Ericsson and Ernst and Young (EY) recently launched a Growth Codes report that looks at the evolvement of operators in respect of their networks and their business models. These operators have been classified as Frontrunners and enjoyed a 9.6% CAGR while competitors in their markets achieved only 2.7%,while average in markets with no Frontrunners is -1.4% (2010-2014).

FreeDigitalImages

With traditional revenues under pressure and mobile data use soaring, operators have been forced to evolve both their networks and their business models. Some have been more successful than others have. Successful operators share a common focus on network performance and customer experience; differentiation, innovation and technology approaches vary by strategy.

The report has identified three distinct strategies adopted by Frontrunners. Significantly, what is good for the end user is also good for the operator.

Frontrunner strategies

• Quality-led progression: These Frontrunners differentiate through high-performing networks and high brand preference

• Market-led adaptation: Includes Frontrunners that differentiate through quick adaptation to market conditions• Offering-led transformation: Refers to Frontrunners that differentiate by being first to market with uniquely designed offerings

The study also revealed a number of ways in which Frontrunners are similar including their views on connectivity and services as differentiators rather than commodities, and their focus on innovating new revenue streams rather than maximising old ones. Frontrunners display greater interaction between marketing and technical roles, rather than the traditional silos, and they leverage network performance by either utilising superior network performance as a differentiator or by improving network performance to meet customer expectations.

Martin Sebelius, Executive Director of Nordic Advisory, EY, says, "We clearly see that despite their different strategies, frontrunner operators share a common commitment to network quality. Not surprisingly, Frontrunners constantly seek new ways of challenging industry conventions to make connectivity more relevant to people, business and society."

Focus on growth

Patrik Cerwall, Head of Radio Strategic and Tactical Marketing, Ericsson, says, "We wanted to understand what makes operators successful in order to be the best partner to our customers. It may sound self-serving, but Frontrunners focus on growth, both enhancing the core business while at the same time exploring new markets and capabilities to secure future revenues, such as IoT (Internet of Things) and vertical solutions.

"The journey toward 5G in 2020 will be marked by both new technology advances and new business models, but that transformation really started with the shift from voice to data-driven networking. The operators who are managing that transition successfully may provide the blueprint for success in 5G."

Understanding these strategies can help more operators become Frontrunners. This may have a beneficial effect for all operators, as it appears that the presence of a Frontrunner in any given market benefits all operators in that market: peers of operators in markets with Frontrunners are growing at 2.7% while markets without Frontrunners have negative growth of 1.4%.

Increase in Frontrunners

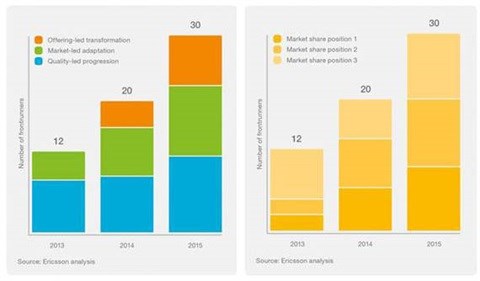

In 2013, most of the 12 identified Frontrunners were associated with the Quality-led strategy, leveraging their size and assets to deliver superior quality, and thereby achieve profitable growth. Market-led operators were in the minority and Offering-led operators had not yet joined the Frontrunner ranks. In 2014, the number of Frontrunners increased to around 20 and included Offering-led operators.

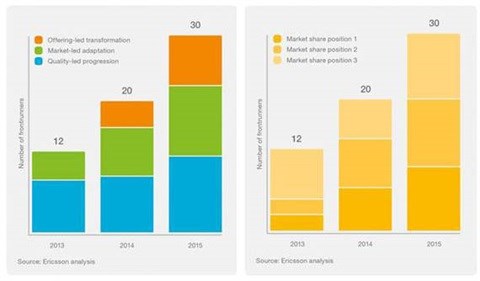

By 2015, it is projected that there will be 30 or more Frontrunners, with distribution between strategies starting to even out. It is important to recognise that Frontrunners are not necessary market share leaders in their respective regions. In fact, in 2013, most Frontrunners were #3 by market position. By 2015, it is projected that this, too, will even out, with Frontrunners having representation across the top three market share positions.

Fig 1: As the number of Frontrunners grows, the distribution between strategies starts to even outFig 2: Frontrunners are not necessarily market share leaders in their respective regions

click to enlarge