Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 2 days

More news

Insight Survey’s latest South African Carbonated Soft Drinks (CSD) Industry Landscape Report 2022, carefully uncovers the global and local carbonated soft drinks market (including the impact of Covid-19), based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African carbonated soft drinks industry environment and its future.

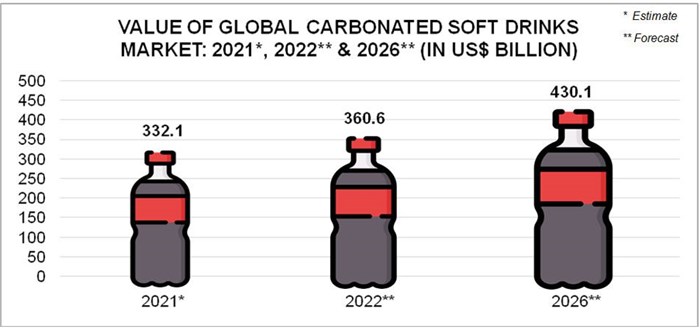

The global CSD market was estimated to have generated US$332.1 billion in 2021 and is forecast to reach approximately US$360.6 billion in 2022, growing by 8.6% year-on-year. Furthermore, as per the graph below, the global CSD market is forecast to increase by a compound annual growth rate (CAGR) of 4.5% between 2022 and 2026, to reach approximately US$430.1 billion by 2026.

In terms of the South African market, the local carbonated soft drinks market achieved growth of 4.1% year-on-year, in current prices, between 2020 and 2021. Furthermore, the market is expected to grow at a CAGR of 5.8% between 2022 and 2026. Interestingly, as the Covid-19 restrictions ease, on-trade consumption is predicted to grow at a CAGR of 8.3% between 2022 and 2026, compared to 4.9% for off-trade consumption.

Within the global market, consumers are continuing to seek out healthier CSD options. These include low-calorie and sugar-free CSD products, as well as CSD products offering functional benefits, such as reducing stress, supporting immune health, and providing sources of plant-based proteins.

This trend has also gained traction within the local market, with more South African consumers opting for healthier CSD products, including products that contain less sugar, as well as those that boast functional benefits. However, this health focus does not mean that South African consumers are willing to compromise on taste, with more consumers specifically seeking out healthy CSD products that also offer appealing flavours.

As an example of this, The Coca-Cola Company recently launched a new recipe for its Coca-Cola Zero Sugar product. This new recipe aims to make the product taste more like original Coca-Cola, as well as to capitalise on the accelerated growth of the Coca-Cola No Sugar brand in South Africa.

Furthermore, Whole Earth’s Organic Elderflower drink contains no sugar, as well as containing elderflower, which provides immune-boosting properties. Another example is Monatea’s Lightly Sweetened Hibiscus Berry and Buchu Sparkling Tea, which contains hibiscus petals that provide antioxidative effect.

However, the demand for appealing and novel flavours continues to be a major factor in the CSD market. This is demonstrated by newly launched global products with unique flavours, such as Pepsi’s new Pepsi Mango flavour, as well as the unusual Mountain Dew Flamin’ Hot limited-edition beverage, which combines the flavour of Mountain Dew, with the spicy flavour of Cheetos.

This flavour trend is also highlighted in CSD products released into the South African market, including aQuellé’s Khula range, as well as Woolworths’ Cool range. More specifically, the Khula range is low in kilojoules and is created using aQuellé’s unique spring water. The range is available in a variety of flavours, including cola, ginger burst, cream soda, and raspberry.

In addition, Woolworths’ Cool range offers a range of flavours, including cola, cola and vanilla, and cola and cherry, as well as non-cola flavours, such as lemonade, passion fruit, cream soda, ginger beer, and raspberry. In addition to offering an assortment of flavours, these products are made with spring water and do not include any added preservatives or azo-dyes. Furthermore, a selection of these products is also available in sugar-free variants.

The South African Carbonated Soft Drinks (CSD) Industry Landscape Report 2022 (110 pages) provides a dynamic synthesis of industry research, examining the local and global carbonated soft drinks industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as manufacturer, distributor, retailer, and pricing analysis.

Some key questions the report will help you to answer:

Please note that the 110-page report is available for purchase for R35,000 (excluding VAT). Alternatively, individual sections can be purchased for R15,000 (excluding VAT). For additional information, contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140-5756.

For a full brochure please go to: SA Carbonated Soft Drinks (CSD) Industry Landscape Brochure 2022.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions, to help you to successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment, through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.