Gauteng accounts for nearly 34% of South Africa's total GDP and is larger than almost every other African economy, producing approximately 10% of Africa's total GDP. With Johannesburg being the epicentre of the province, the economic bullishness experienced in the region translated into direct increase in pent-up demand, especially over the period 2005 to 2007, and moving into 2008, sparking-off the substantial increase in hotel room capacity.

Pretoria - growth in 3 Star

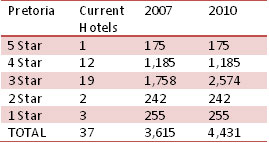

Source: PGTHC Analysis

Pretoria has seen very limited growth in hotel room capacity and has been secondary to the main travel cities of Cape Town, Durban and Johannesburg. However, 2010 will see the introduction of substantial new inventory - albeit only at the 3 Star level.

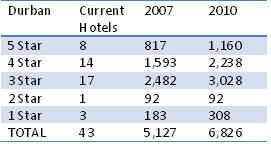

Largest growth - Durban

Source: PGTHC Analysis

The Greater Durban hotel industry experienced 35.6% increase in overall capacity, recording the largest growth in the country albeit off a fairly low base and a historically static inventory base. The strongest growth is in the 5 Star segment at 42%, with growth at the 4 Star level 40.5%. The 3 Star segment increased by 24% while the remaining segments were fairly static. Durban remains a major industrial and manufacturing province, which has also faced an economically driven pent-up demand. However, another major contributor has been the established shift from the CBD to the Umhlanga Ridge area as well as new hotel developments in the Ballito and Umhlanga region, driven by the relocation of the airport coupled with the growing business and leisure popularity of the North Coast region.

Hotel industry not irresponsible

This analysis and interpretation of the prevailing hotel room capacity growth presents a substantiated overview of the current supply dynamics, and while the difficulties facing the hotel industry are consistently blamed on over-capacity in the industry, due cognisance needs to be taken of the economic decline both nationally and globally.

While both capacity increases and economic volatility face their own individual gestation periods, what needs to be understood is that the industry has largely not been irresponsible as is often intimated by swashbuckling commentators with limited understanding of the industry and its drivers.

Developers could go back to apartments

The hotel industry is a long-term commitment and suggesting that capacity growth is aligned purely to 2010 opportunism is irresponsible and sensationalist. The group believes there will be some attrition after the event, and as the luxury residential market improves, developers, who traditionally are in for the short-term gain on developments, will retire to their normal business of selling apartments and not operating them as hotels. The hotel industry will again revert to being a responsible and gratifying business operated by impassioned specialists committed to serving people.