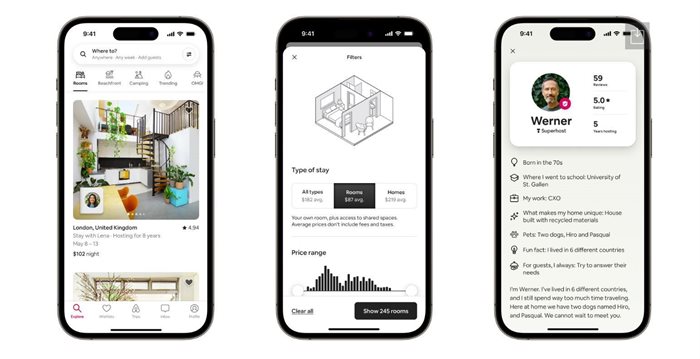

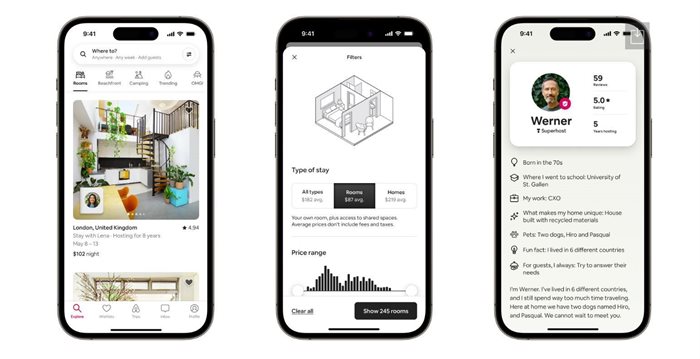

For South Africans trying to keep up with the cost of living, the new Airbnb Rooms category could be a great way to make money.

Source: Airbnb

Private rooms were already Airbnb’s third most-popular category, showing that travellers are looking to cut back on accommodation costs, and many are more than happy to pay for a night or two - or more - in a room in a local’s home. The average rate being charged for a room in South Africa is R675/night, according to Airbnb.

This could offer some relief, and leveraging a platform like AirBnB that screens guests allows them to be rated and provides you with insurance against damage and loss, says Paul Stevens, CEO of Just Property. “But remember that there are risks associated with letting people stay in your property,” he warns.

Three points to be aware of:

What if they don’t leave?

“While it will make sense to many to take advantage of Airbnb’s short-stay rental model, few homeowners consider a scenario where a tenant would take occupation but then fail to vacate or even steal items from the premises. Sadly, many owners have subsequently discovered that this is not uncommon,” says Stevens. “So besides being adequately insured, hosts must know where they stand with regards to the law.

“In the case of short-stay rentals, there is often an assumption that credit ratings and past payment behaviour aren’t all that relevant because the person will only be in the premises for a short period of time.

“This couldn’t be further from the truth," says Stevens. "In-depth tenant vetting is as important in a short-term rental as it would be in any other form of rental.”

Fortunately, the Prevention of Illegal Evictions from and Unlawful Occupation of Land Act, 19 of 1998 (“PIE”) would not apply, says Cilna Steyn of SSLR Inc. Attorneys, Notaries and Conveyancers. “This is because the intention of the agreement is not for the ‘guest’ to reside in the premises but to have a place to sleep and maybe eat for a specific period of time. Case law is very clear that the PIE will not apply in these cases.”

Airbnb’s short-term rental agreements are as simple as the click of a mouse on the app, but Steyn’s advice is to conclude a full and in-depth lease agreement, despite the short duration of the stay. Short-term rental lease agreements can specifically exclude certain provisions of the Consumer Protection Act, as well as the PIE. “A detailed lease agreement secures both parties and it will make for a much more successful and stress-free transaction,” she says.

“Forewarned is forearmed,” says Stevens. “Make an effort to get the best legal advice you can afford, ask a professional letting agent for advice on vetting prospective 'guests'/tenants and have them look over your lease. Better still, appoint a good agent to manage your short-rentals for you.”

Sars is watching…

Two years ago, Sars warned South Africans hosting fee-paying guests that they had to declare rental income in their tax return. Airbnb requires tax-related declarations before payments are made to hosts, and those who try to “game” the system will be caught out.

Airbnb is legally required to provide a limited amount of data about transactions that take place on the Airbnb platform to Sars upon request. “Hosts who have not been declaring their Airbnb income will need to declare their affairs sooner than later,” says Sohail Govender, finance director of Just Property.

Govender also worries that the increased focus on short-stay room-lets may tempt homeowners to DIY the letting of their granny flat or spare room. “I worry that there are many ‘hosts’ in the informal sector who are not aware of the income tax requirements, not to mention capital gains tax implications.”

When you sell your primary residence, Govender explains, the first R2m profit is exempt from capital gains tax. If you’ve been renting out any part of your property, you forfeit that exemption and will have to pay capital gains tax on the full profit.

But wait, there is some good news, too. Rates and taxes, bond interest, advertisements, estate agent fees, homeowner’s insurance, garden services, repairs associated with the rented area, security and property levies, cleaning, AirBnB fees and other types of services applicable to keeping your short-stay business in operating order can be claimed as deductions, says Govender.

“Anyone thinking of renting out a room or a complete home to boost their income needs to ensure they are fully apprised of all the implications,” says Govender. He recommends speaking to a reputable rental agency to discuss the help that a professional property practitioner can offer.