Despite the upward trend in the prime lending rate, Ooba Home Loans statistics for Q4 2022 show that consumers continue to have access to good home loan opportunities through the country's banks.

“The banks are still competing strongly for home loan business and are improving barriers to entry by offering some of the lowest rate levels seen in the last decade and keeping approval rates robust,” notes Rhys Dyer, CEO of Ooba.

Increases in prime lending rate impacting home loan demand

The quick succession of rate hikes experienced since November 2021 has had a dampening effect on the homebuying market. “The prime lending rate increased by 350 basis points to it’s current rate of 10.5% at the end of Q4 '22,” says Dyer.

“Ooba’s Q4 '22 home loan application volumes are down by 17% from Q4 '21 and have returned to volumes similar to those recorded in pre-pandemic Q4 '19, when the prime lending rate was at 10%,” explains Dyer.

Approvals remain strong due to bank competitiveness

Ooba achieved an approval rate of 84.1% for its homebuyers in Q4 '22, similar to the approval rate of 83.7% in Q4 '21. “Banks’ confidence in the South African residential property market is evident in their willingness to grant home loan finance at these levels, despite subdued economic growth,” notes Dyer.

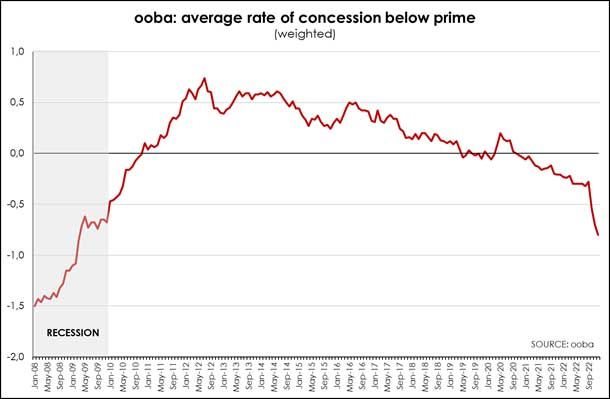

At current levels, the average rate below prime (-0.68% in Q4 '22) is significantly lower than the levels reached during the early stages of the pandemic, matching the rate concessions last seen more than a decade ago. This cheaper cost of borrowing at lower interest rates improves affordability for home loan finance.

“Rates offered below prime have improved sharply across all regions, with the Western Cape, in particular, offering a rate of prime -0.88% in Q4 '22. This is significantly lower than the rate offered during the height of the Covid-19 buying boom when it reached a low of prime -0.71% in May '20,” says Dyer. “Gauteng North and West Rand follow closely at prime -0.76% in Q4 '22, following a low of prime -0.86% in Apr '20.”

Slowing property prices will be good news for new home buyers

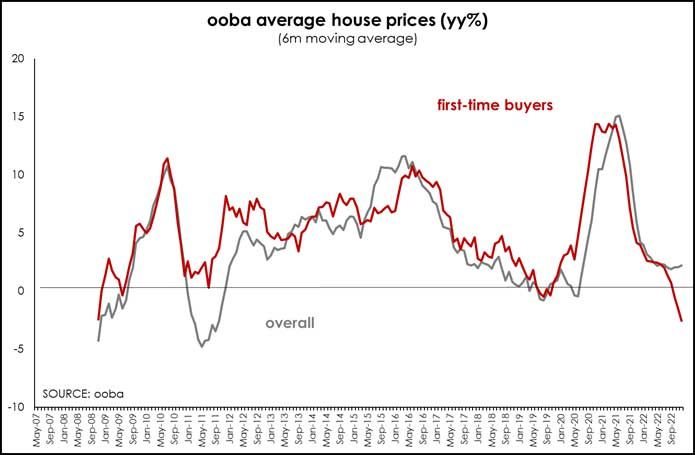

In response to the effects of the prime lending rate, property price growth has slowed and is now showing meagre nominal growth. The average purchase price in Q4 '22 is recorded at R1,422,992; this is only a 1.5% increase on the Q3 '22 figure of R1,402,408, and a 2.4% year-on-year increase from the average purchase price of R1,389,715 in Q4 '21.

Notably, property prices of first-time homebuyers are recording negative real growth. In Q4 '22, the average purchase price of the first-time buyer dipped to R1,113,157 - showing a year-on-year decline of 2.4% for this segment.

This is driven by a combination of slower growth in property prices as well as first-time homebuyers choosing to buy, on average, smaller properties that meet their monthly repayment capabilities.

Trends in purchase price segments

Properties in the price segment above R1.5m make up 59% of finally granted bonds in Q4 '22 – unchanged from Q4 '21, while properties in the price range above R750,000 to R1.5m account for 30%, marginally down on the 31% recorded in Q4 '21. 11% of finally granted bonds in Q4 '22 fell into the price category of below R750,000, up 1% on Q4 '21.

“Rising interest rates have, therefore, only seen a slight shift of more homebuyers into this more affordable property price segment. With homebuyers set to face affordability hurdles in 2023, we expect to see a more significant shift towards the middle to lower purchase price segments,” notes Dyer.

First-time homebuyers remain sensitive to interest rates

In spite of rate concessions to prime that are available, financial pressure hits first-time buyers the hardest, which is evident in the lower volume of applications received from this market segment in Q4 '22.

“We saw the first-time homebuyer purchasing frenzy reach a peak in May 2020 following historically low interest rates, making up 62% of all applications received during that period,” explains Dyer.

“By comparison, just under 49% of our applications in Q4 '22 were from this segment. This represents a decrease of 3% from Q4 '21 and a drop of 13% from the May 2020 peak.”

Demand from first-time homebuyers varies significantly across regional housing markets – from a low of 42.5% of applications in the Western Cape in Q4 '22 to a high of 62.1% of applications in the Free State. Unsurprisingly, the average purchase price for the first-time homebuyer in the Western Cape was highest among the regions at R1.37m in Q4 '22, while it was a more affordable R0.89m in the Free State.

Homebuyers are becoming more financially savvy

While banks continue to lend at high loan-to-value levels and offer cost-inclusive loans to first-time homebuyers, more buyers are opting to put down deposits. “This is evident in the increase in the average deposit amount, and the fact that we have seen the demand for no-deposit loans in Q4 '22 drop by 7% on Q4 '21, now representing 57% of our application intake,” notes Dyer.

The average deposit size has also increased by 23% year-on-year, from 7% of the average purchase price in Q4 '21, to 8.6% in Q4 '22. “This demonstrates that homebuyers are prioritising deposits as financial tools,” says Dyer.

The loan-to-value percentages vary markedly between the regional housing markets. While it has declined across all provinces, it remains elevated at 95.3% in Gauteng North and West Rand in Q4 '22 – down from a peak of 100.7% in April last year.

“In contrast, the Eastern Cape, where the loan-to-value has fallen to 87.1% in Q4 '22, registered the second strongest growth in regional house prices at 7.8% last year. The country’s most expensive regional housing market – the Western Cape – has the second lowest loan-to-value rate of 90.2% - down from a high of 97.5% in late-2021.”

The prioritisation of deposits for the first-time homebuyer segment has persisted, with an average deposit size of 8.8% of the total purchase price in Q4 '22, up 14% from Q3 '21 (at 7.7% of total purchase price).

Looking ahead to a resilient property market

With interest rate hikes expected to plateau and an expectation of low nominal property price growth for 2023, the property market is set to continue to offer opportunities for new buyers, with homebuyers prioritising smart budgeting - deposits and more affordable properties.

“In the current tougher economic climate, housing affordability is going to be the greatest challenge for the residential property market in 2023. However, we envisage that banks will continue to compete for new home loan business and offer favourable home loan finance terms, similar to levels experienced in 2022,” says Dyer.

“We anticipate that several key trends will lead the way this year, namely shifts in the first-time homebuyer’s profile; fewer 100% home loans due to long-term affordability; buyers focusing their purchase decisions on areas where they can get more value for their money; increasing popularity of energy-efficient homes; and the ongoing buy-to-let investments,” Dyer concludes.