Results from the latest EY/Bureau for Economic Research (BER) Retail Survey signal a substantial deterioration in trading conditions in the retail sector during 2015Q3.

The majority of the retailers surveyed by the BER in all three sub-categories - namely durable goods[1], non-durable goods[2] and semi-durable goods[3] - reported a marked slowdown in sales growth and a slump in overall profitability levels during 2015Q3[4].

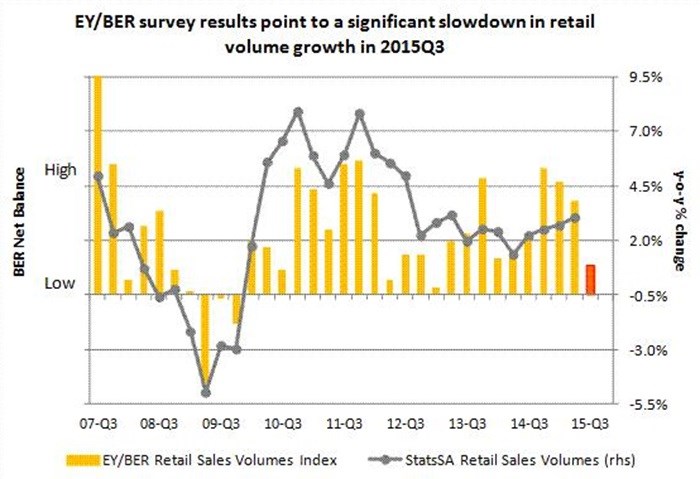

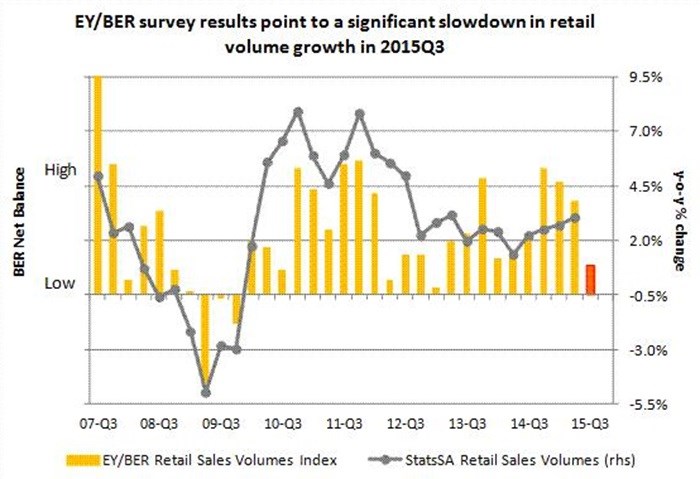

According to Statistics South Africa, the growth in retail sales volumes improved gradually from just below 2% year on year (y-o-y) during 2014H1 to 3.1% y-o-y in 2015Q2, largely on the back of receding inflation and a recovery in strike-affected incomes (following the prolonged platinum sector strike in 2014H1). However, results from the EY/BER Retail Survey suggest that volume growth slumped back down to around 2% y-o-y during 2015Q3.

Derek Engelbrecht, consumer products & retail sector leader at EY, said: "A confluence of adverse economic developments has been putting renewed downward pressure on the spending power of households, including higher personal income tax and indirect taxes, job losses, significantly lower growth in government wages and social grants expenditure, rising inflation and interest rates, a sharp depreciation in the rand exchange rate and the slump in stock prices on the JSE. Some of these factors already contributed to a dramatic decline in consumer confidence levels in 2015Q2, but retail sales growth still held up relatively well. Unfortunately, the latest EY/BER Retail Survey results suggest that the retail sector has now also capitulated, with most retailers reporting a broad-based slowdown in volume growth and a marked deterioration in profitability levels during 2015Q3."

Even hardware retailers - which recorded strong sales growth during 2015H1 on the back of surging demand for products that could be utilised during power outages - reported a marked deceleration in sales growth in 2015Q3.

Input costs and selling prices

Looking at input costs and selling prices, the majority of retailers reported that input costs escalated at a faster rate than their selling prices. "Non-durable goods retailers in particular experienced considerable upward pressure on their input costs, most likely on the back of the drought-induced rise in domestic grain prices and a further depreciation in the rand exchange rate," said Engelbrecht. It appears as though most non-durable goods retailers did not pass the full impact of higher input costs on to consumers during 2015Q3 - leading to a decline in profitability - but the vast majority of survey respondents now expect to hike their selling prices in 2015Q4. The results from the latest EY/BER Retail Survey therefore suggest that, while food inflation has surprised on the downside in recent months (averaging only 4.4% in June/July) and may well remain relatively benign in the remainder of 2015Q3, we could see a substantial rise in 2015Q4.

Semi-durable goods retailers also experienced upward pressure on their input costs. However, instead of passing higher costs on to consumers, it appears as though many semi-durable goods retailers (and, to some extent, durable goods retailers) were forced to sell an abnormally large proportion of their stock at a discount in the face of waning demand.

Given the high import content of durable goods (e.g. household appliances and electronic goods) and semi-durable goods (e.g. textiles, clothing, footwear and toys), these categories are particularly vulnerable to the inflationary effect of the sharp depreciation in the rand exchange rate in recent months. Apart from the projected increase in imported inflation and slowdown in real disposable (after tax) income of households, durable and semi-durable goods sales are also more sensitive to interest rate hikes, credit growth and consumer confidence levels. Engelbrecht noted: "Given rising interest rates, tougher credit requirements for lenders and a dramatic decline in consumer confidence levels - signalling a greater reluctance to spend, particularly on discretionary items - we expect to see a significant deceleration in durable and semi-durable goods volume growth in coming quarters."

Deterioration in trading conditions

Unsurprisingly, the broad-based deterioration in trading conditions during 2015Q3 dealt a further (hefty) blow to business confidence levels in the retail sector. Only 34% of the retailers surveyed by the BER indicated that they were satisfied with prevailing business conditions in 2015Q3, sharply down from 60% in 2015Q1 and 52% in 2015Q2. Alarmingly, retailer confidence levels are currently at a similar level compared to the low of 35 index points reached during the 2008/9 recession (recorded in 2009Q3)[5]. The sharp drop and low level of retailer confidence booked in 2015Q3 now mirrors the dramatic decline in the FNB/BER Consumer Confidence Index (to a 14.5 year low) during 2015Q2.

Engelbrecht said: "Despite the welcome decline in fuel prices and recent respite from load-shedding, business conditions in the retail sector continued to deteriorate during the third quarter. The results from the latest EY/BER Retail Survey suggest that the growth in sales volumes slowed more than retailers had expected, notwithstanding their efforts to contain price hikes by cutting profit margins. With selling prices now set to increase in the fourth quarter - adding to the strong headwinds already battering the South African consumer - most retailers expect weak volume growth during the festive season."

Engelbrecht ended: "Given that consumer spending, along with government expenditure, has been the mainstay of economic growth since the 2008/9 recession, the sharp deterioration in business conditions in the retail sector do not bode well for South Africa's economic prospects in coming quarters."