Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest South African Pet Care (Dog) Industry Landscape Report 2017 provides a dynamic synthesis of industry research, examining the local and global pet care industry from a uniquely holistic perspective, with detailed insights into the entire South African value chain.

Globally, the pet care industry has experienced continuous growth between 2011 and 2016 with a compound annual growth rate more than 4%. The four key markets for pet care products are the USA, Japan, Europe and South America. In the USA alone, for example, the market has grown from US$36.8 billion in 2011 to US$44.7 billion in 2016.

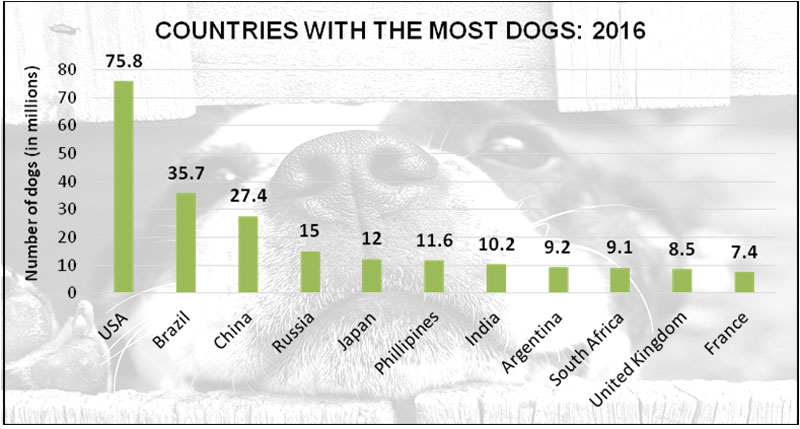

In South Africa, pet ownership is on the rise due to the growing number of empty-nesters, single professionals, couples who delay having children and even for security reasons. In 2016, there were an estimated 9.2 million dogs living in SA households, ranking South Africa the ninth highest in the world.

In our country, pets are also increasingly being treated as members of the family. Greater variety is being experienced within the pet care industry, whether it be food (there are currently more than 200 pet food brands available), health insurance (with close to 10 major market players currently leading the field), toys, accessories, grooming services and pet hotels! An increasing number of retailers are making their mark, from Absolute Pets and Pet Masters to Yuppie Pet (an online retailer). There is also an increased focus on purchasing premium products, e.g. more organic and nutritious food, and toys/accessories like bedding, collars and clothing – but this is typically limited to the affluent, upper LSM groups.

According to the Pet Food Association of South Africa (PFA), South African pet owners spend approximately R5 billion per year on pet food with an expected growth rate of 2% up to 2018, which is significantly lower than the current global growth.

The economic pressures being faced by South Africa consumers are impacting the spending habits of the average South African. This lack of spending can be seen in the estimate that only 20% of dogs and 35% of cats are fed by their owners with commercial pet food.

Even though more affluent consumers will continue to spend on premium pet products and services, the average consumer’s lack of disposable income could lead to a strain on the pet care industry, with pet-loving South Africans continuing to spend less on their animal family members than their overseas counterparts.

The Pet Care (Dog) Industry Landscape Report 2017 (128 pages) provides a dynamic synthesis of industry research, examining the local and global pet care (dogs) industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to retailing, competitor positioning, latest marketing and advertising news for each competitor, pricing and promotions analysis, consumption and purchasing trends.

Some key questions the report will help you to answer:

Please note that the 128-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R9,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045 0202.

For a full brochure please go to: SA Pet Care (Dog) Industry Landscape Report 2017.

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za. Alternatively, contact +27 (0)21 045-0202.